Illinois Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

Are you in a situation where you require documentation for potential business or particular tasks every day.

There are numerous legal document templates accessible online, yet finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Illinois Exchange Addendum to Contract - Tax Free Exchange Section 1031, which can be customized to satisfy state and federal standards.

Once you locate the appropriate form, click on Purchase now.

Choose your desired pricing plan, enter the requisite information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms site and possess an account, simply Log In.

- Subsequently, you can download the Illinois Exchange Addendum to Contract - Tax Free Exchange Section 1031 template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it corresponds to the correct city/state.

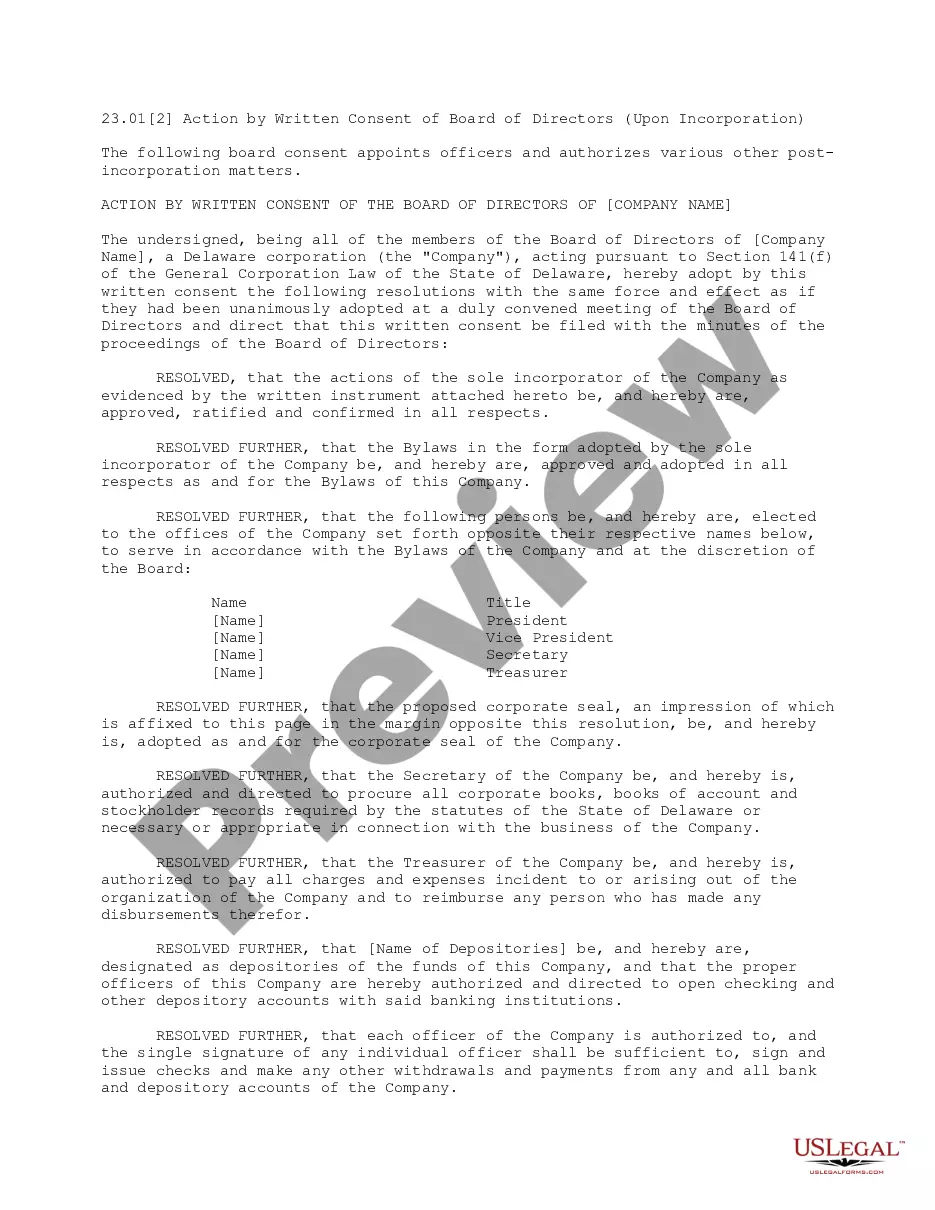

- Use the Preview button to examine the document.

- Review the details to guarantee that you have selected the correct form.

- If the form isn't what you're looking for, use the Lookup field to find the document that fits your needs and requirements.

Form popularity

FAQ

Illinois doesn't have any specific statewide laws governing 1031 exchanges, so an Illinois 1031 exchange will generally be a straightforward affair. But that doesn't mean it's any less important to find the right qualified intermediary (QI) to help execute your Illinois 1031 exchange.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

For instance, when an installment sale includes seller financing for which the seller wishes to complete a 1031 exchange but will be receiving some or all of the buyer's installment payments beyond the 180 day window for concluding the exchange.

A 1031 exchange allows the seller of real estate to avoid the payment of taxes by acquiring new real estate. As long as the proper procedures are followed, the Internal Revenue Service will recognize the transaction, not as a sale and purchase, but as an exchange of a relinquished property for a replacement property.

For a Section 1031 exchange, it is imperative that the purchase and sale contracts for both parties be assignable.

A portion of the proceeds can be cashed out for immediate use, and the remainder of the proceeds can be reinvested into another property through a partial 1031 exchange. 1031 exchange rules do not limit you from completing an exchange if you do not intend to reinvest the entirety of your sale proceeds.

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

A 1031 exchange gets its name from Section 1031 of the U.S. Internal Revenue Code, which allows you to avoid paying capital gains taxes when you sell an investment property and reinvest the proceeds from the sale within certain time limits in a property or properties of like kind and equal or greater value.

What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.