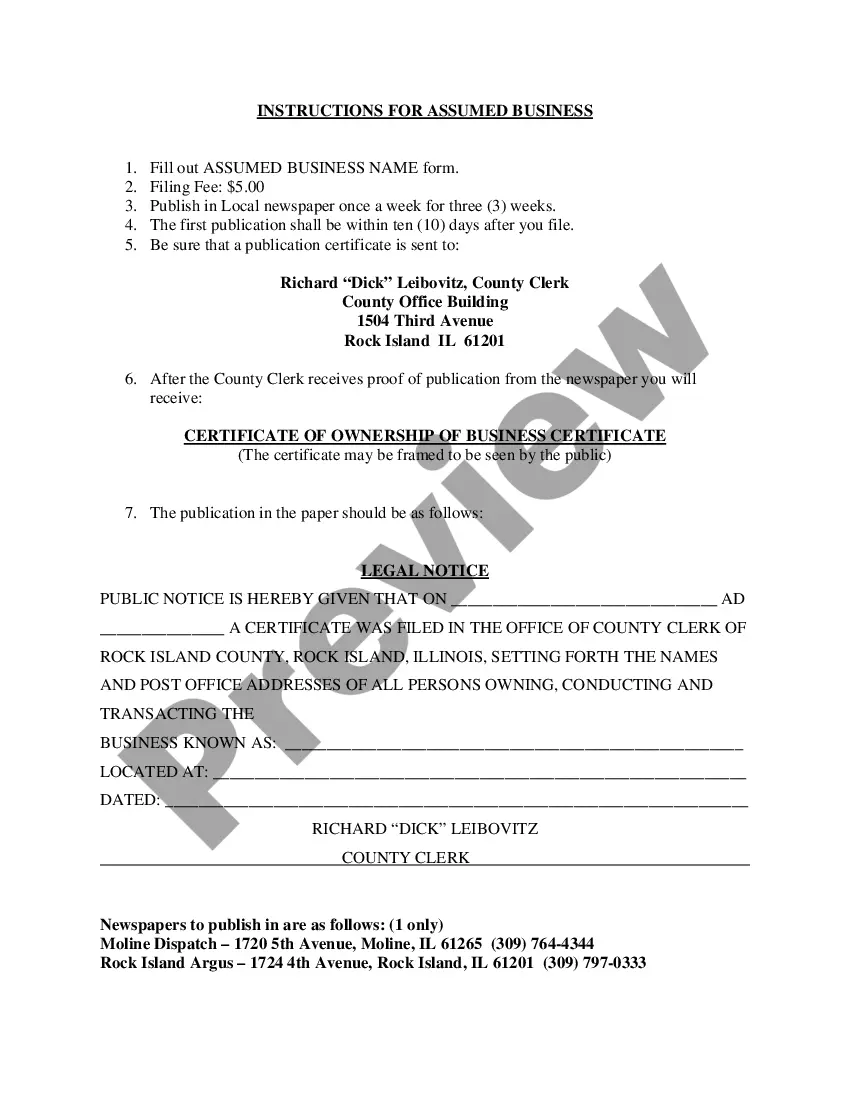

Illinois Notice Final is a legal document that must be filed in a court by an individual or entity involved in a lawsuit in the state of Illinois. It is a written notice that informs the court and all parties involved that the plaintiff is ready to move forward with the lawsuit. There are two types of Illinois Notice Final: Notice of Final Settlement and Notice of Final Judgment. Notice of Final Settlement is a notice that is filed after a settlement has been reached between the parties, and Notice of Final Judgment is a written notice that is filed after a court has issued a ruling or judgment in a case. Both notices are necessary in order for the court to enter the settlement or judgment into the court's official record.

Illinois Notice Final

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Notice Final?

Completing official documentation can be quite a challenge unless you possess pre-prepared fillable templates. With the US Legal Forms online collection of formal papers, you can have confidence in the blanks you discover, as all of them adhere to federal and state guidelines and are reviewed by our experts.

Acquiring your Illinois Notice Final from our collection is as easy as pie. Previously registered users with an active subscription simply need to Log In and click the Download button once they find the suitable template. Afterwards, if needed, users can retrieve the same document from the My documents tab in their account.

Haven’t you utilized US Legal Forms yet? Register for our service today to obtain any official document swiftly and effortlessly whenever you require, and maintain your paperwork organized!

- Document compliance validation. You should thoroughly inspect the content of the form you desire and confirm whether it meets your needs and adheres to your state legal requirements. Previewing your document and reviewing its general description will assist you in doing this.

- Alternative search (optional). If there are any discrepancies, navigate the library using the Search tab above until you locate a suitable blank, and click Buy Now when you spot the one you require.

- Account creation and document acquisition. Register for an account with US Legal Forms. After account validation, Log In and choose your preferred subscription plan. Proceed to make a payment (PayPal and credit card options are offered).

- Template download and subsequent use. Choose the file format for your Illinois Notice Final and click Download to store it on your device. Print it to manually fill out your documents, or utilize a multi-featured online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

Yes. Illinois is an "employment at-will" state, meaning that an employer or employee may terminate the relationship at any time, without any reason or cause.

There are absolutely no Illinois state laws or federal laws which require an employer to give any notice whatsoever to employees when they fire them.

When an employee leaves an employer's employment, the employer is required to pay the final compensation of separated employees in full at the time of separation, if possible, but in no event later than the next regularly scheduled payday for such employee.

When an employee leaves an employer's employment, the employer is required to pay the final compensation of separated employees in full at the time of separation, if possible, but in no event later than the next regularly scheduled payday for such employee.

If your employer failed to pay you all of the wages you are owed, you can file a wage claim with the Illinois Labor Department. The Illinois Labor Department allows you to file a wage claim online. In general, you must file your wage claim within one year after your employer violates the law.

There are no circumstances under which an employer can totally withhold a final paycheck under Illinois law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages.

There are no circumstances under which an employer can totally withhold a final paycheck under Illinois law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages.

If I quit or am fired, am I entitled to severance pay, sick pay, or holiday pay? No. You are not entitled to severance pay, sick pay, or holiday pay unless your employer promised the pay in a contract or other agreement.