Illinois Software Support Agreement

Description

Software is often divided into two categories: Systems Software includes the operating system and all the utilities that enable the computer to function; and Applications Software includes programs that do real work for users (e.g., word processors, spreadsheets, and database management systems).

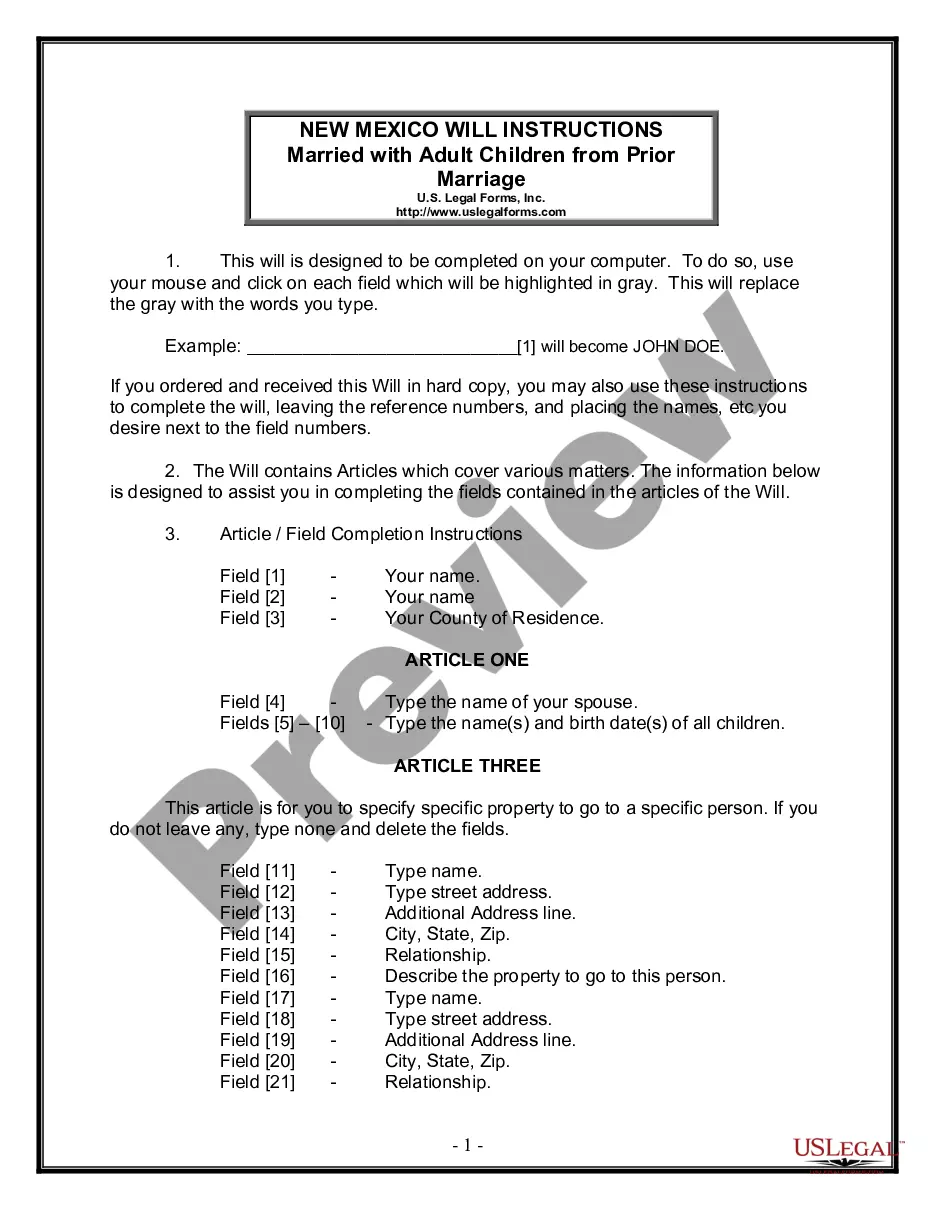

How to fill out Software Support Agreement?

Have you ever been in a situation where you require documents for both business or personal needs almost every day.

There are numerous legitimate document templates available online, but locating reliable ones is challenging.

US Legal Forms offers thousands of form templates, such as the Illinois Software Support Agreement, designed to meet federal and state requirements.

Once you obtain the correct form, click on Purchase now.

Select the payment plan you prefer, fill out the necessary information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Illinois Software Support Agreement template.

- If you do not have an account and want to use US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Use the Review option to review the form.

- Examine the details to ensure you have selected the right form.

