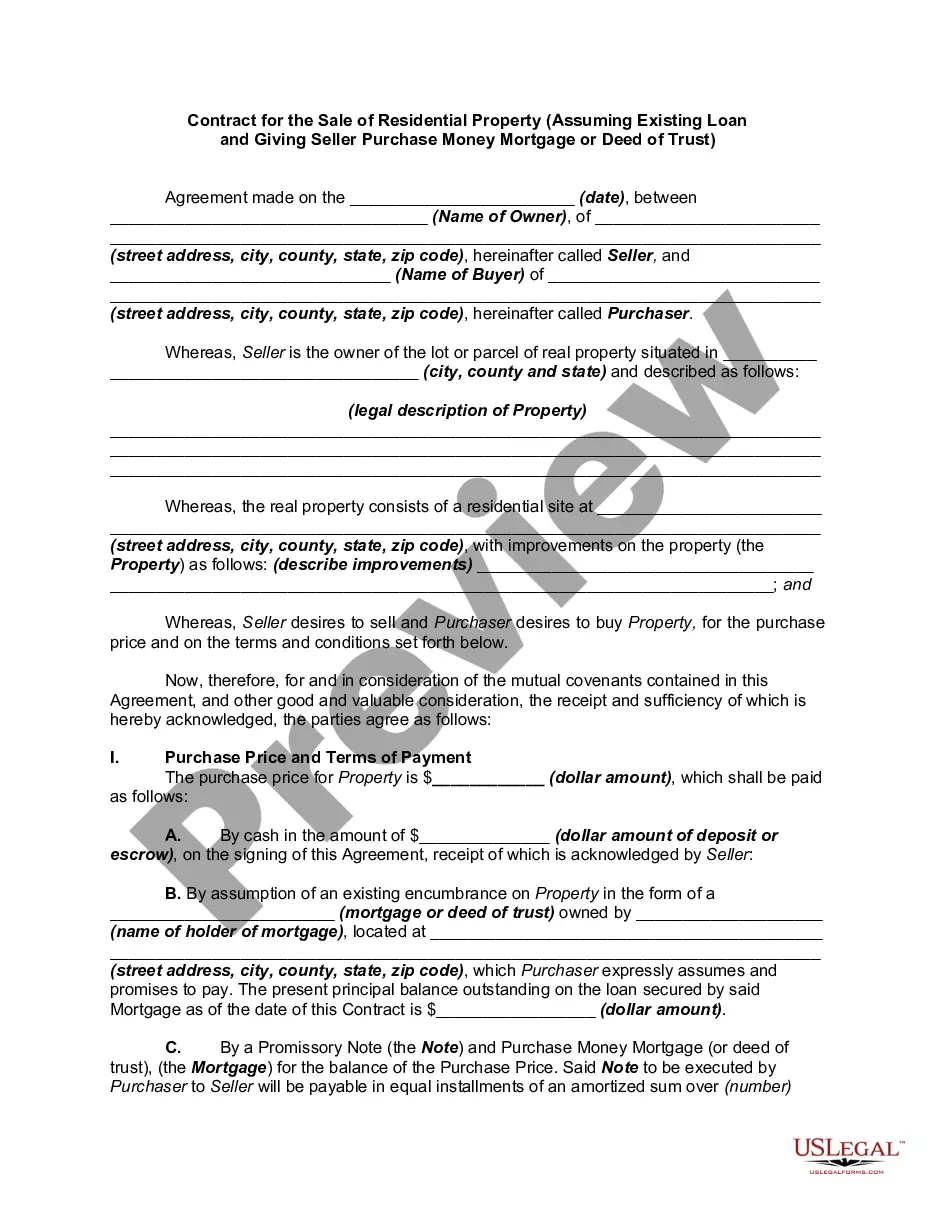

Illinois Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

If you want to thoroughly obtain, download, or print legal document templates, utilize US Legal Forms, the largest variety of legal forms available online.

Take advantage of the website's user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours to keep forever.

You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

- Use US Legal Forms to access the Illinois Sample Letter for Withheld Delivery in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to locate the Illinois Sample Letter for Withheld Delivery.

- You can also access forms you have previously downloaded within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the content of the form. Don’t forget to check the details.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the screen to find other versions of your legal document format.

- Step 4. After identifying the form you need, click the Buy now button. Select the pricing plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Illinois Sample Letter for Withheld Delivery.

Form popularity

FAQ

The reject code IL1040 10000 1 typically indicates a problem related to the information submitted on your Illinois tax return. This may stem from discrepancies in your personal information or inconsistencies with other documents filed, such as your W-4. To correct such issues, ensure that all details align and consider the Illinois Sample Letter for Withheld Delivery for guidance on communicating with tax authorities effectively.

The W-4 form is essential for the state of Illinois as it determines the amount of tax withheld from your paycheck. This helps you avoid underpayment or overpayment of taxes throughout the year. By filling it out correctly, you set the stage for a smoother tax filing experience. Utilizing resources such as the Illinois Sample Letter for Withheld Delivery can assist you in confirming the proper completion of your W-4.

Receiving a letter from the Illinois Department of Revenue can occur for multiple reasons, including discrepancies in your tax return or issues with your withholding. Perhaps they need clarification on specific deductions or allowances, or they may request further documentation related to your income. It's essential to act promptly to resolve any issues to prevent penalties. You may reference the Illinois Sample Letter for Withheld Delivery for tips on responding appropriately.

Filling out the Illinois W-4 requires a few simple steps. Begin by providing your name, address, and Social Security number at the top of the form. Next, indicate the number of allowances you wish to claim and fill out any additional sections as necessary. For specific instructions, review the Illinois Sample Letter for Withheld Delivery, which offers clear guidelines on the processes involved.

Completing your W-4 accurately is essential for ensuring the right amount of tax is withheld from your paycheck. Start by entering your personal information accurately, followed by claiming your allowances based on your tax situation. Use the worksheet attached to the form for guidance, ensuring you consider any additional deductions you may have. If you’re not sure, the Illinois Sample Letter for Withheld Delivery could help clarify your needs.

The amount you should withhold for taxes in Illinois varies based on your income and personal situation. Generally, you can estimate your withholding by using the Illinois W-4 form, where you also consider any additional factors such as dependents. To better understand your specific needs, an Illinois Sample Letter for Withheld Delivery can serve as a helpful guide when communicating with your employer regarding withholding adjustments.

You should file IL-1040-X, your amended tax return, by sending it to the address listed in the instructions of the form. If you owe additional taxes, you may need to send payment along with your submission. For ease and accuracy, you can utilize US Legal Forms to ensure you have the right documents. Completing this correctly ensures you correct any previous errors and stay compliant with tax regulations.

To file withholding tax in Illinois, you should start by collecting your payroll information and filling out the appropriate forms. You can submit your forms electronically through the Illinois Department of Revenue's website. US Legal Forms offers templates to simplify this process if needed. Make sure to follow the deadlines to avoid penalties and maintain compliance.

Filling out the Illinois W-4 form requires personal information, such as your name, address, and Social Security number. Follow the instructions carefully to claim the appropriate number of allowances based on your situation. If you need help, check out resources on US Legal Forms, which can guide you through the process. Accurate completion helps facilitate correct tax withholding and prevents issues down the road.

If an employer fails to withhold child support in Illinois, they may face legal consequences. The state's child support enforcement office can intervene to ensure payment is collected. Additionally, you can use an Illinois Sample Letter for Withheld Delivery to formally request proper withholding from your employer. Doing so can help protect your rights and ensure your child's needs are met.