The Illinois Oath and Bond of Representative-Surety is a legal document required by the state of Illinois for any individual or business entity that will be acting as a representative and surety for another individual or business entity. This document is used to ensure that the representative-surety will act in the best interests of the other party and will adhere to all laws and regulations in the state of Illinois. The document includes an oath of office, a statement of the duties of the representative-surety, and a bond of fidelity. The most common type of Illinois Oath and Bond of Representative-Surety is the Surety Bond. This type of bond is used to guarantee the performance of a contract, such as a loan agreement or other agreement between two parties. The bond is usually secured by a third party and is held in trust until the terms of the agreement are fulfilled. If the terms are not met, then the surety is responsible for any losses incurred. Another type of Illinois Oath and Bond of Representative-Surety is the Power of Attorney Bond. This type of bond secures the appointment of another person to act on behalf of the principal who is entering into a contract. The bond guarantees that the appointed person will act in the best interests of the principal. The last type of Illinois Oath and Bond of Representative-Surety is the Bond of Indemnity. This type of bond is used to protect a party that is entering into a contract from any losses they may incur due to the actions of the other party. The bond guarantees that the party will be compensated for any losses they face due to the action of the other party.

Illinois Oath and Bond of Representative-Surety

Description

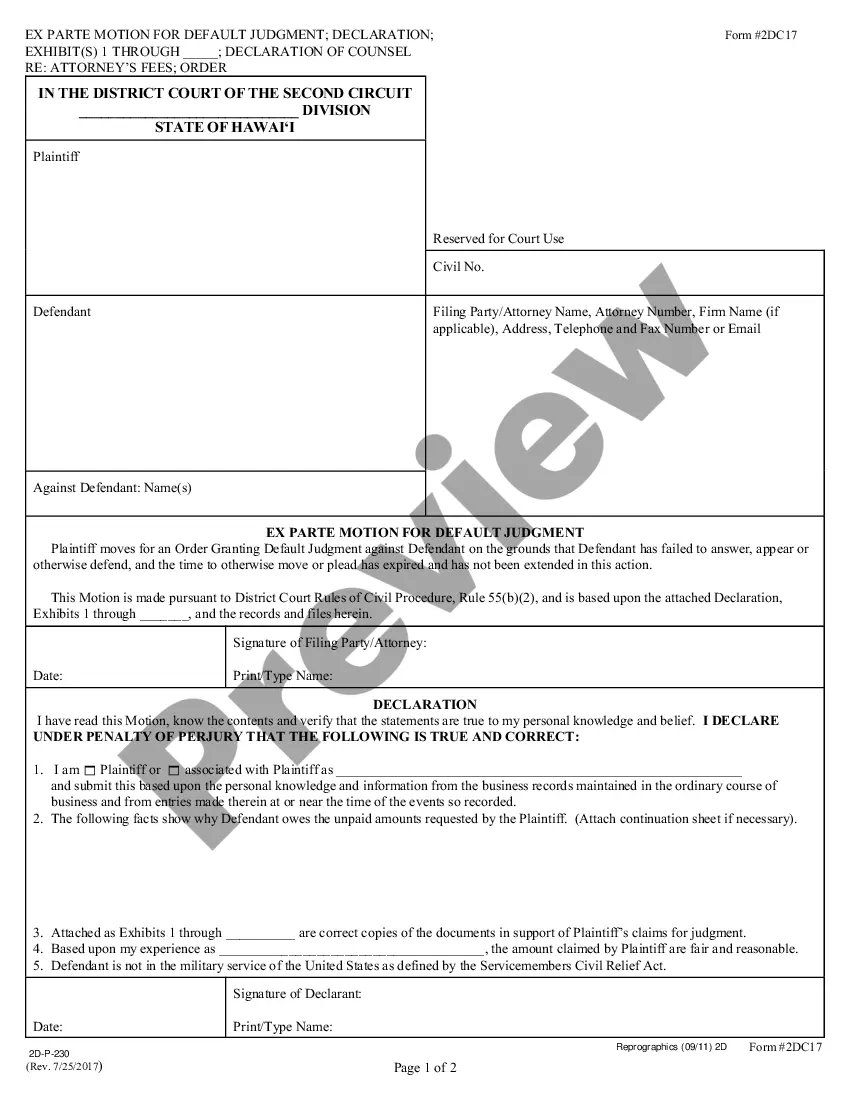

How to fill out Illinois Oath And Bond Of Representative-Surety?

Managing formal documentation necessitates carefulness, precision, and utilizing well-structured forms.

US Legal Forms has been assisting individuals nationwide for 25 years, so when you select your Illinois Oath and Bond of Representative-Surety template from our platform, you can rest assured it adheres to federal and state laws.

All documents are prepared for various uses, like the Illinois Oath and Bond of Representative-Surety shown on this page. If you require them in the future, you can complete them without additional payment - just access the My documents tab in your profile and finish your document any time you want. Experience US Legal Forms and complete your commercial and personal paperwork swiftly and in complete legal compliance!

- Ensure to thoroughly verify the form's content and its alignment with general and legal standards by previewing it or reviewing its description.

- Search for another official template if the one you opened does not fit your circumstances or state laws (the option for that is located at the top page corner).

- Log in to your account and save the Illinois Oath and Bond of Representative-Surety in the format you prefer. If it’s your first time using our website, click Buy now to proceed.

- Create an account, choose your subscription plan, and pay using your credit card or PayPal account.

- Decide on the format in which you wish to save your form and click Download. Print the form or utilize a professional PDF editor for a paperless submission.

Form popularity

FAQ

The $5,000 notary public bond in Illinois, known as the Illinois Oath and Bond of Representative-Surety, protects the public from potential misconduct by a notary. This bond guarantees that if any damages occur due to the notary's actions, the bond can provide compensation up to the specified amount. Obtaining this bond is a crucial step in the notary application process. Consider using USLegalForms to find resources and services that can help you navigate the bond acquisition process efficiently.

Illinois law requires Notaries to purchase and maintain a surety bond for the duration of their 4-year commission.

A Surety Agreement Defined They differ from an insurance contract in that an insurance contract includes two entities (insurance provider and policyholder), whereas a surety bond involves three parties: the Principal, the Obligee and the Surety.

Public adjuster surety bond ? public adjusters in Illinois are required to post a $20,000 bond to protect their clients. A public adjuster bond ensures that all public adjusters in the state conduct themselves to the required professional standards.

Surety Bond Requirements in IL You must have a proper surety bond in place if you are an appraisal management company (AMC), motor vehicle dealer, plumbing contractor, roofing contractor, or residential mortgage broker. Most Illinois surety bonds have a fixed liability amount, while some vary.

Most Popular Surety Bonds in Illinois You'll need to post a $50,000 bond to get your car dealer license from the Illinois Secretary of State. Roofing contractors in Illinois need a $10,000 or $25,000 bond, while plumbers need a $20,000 bond.

Illinois title bond amounts must be 1.5 times the vehicle's appraised value. The Secretary of State will provide the exact bond amount required.

The first step to getting an Illinois surety bond is to apply for your bond. Not everyone can get approved for a bond, so this is the first step to getting bonded. Most companies all you to apply for your bond online. You can apply for a bond at your local insurance agency, or a specialized surety bond company.