Illinois Agreement and Release for Working at a Novelty Store - Self-Employed

Description

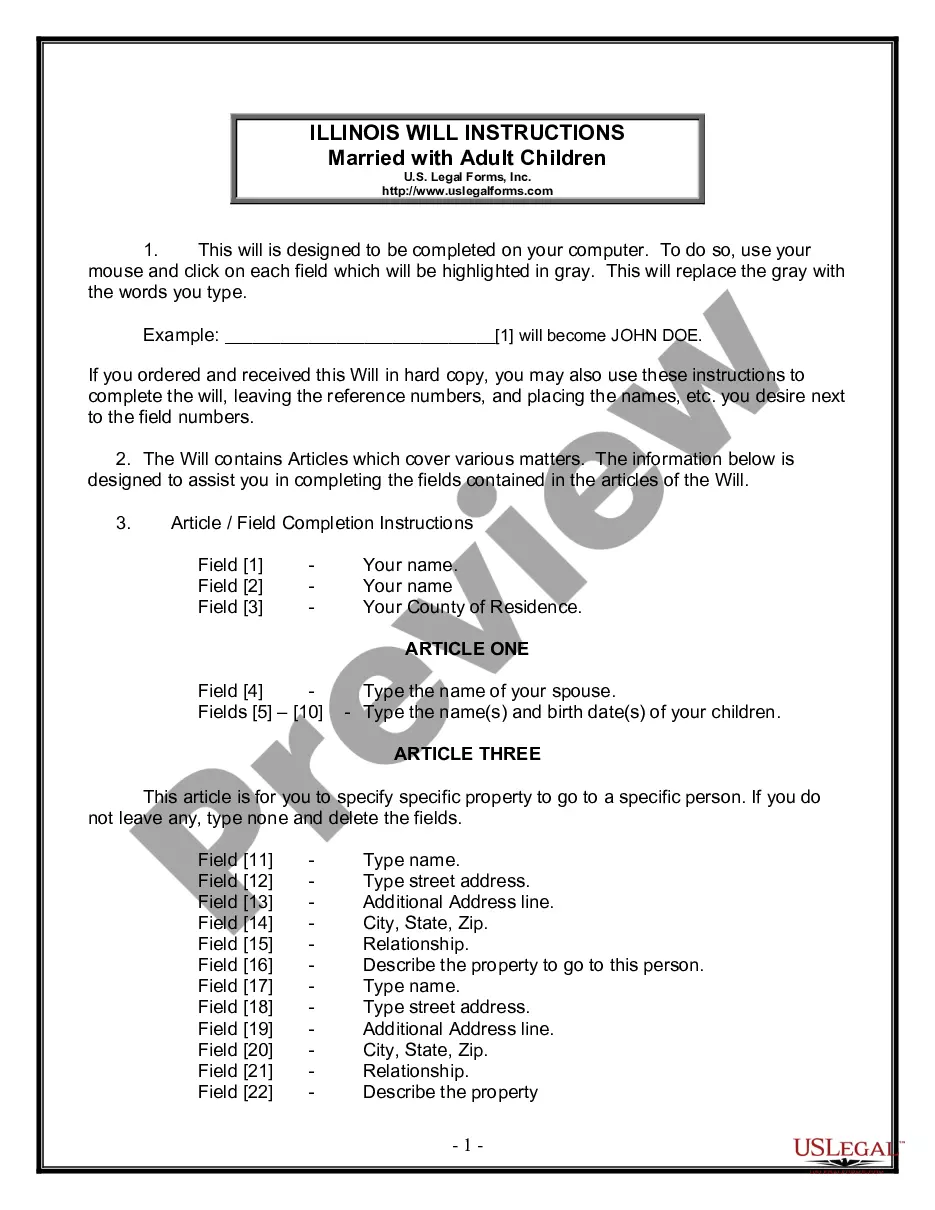

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

If you intend to finish, acquire, or create official document templates, utilize US Legal Forms, the most extensive selection of legal documents available online.

Employ the site's straightforward and convenient search function to locate the forms you require.

A variety of templates for commercial and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Get Now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the Illinois Agreement and Release for Working at a Novelty Store - Self-Employed with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Illinois Agreement and Release for Working at a Novelty Store - Self-Employed.

- You can also access forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/location.

- Step 2. Use the Preview option to review the form's details. Do not forget to check the information.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The Workplace Protection Act in Illinois serves as an essential legislative framework that safeguards workers' rights. This law ensures that employees, including those self-employed in roles such as novelty store operators, can operate with legal protection against workplace discrimination and retaliation. If you are utilizing an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed, this act provides a solid foundation for your rights and responsibilities. Understanding this law is vital for both business owners and employees to create a fair and equitable working environment.

The most important factor in distinguishing an employee from an independent contractor is the degree of control exercised by the employer. If the employer has significant control over how tasks are performed, it indicates an employer-employee relationship. Understanding this distinction is vital for those creating an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed to ensure proper classification and compliance with labor regulations.

A freelance worker is typically a self-employed individual who offers services to clients on a project basis. This type of work allows for greater flexibility and autonomy compared to traditional employment. If you're pursuing freelance opportunities, utilizing an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed can help streamline your agreements and protect your interests.

An independent contractor in Illinois is someone who provides services under a contract and retains control over how they perform their work. Unlike employees, independent contractors can set their own hours and work for multiple clients. This designation is essential, especially when formalizing an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed to clarify roles and responsibilities.

The freelance worker law in Illinois establishes rights for those engaged in freelance work, protecting them from discrimination and ensuring payment terms are honored. Under this law, freelancers must receive a written contract to clarify the scope of work and payment agreements. Resources such as an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed can help outline these contracts effectively.

An employee in Illinois is an individual who works for a company and receives wages or a salary. This work relationship often includes benefits like health insurance and retirement plans, as well as an employer’s responsibility to withhold taxes. It's important to recognize this distinction, particularly when executing an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed, to ensure compliance with labor laws.

In Illinois, a 1099 form is typically used for independent contractors, while a W-2 form is for employees. When you receive a 1099, it indicates that you are self-employed, and responsible for your own taxes. Conversely, with a W-2, your employer deducts taxes from your paycheck and provides you with benefits. For those working under an Illinois Agreement and Release for Working at a Novelty Store - Self-Employed, understanding these forms is crucial for proper tax reporting.

As a freelancer, you have the right to establish your working terms, including rates, project scope, and deadlines. You also have the right to receive payment for your work and to protect your intellectual property. Understanding and using the Illinois Agreement and Release for Working at a Novelty Store - Self-Employed can help you affirm these rights while providing a solid foundation for your freelance career.

Contract law in Illinois governs the creation and enforcement of agreements between parties. For contracts to be valid, they generally must include an offer, acceptance, consideration, and mutual consent. Familiarizing yourself with Illinois laws will be beneficial, especially when drafting agreements, such as the Illinois Agreement and Release for Working at a Novelty Store - Self-Employed, that can help safeguard your interests.

A legal contract for freelancers outlines the terms of the working relationship between the freelancer and the client. This contract should detail payment terms, project scope, deadlines, and any other expectations. By utilizing a solid agreement, like the Illinois Agreement and Release for Working at a Novelty Store - Self-Employed, you can ensure both parties are clear on their rights and obligations, which can protect you in case of disputes.