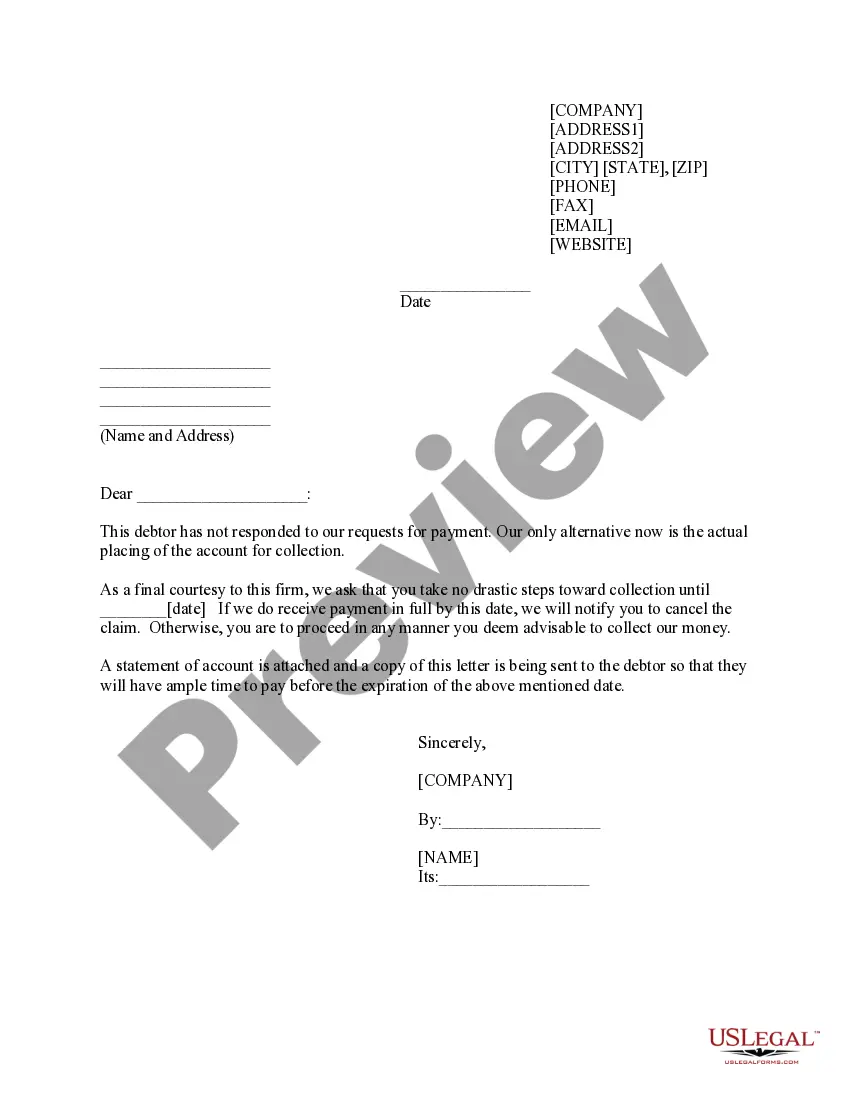

Illinois Sample Letter for Collection - Referral of Account to Collection Agency

Description

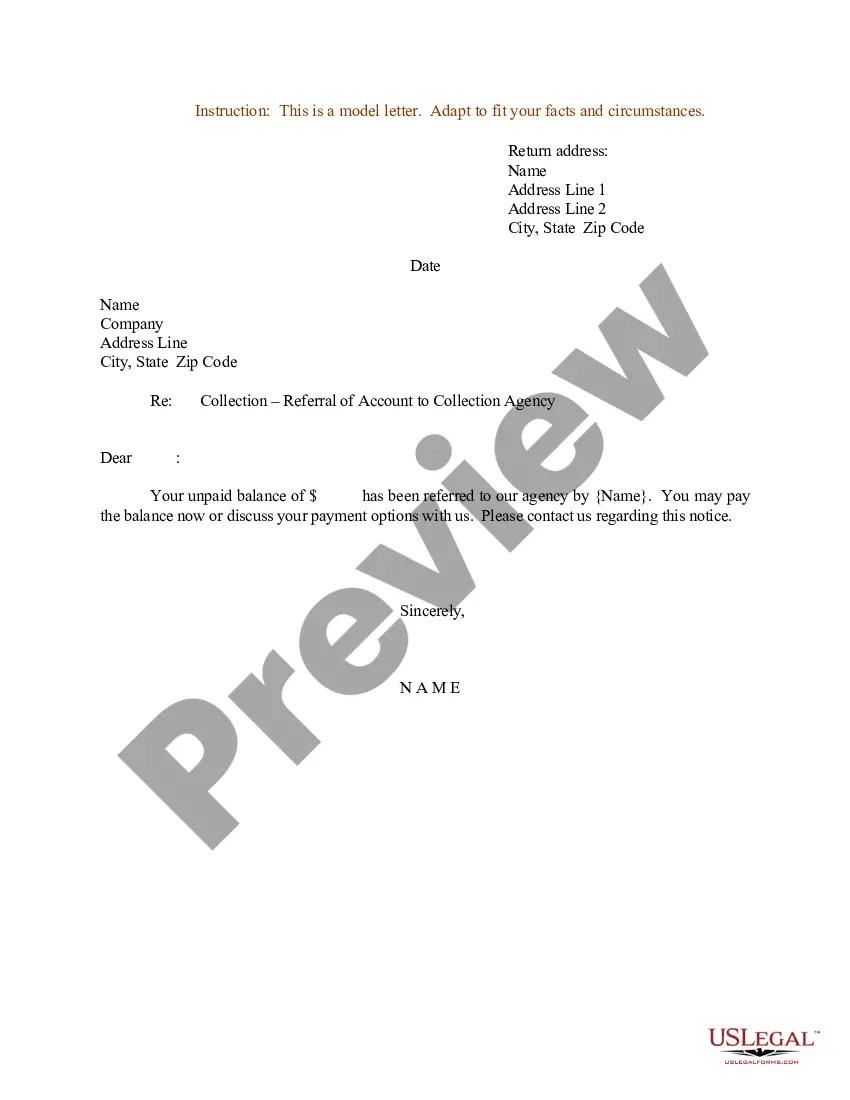

How to fill out Sample Letter For Collection - Referral Of Account To Collection Agency?

Are you situated in a location where you frequently require documentation for either organizational or personal purposes.

There is a wide range of legal document templates available online, but finding forms you can trust is challenging.

US Legal Forms offers a multitude of document templates, including the Illinois Sample Letter for Collection - Referral of Account to Collection Agency, which can be formatted to comply with state and federal regulations.

Once you find the correct document, click Acquire now.

Select your preferred payment plan, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Illinois Sample Letter for Collection - Referral of Account to Collection Agency template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is suitable for your specific city/region.

- Utilize the Review button to evaluate the form.

- Check the description to make sure you have chosen the appropriate document.

- If the form does not meet your requirements, use the Lookup section to find the document that satisfies your needs.

Form popularity

FAQ

A debt collection letter must use clear and straightforward language that conveys the details of the debt, including the amount owed and any consequences of non-payment. It should also comply with federal regulations regarding the tone and content. Using an Illinois Sample Letter for Collection - Referral of Account to Collection Agency can guide you in crafting the appropriate language.

When communicating with a debt collector, avoid admitting liability or providing personal financial details. It is crucial to remain calm and composed, as saying too much can unintentionally harm your position. Understanding the nuances of debt collection can be aided by referring to the Illinois Sample Letter for Collection - Referral of Account to Collection Agency for best practices.

The 777 rule refers to the seven-day time frame required for debt collectors to provide validation of the debt after being contacted. It ensures that debtors have adequate time to respond to the collection agency. Exploring these concepts further using an Illinois Sample Letter for Collection - Referral of Account to Collection Agency will provide clarity on appropriate timelines and responses.

To write a dispute letter to a collection agency, start by identifying the debt in question and state your reasons for disputing it. Clearly request validation of the debt attached to your name, and keep a record of your correspondence. An Illinois Sample Letter for Collection - Referral of Account to Collection Agency provides a template that can aid you in presenting your case clearly.

