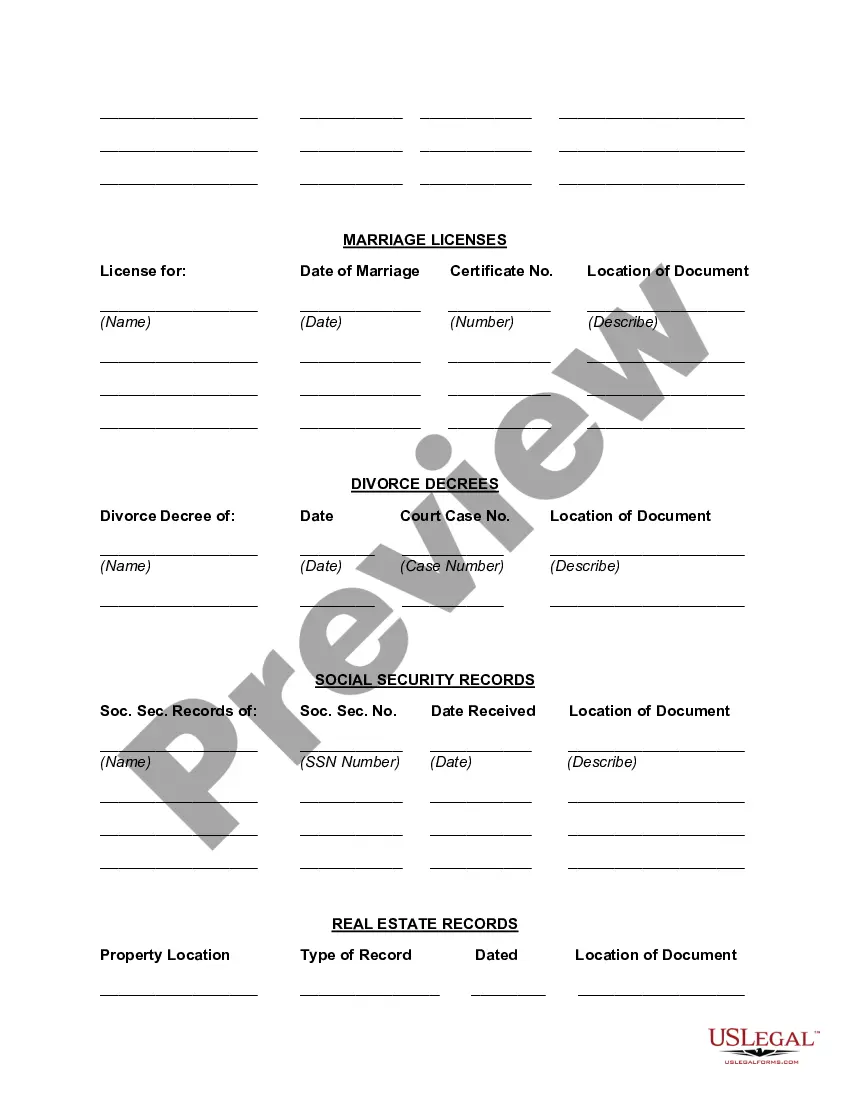

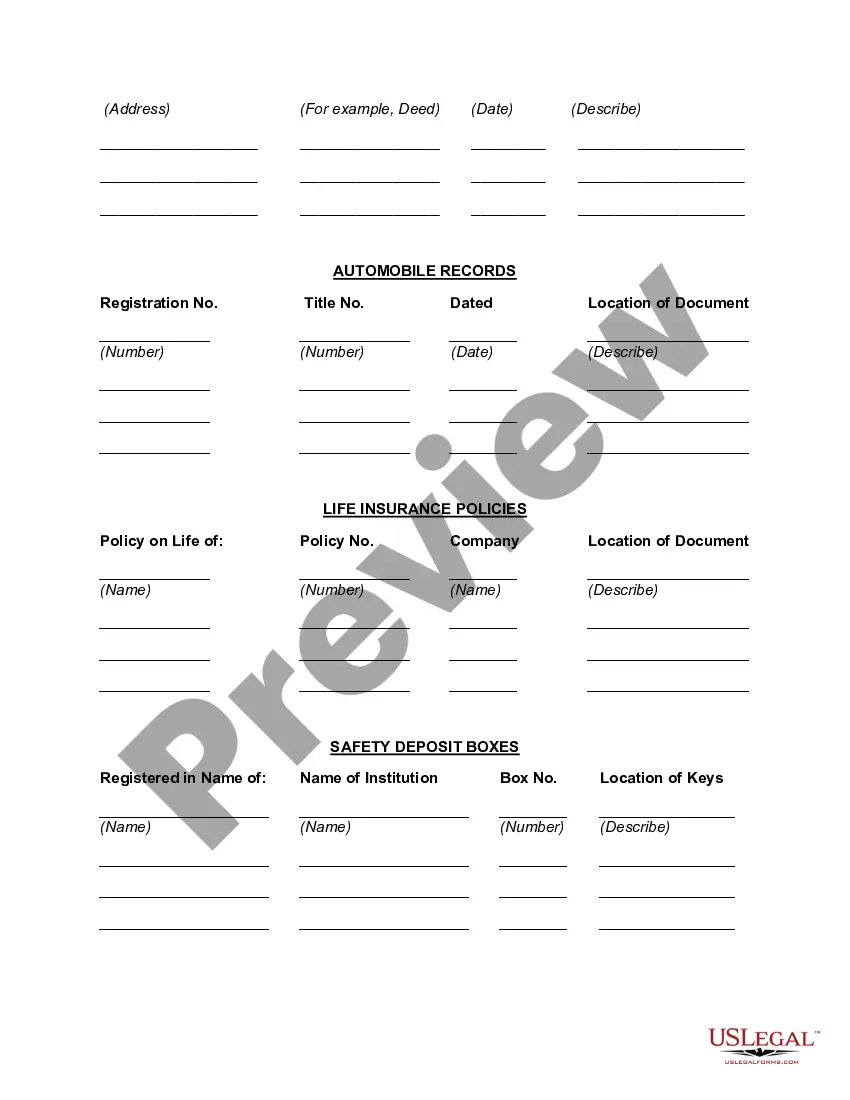

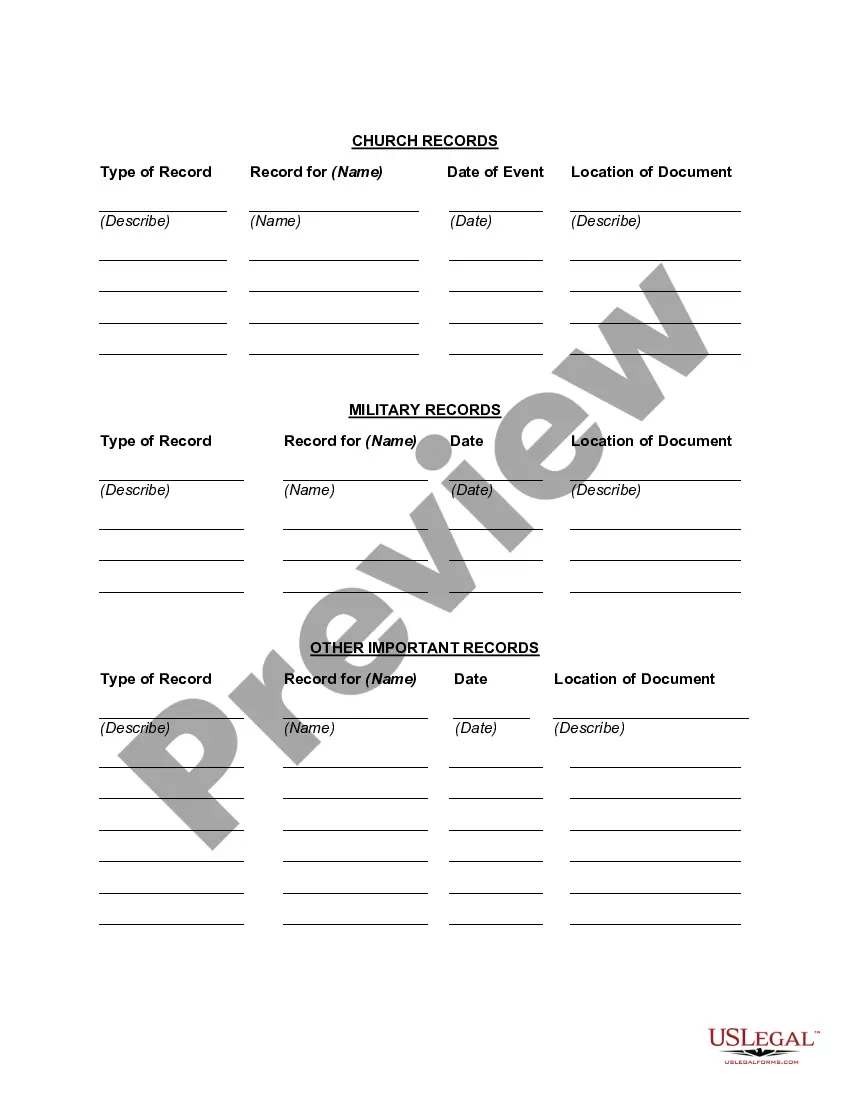

Illinois Worksheet for Location of Important Documents

Description

How to fill out Worksheet For Location Of Important Documents?

You can invest multiple hours online trying to locate the official document template that satisfies the state and federal requirements you need.

US Legal Forms offers a plethora of official forms that can be reviewed by experts.

You can effortlessly download or print the Illinois Worksheet for Location of Important Documents from my service.

Review the form details to confirm you have selected the correct form. If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Download button.

- After that, you can complete, edit, print, or sign the Illinois Worksheet for Location of Important Documents.

- Every official document template you purchase is yours indefinitely.

- To get another copy of a purchased form, visit the My documents section and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the right document template for the region/city you choose.

