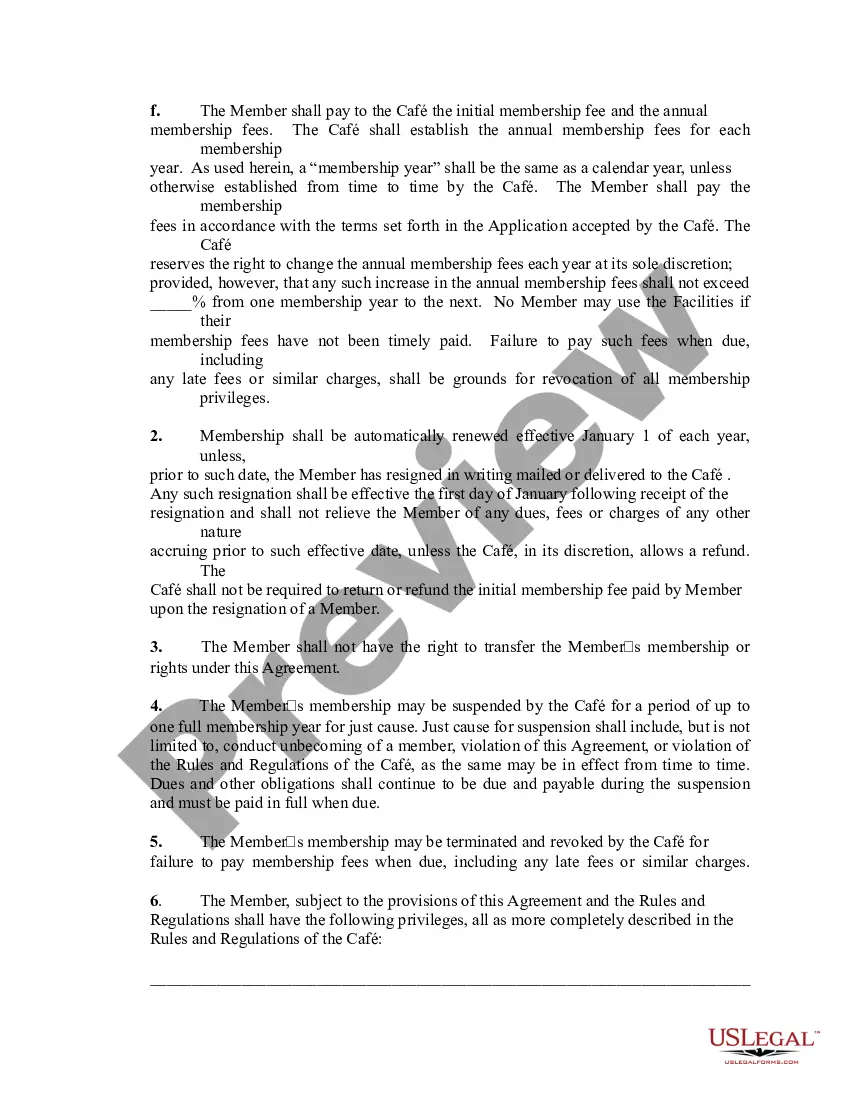

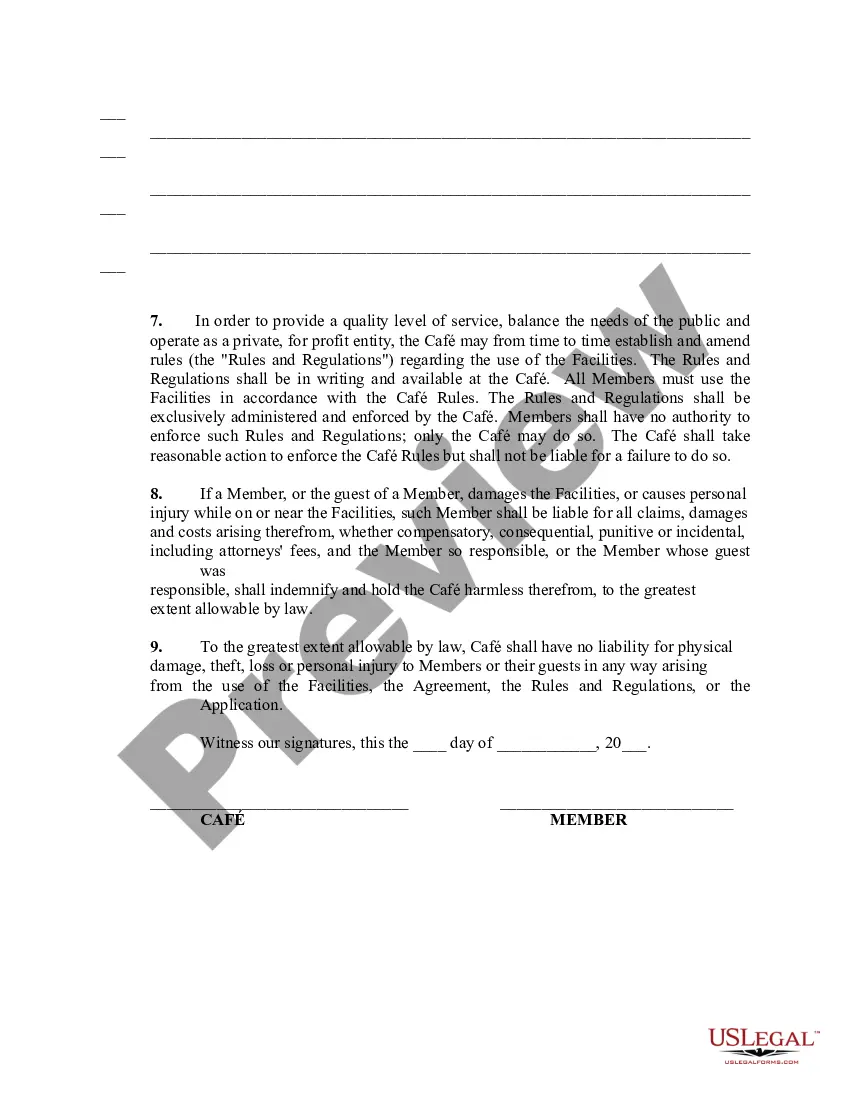

This form outlines an agreement between a member and a for-profit organization which owns and operates a facility where members can work on their business dreams, brainstorm, and engage in business and academic research.

Illinois Membership Agreement in Member Based Organization

Description

How to fill out Membership Agreement In Member Based Organization?

If you want to obtain, acquire, or print approved document templates, use US Legal Forms, the largest repository of legal forms available online.

Utilize the site's straightforward and user-friendly search feature to find the documents you need. A wide array of templates for business and personal use are organized by categories and jurisdictions, or keywords.

Access US Legal Forms to download the Illinois Membership Agreement in Member Based Organization in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Illinois Membership Agreement in Member Based Organization. Every legal document template you acquire is yours permanently. You have access to every form you saved in your account. Select the My documents section and choose a form to print or download again. Be proactive and download, and print the Illinois Membership Agreement in Member Based Organization using US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Illinois Membership Agreement in Member Based Organization.

- You can also access forms you previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your correct region/state.

- Step 2. Use the Review function to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

Form popularity

FAQ

B FORM AG990-IL FILING INSTRUCTIONS B. ATTORNEY GENERAL. A COMPLETE ANNUAL FINANCIAL REPORT (AG990-IL with all required attachments and applicable fees) is due within six months. after the organization's fiscal year end. A REPORT WILL NOT BE CONSIDERED FILED UNLESS IT IS COMPLETE.

