Illinois Deed of Trust - Assignment

Description

How to fill out Deed Of Trust - Assignment?

Are you presently in a situation where you need documentation for both business or personal reasons nearly every workday.

There is a multitude of official document templates available online, but locating forms you can trust is not straightforward.

US Legal Forms provides thousands of form templates, such as the Illinois Deed of Trust - Assignment, which are designed to comply with federal and state standards.

Choose the pricing plan you prefer, provide the necessary information to create your account, and purchase the order using your PayPal or credit card.

Select a convenient format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Illinois Deed of Trust - Assignment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct state/region.

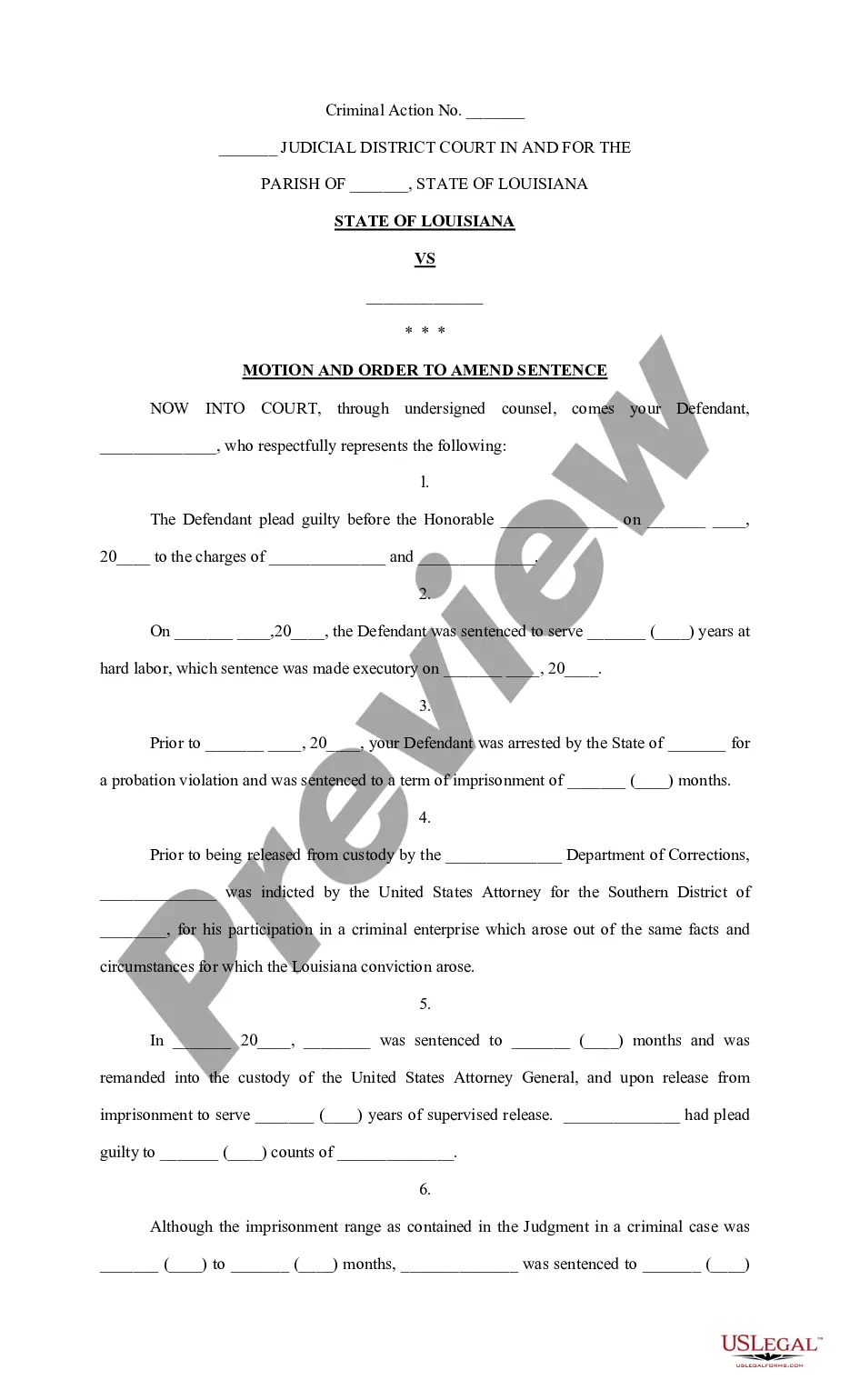

- Use the Review button to inspect the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

- Once you locate the appropriate form, click Buy now.

Form popularity

FAQ

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The type of foreclosure: If you have a deed of trust, you will usually have a nonjudicial foreclosure. On the other hand, the courts will typically be involved if you have a mortgage. Foreclosure details: When your lender forecloses with a deed of trust, the process will usually take less time and money to complete.

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy.

Illinois allows the use of both a deed of trust and a mortgage. Illinois is a lien-theory state.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another. This usually happens when the beneficiary of a trust deed sells their loan to another lender.