Are you in the position where you need to have paperwork for either company or individual functions virtually every day time? There are a variety of legal record templates available on the Internet, but finding ones you can depend on is not easy. US Legal Forms gives a huge number of type templates, like the Illinois Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust, that are written to fulfill federal and state requirements.

If you are already knowledgeable about US Legal Forms web site and also have a free account, simply log in. Next, it is possible to acquire the Illinois Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust web template.

If you do not provide an account and want to begin using US Legal Forms, abide by these steps:

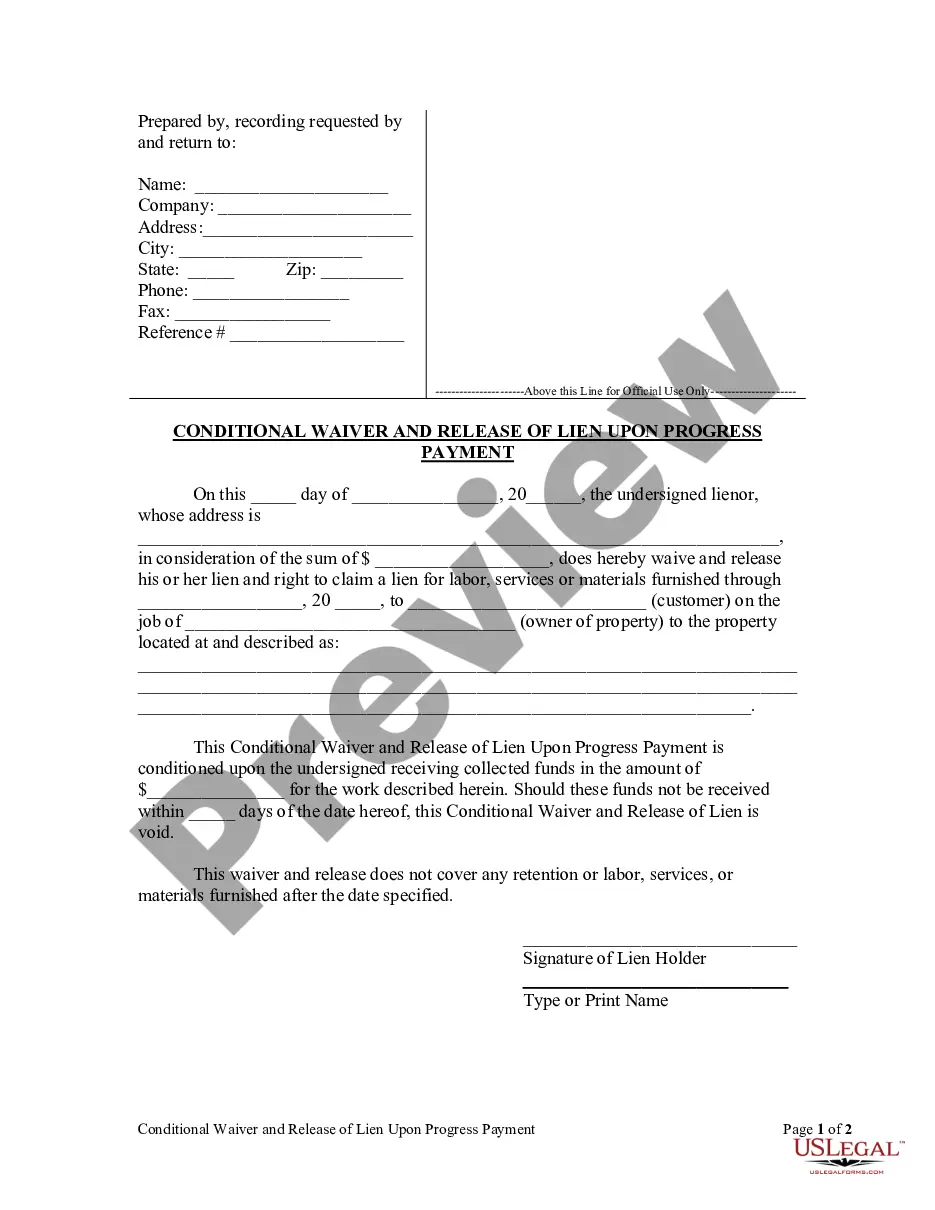

- Obtain the type you need and ensure it is for that right metropolis/state.

- Take advantage of the Preview switch to check the shape.

- See the description to ensure that you have selected the correct type.

- If the type is not what you are trying to find, take advantage of the Lookup area to get the type that meets your needs and requirements.

- Once you discover the right type, simply click Purchase now.

- Select the pricing program you need, complete the specified details to produce your bank account, and purchase the order with your PayPal or charge card.

- Select a hassle-free file file format and acquire your copy.

Get all of the record templates you might have purchased in the My Forms food list. You can obtain a more copy of Illinois Agreement to Change or Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Deed of Trust anytime, if needed. Just select the needed type to acquire or printing the record web template.

Use US Legal Forms, probably the most extensive selection of legal varieties, to save lots of efforts and avoid faults. The service gives expertly created legal record templates which can be used for a variety of functions. Make a free account on US Legal Forms and initiate producing your life a little easier.