The Internal Revenue Service (IRS) requires that all nonprofits registered at the federal level maintain a minimum of three members on the board of directors.

How to Start a Nonprofit in IllinoisName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

Board of Directors: There must be at least three (3) directors on the board. Board members do not need to be residents of the State of Illinois. The board runs the organization, and no individual can receive any profits from organization revenues.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

The answer is yes, although most nonprofit corporation laws contain a requirement that one person is designated as the president. However, you could have bylaws that allow for two people to be co-presidents and share duties.

According to a study by Bain Capital Private Equity, the optimal number of directors for boards to make a decision is seven. Every added board member after that decreases decision-making by 10%. Nonprofits can use that as a starting metric before considering the organization's life cycle, mission and fundraising needs.

Membership Nonprofits In a membership nonprofit, individuals who support the nonprofit can join the organization as members and become part of the decision-making process. Nonprofit members can elect and vote for new board members and suggest changes to the nonprofit's bylaws.

If the organization has more than $25,000 in gross revenue and assets, they must file Form AG990-IL with a copy of their IRS Return or Report (IRS 990, 990EZ, 990PD, etc.). Two individuals (the president or authorized officer and the treasurer or two trustees of the organization) must sign the AG990-IL.

Even though nonprofit organizations aren't required by law to publish annual reports, most nonprofit leaders recognize the value reports can provide.