- If the form does not meet your requirements, use the Search field to locate the form that satisfies your needs.

Form popularity

FAQ

Filing sales tax in Illinois involves a few steps. First, you must register for a sales tax permit with the Illinois Department of Revenue. After that, you can report your sales tax through various methods, such as online filing. Utilizing services like US Legal Forms can help streamline the process, especially when dealing with complex agreements like the Illinois Software Support Agreement.

Yes, digital subscriptions are typically taxable in Illinois. This taxation includes software and services provided through an Illinois Software Support Agreement. Users should be aware of these tax implications to accurately plan their budgets. Always review the specific terms of your agreement to understand any applicable taxes.

The 10.25% tax in Illinois refers to the combined sales tax rate applicable to certain purchases. This rate includes both state and local taxes, which can vary by jurisdiction. When considering an Illinois Software Support Agreement, it's essential to factor in this tax, as it may impact your overall costs. Always check your local rates to ensure accurate budgeting.

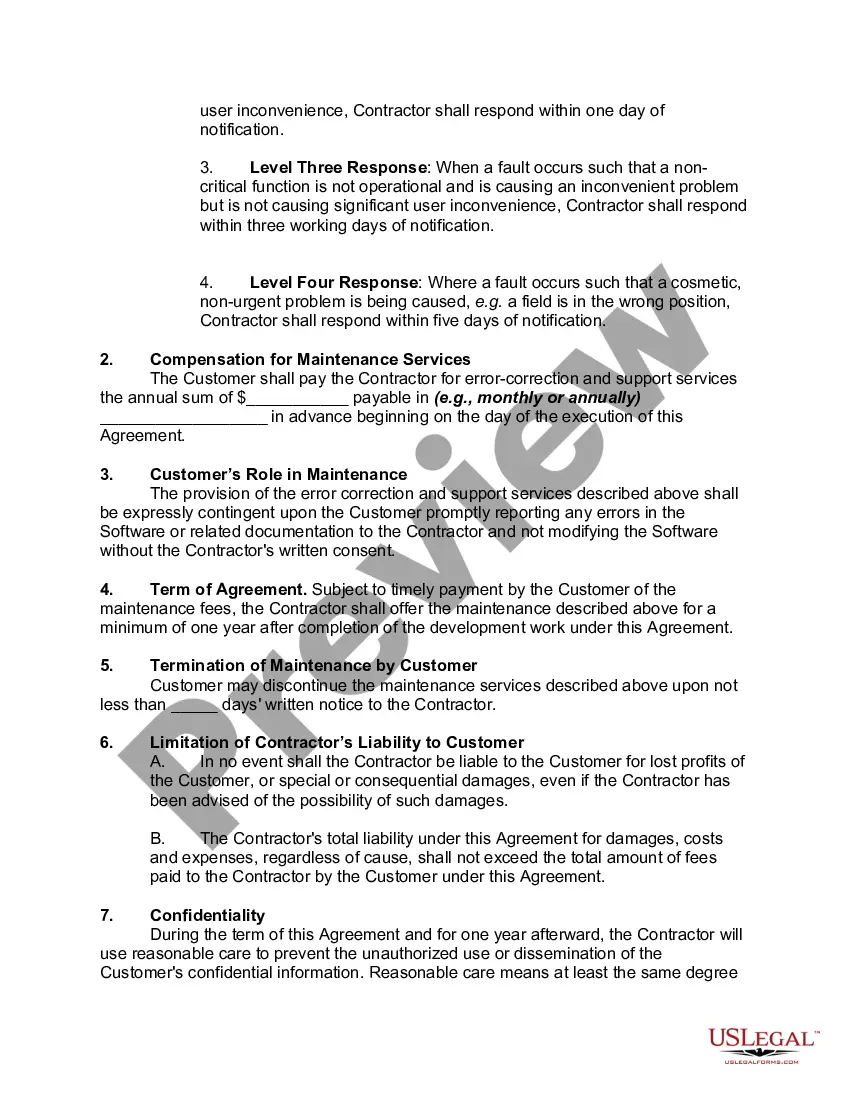

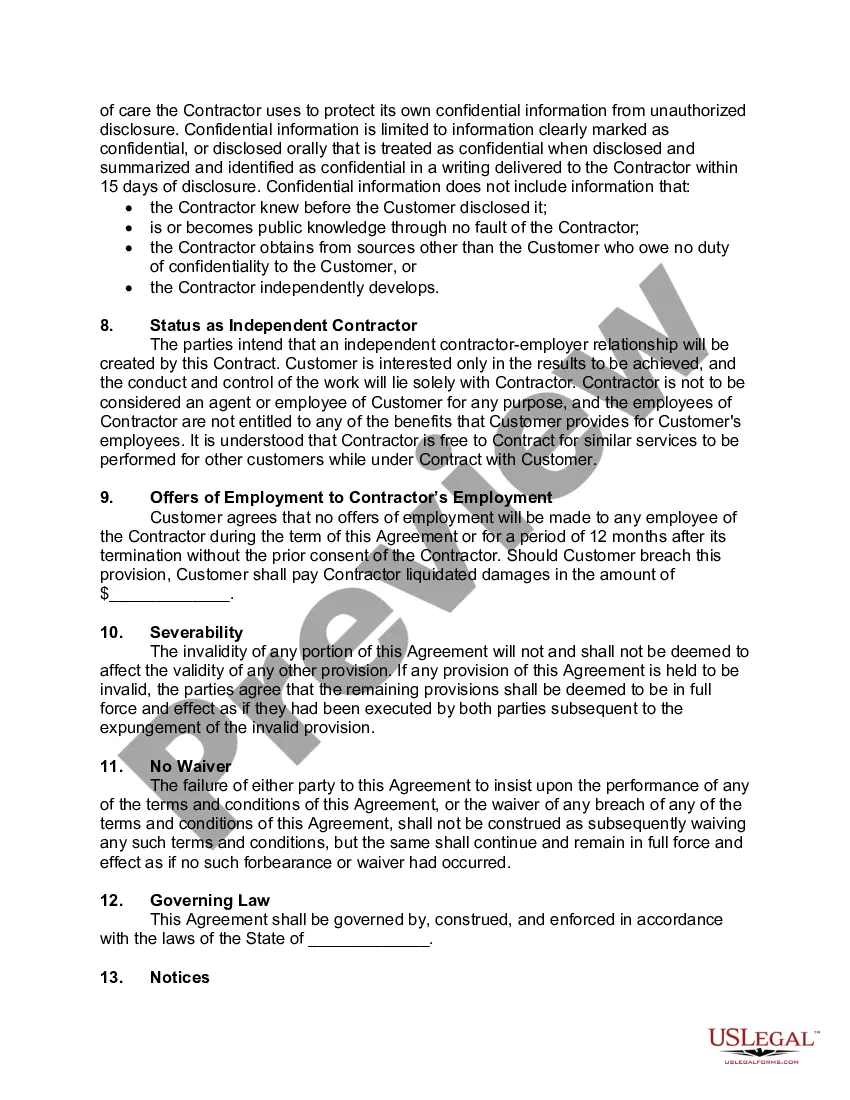

A software service agreement is a contract that defines the relationship between a service provider and the client regarding software solutions. It details the scope of services, liabilities, and expectations for both parties. By having an Illinois Software Support Agreement, businesses can ensure they receive tailored services that match their specific software support needs. This agreement serves to protect both parties and facilitate smooth collaboration in achieving desired outcomes.

The purpose of a support agreement is to outline the terms and conditions under which software support will be delivered. It ensures that users receive reliable assistance, addressing any potential problems promptly. An Illinois Software Support Agreement provides peace of mind, clarifying response times and available resources. This clarity helps users focus on their core business while knowing they have a safety net for their software needs.

