Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report

Description

the process that organizations have created to ensure the integrity of their message. The following form is a checklist of comments and questions that may help you prepare a user-friendly and informative annual report.

How to fill out Checklist - Dealing With Shareholders And Investors - Preparing A User-Friendly Annual Report?

You may spend numerous hours online looking for the valid file template that meets the state and federal requirements you desire.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

It is easy to download or print the Illinois Checklist - Managing Shareholders and Investors - Crafting a User-Friendly Annual Report from the service.

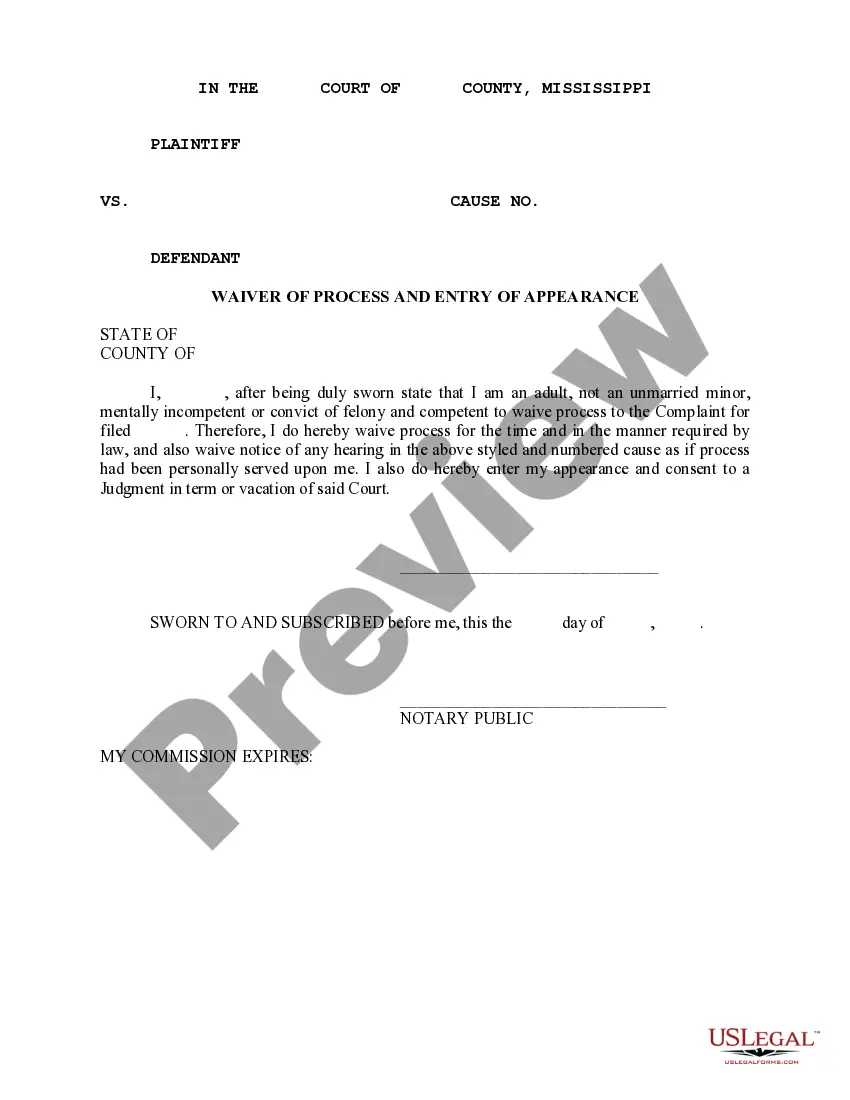

If available, use the Review button to check the file template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, edit, print, or sign the Illinois Checklist - Managing Shareholders and Investors - Crafting a User-Friendly Annual Report.

- Each valid file template you purchase is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct file template for the state/city of your choice.

- Review the form description to ensure you have selected the correct form.

Form popularity

FAQ

Annual reports for shareholders and creditors are prepared by the finance and management teams of the company. They focus on delivering clear and useful information that meets legal requirements and stakeholder needs. Utilizing the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report can further improve these reports by ensuring they address essential topics and enhance user engagement.

An annual report is typically prepared by a company's internal team, often led by the finance department. It may also involve the participation of external consultants or auditors for added credibility. By adhering to the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, organizations can produce high-quality reports that meet shareholder expectations.

The annual report should be prepared by a dedicated team that may include finance professionals, legal advisors, and marketing experts. This diverse team works collaboratively to ensure the report is accurate, comprehensive, and engaging. Following the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report helps guide this process and enhances its effectiveness.

The preparation of annual financial statements is generally the responsibility of the chief financial officer (CFO) or the accounting department. They collect, analyze, and present financial data that accurately reflects the company's performance. This process is integral to the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report, ensuring transparency and trust with investors.

Typically, the board of directors holds overall responsibility for a company's annual report. They ensure that the report aligns with the company's goals and regulations. In partnership with management, the board oversees the preparation and approval of the report, which is then shared with shareholders and investors as part of the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report.

In Illinois, specific entities can be exempt from filing an annual report, depending on their structure and purpose. However, most LLCs are required to file, regardless of certain financial thresholds. If you are unsure about your status, consult the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report for clarity. Using platforms like uslegalforms can help you navigate this process smoothly.

Designing a good annual report involves clear organization, engaging visuals, and accurate data presentation. Start by outlining key sections such as finances, achievements, and future goals. Use charts and graphics to illustrate essential information, making it easier for shareholders and investors to digest. Finally, refer to the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report for expert tips.

Yes, Illinois requires every LLC to file an annual report. This requirement helps maintain updated information about your business with the state. By filing your report, you comply with legal obligations and demonstrate professionalism to shareholders and investors. Refer to the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report for detailed guidance.

If you fail to file an annual report for your LLC in Illinois, you risk facing penalties and potential dissolution of your business. This means that you could lose the protection that your LLC status provides. Additionally, not filing can damage your credibility with shareholders and investors. To avoid these issues, follow the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report.

The requirements for the annual report vary by state but generally include essential company information, financial data, and operational insights. Specifically, in Illinois, your report must meet the legal standards set by the Secretary of State, including specific forms and filing fees. Following the Illinois Checklist - Dealing with Shareholders and Investors - Preparing a User-Friendly Annual Report will help ensure all necessary elements are addressed.