Illinois Option to Purchase - Residential

Description

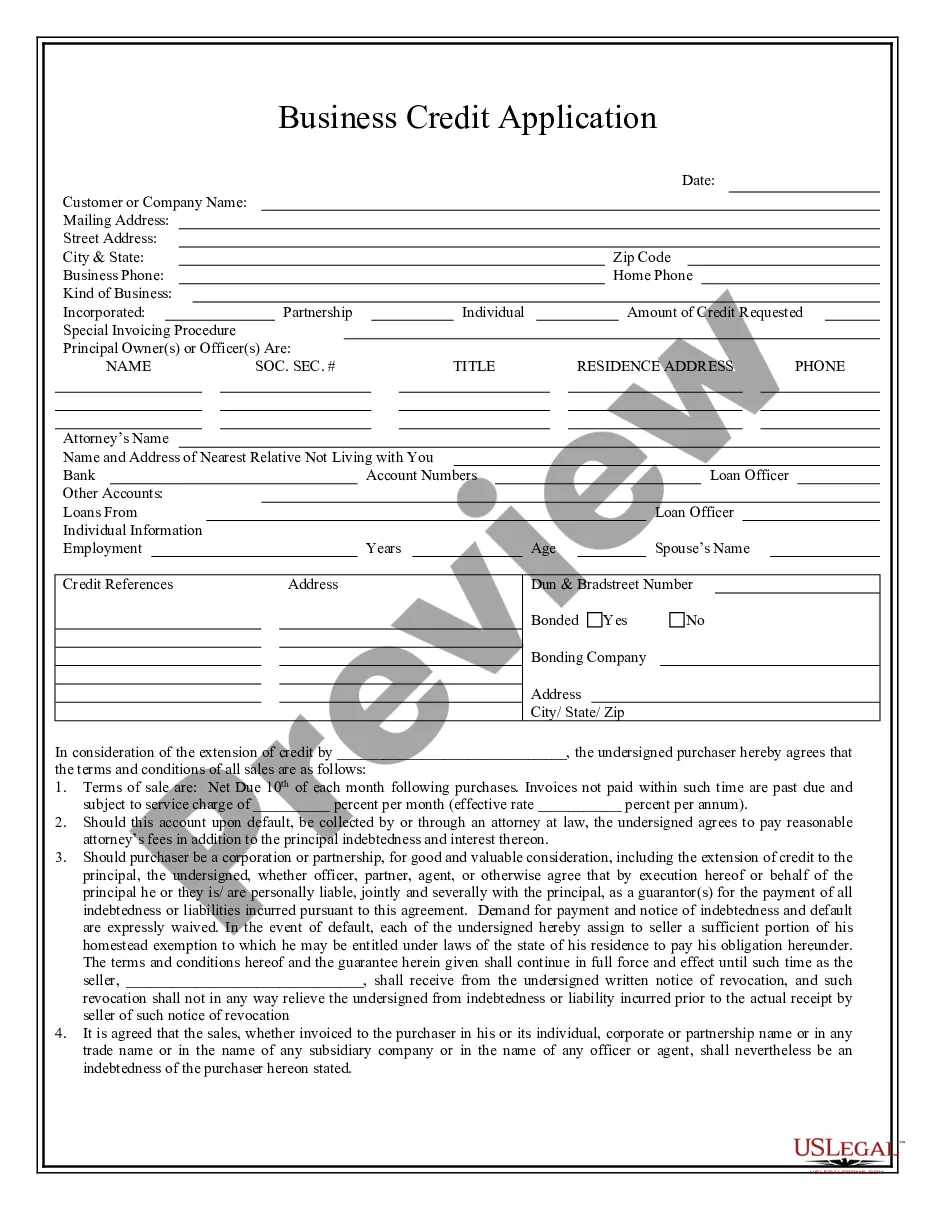

How to fill out Option To Purchase - Residential?

If you want to finish, retrieve, or generate sanctioned document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's simple and user-friendly search to find the documents you need.

Various templates for business and personal purposes are sorted by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you need, click the Get now option. Choose the payment plan you prefer and provide your information to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to acquire the Illinois Option to Purchase - Residential with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to locate the Illinois Option to Purchase - Residential.

- You can also view forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Confirm you have selected the form for the appropriate city/state.

- Step 2. Utilize the Preview option to review the form's content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative types of the legal form template.

Form popularity

FAQ

While circumstances vary, $50,000 can be considered a strong deposit in the UK housing market, especially for first-time buyers. However, this amount may not cover the full deposit requirements for all properties. Keep in mind that factors like property location and market conditions affect deposit levels. As you explore your options, being knowledgeable about financing can be advantageous.

David Smith of Anthony Gold Solicitors warns that rent-to-rent is a legal "fiasco", and says that not only tenants but landlords can be seriously affected. "If the landlord lets to a rent-to-renter they are creating a commercial tenancy which is subject to different laws than a residential tenancy," he explains.

The basics: What is an option contract in real estate? In the simplest terms, a real-estate option contract is a uniquely designed agreement that's strictly between the seller and the buyer. In this agreement, a seller offers an option to the buyer to purchase property at a fixed price within a limited time frame.

Rent-to-own car financing deals can be a good way for consumers with bad or no credit histories to enter the car-buying market if the deal is fair.

The fundamental difference between an Option and a Right of First Refusal is that an Option to Buy can be exercised at any time during the option period by the buyer. With a Right of First Refusal, the right of the potential buyer to complete the transaction is triggered only if the seller wants to complete a sale.

What Is An Option To Purchase? An option to purchase agreement gives a home buyer the exclusive right to purchase a property within a specified time period and for a fixed or sometimes variable price. This, in turn, prevents sellers from providing other parties with offers or selling to them within this time period.

This option is called rent to buy but can also be seen as rent to own, try before you buy, and intermediate market rent. These terminologies all mean the same thing and we're about to turn the lights on by providing all the information you need to fully understand them.

The assignable purchase option transfers and grants assignments to another party. This process is known as the contract assignment, and they're used when one party wants to directly transfer real estate assets to the assignee.

An option to purchase is an agreement that gives a potential buyer (optionee) the right, but not the obligation, to buy property in the future. The optionee must decide by a certain time whether to exercise the option and thereafter by bound under the contract to purchase.

The Illinois Installment Sales Contract Act (rent to own) specifically applies to sellers (with a legal or beneficial interest) who enter into an installment sales contract for residential real estate more than 3 times in a 12-month period (and the Act does not apply to agricultural property larger than four acres).