Software support refers to the services provided to maintain and assist software functionality. This includes troubleshooting issues, applying updates, and ensuring compatibility with various operating systems. With an Illinois Software Support Agreement, users gain access to timely help from professionals who understand local regulations and requirements. Ultimately, this support enhances your software experience and keeps your operations running smoothly.

A software support agreement is a contract between a software provider and a user that outlines the support services available for a specific software product. Typically, it covers technical support, software updates, and troubleshooting assistance. In the context of an Illinois Software Support Agreement, users can expect clear terms regarding response times and service availability. This agreement ensures you get the help you need to keep your software running smoothly.

Typically, professional services are exempt from sales tax in Illinois, which includes consulting related to the Illinois Software Support Agreement. However, it is vital to review the specific regulations to determine any unique cases where tax might apply. Understanding these nuances can save you from unexpected costs.

There are a few states that do not impose a digital sales tax, including Delaware and Montana. This can be advantageous for businesses looking to sell digital products without the added burden of sales tax. However, if you're operating in Illinois, it is essential to follow the guidelines of the Illinois Software Support Agreement.

In Illinois, some items are not subject to sales tax. Basic groceries, prescription medications, and certain utilities fall into this category. Familiarizing yourself with these exemptions can help you navigate the tax landscape, particularly when considering purchases related to the Illinois Software Support Agreement.