Form popularity

FAQ

What are personal allowances? Before 2020, employees claimed personal allowances (aka withholding allowances or W-4 allowances) on their federal Form W-4, Employee's Withholding Allowance Certificate. Personal allowances let employers know how much federal income tax to withhold.

If you sell items for lease at retail in Illinois and those items are of the type that must be titled or registered by an agency of Illinois state government (i.e., vehicles, watercraft, aircraft, trailers, and mobile homes), you must report these sales for lease on Form ST20115562011LSE, Transaction Return for Leases.

Please follow the steps below to enter the ST-556 in TurboTax CD/Download software:Go to Federal Taxes(Personal in Home & Business) at the top, then Deductions and Credits.Then select "I'll choose what I work on.Then scroll down to "Estimates and Other Taxes paid."Next click Start/Revisit next to Sales Tax.More items...?

For the 2020 tax year, it is $2,325 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,325 or less, your exemption allowance is $2,325. If income is greater than $2,325, your exemption allowance is 0. For prior tax years, see Form IL-1040 instructions for that year.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

A single filer with no children should claim a maximum of 1 allowance, while a married couple with one source of income should file a joint return with 2 allowances. You can also claim your children as dependents if you support them financially and they're not past the age of 19.

Form ST-556, Sales Tax Transaction Return, is a form issued by Illinois Department of Revenue to be filed by a retail seller of items like motor cars or other vehicles, watercraft, aircraft, trailers or mobile homes; that need to be registered for a title with the State of Illinois government agency.

The Illinois' general state sales and use tax rates are: 6.25 percent on general merchandise, including items required to be titled or registered by an agency of Illinois state government; and. 1 percent on qualifying foods, drugs, and medical appliances.