A nice collection letter strikes a balance between professionalism and courtesy. It should express understanding of the debtor's situation, while clearly outlining the amount owed and the necessary next steps. You can refer to an Illinois Sample Letter for Collection - Referral of Account to Collection Agency to see how a respectful tone can still effectively communicate your request.

A referral to a collections agency is the process in which a creditor submits a debt account to a third-party agency to recover the amount owed. This typically occurs when efforts to collect the debt directly have failed. Utilizing documents like an Illinois Sample Letter for Collection - Referral of Account to Collection Agency can assist creditors in crafting a professional referral.

When writing to a collection agency, begin by including your personal information, such as your name and address, followed by the agency’s contact details. Clearly state the purpose of your letter, whether it’s to dispute a debt or request verification. Utilizing an Illinois Sample Letter for Collection - Referral of Account to Collection Agency can help you structure your communication effectively.

Writing a letter for debt collection involves clearly stating the purpose and providing essential details about the debt. Include the debtor's information, the amount owed, the due date, and any payment instructions. For an effective approach, you might consider using an Illinois Sample Letter for Collection - Referral of Account to Collection Agency, which can guide you through the proper format and language.

A referral to a collection agency is the action taken by a creditor to pass on your outstanding debt to a specialized organization that focuses on debt recovery. This usually happens when the debtor has not responded to payment requests over an extended period. It is a way to manage delinquent accounts and may include additional fees or penalties for the debtor. To navigate this situation effectively, rely on an Illinois Sample Letter for Collection - Referral of Account to Collection Agency as your template.

Being referred to collections means that your unpaid debt has been turned over to a collection agency for recovery. This usually occurs after a creditor has made multiple attempts to collect the debt without success. It is an important step in the collections process, and it can lead to various consequences, such as legal action or impacts on your credit rating. To handle this more smoothly, consider using an Illinois Sample Letter for Collection - Referral of Account to Collection Agency.