The Illinois Application For Homestead Exemption Limited (Form PTAX-343) is an application that homeowners in Illinois must file with their county assessor’s office in order to receive a homestead exemption on their property tax bill. The homestead exemption is a tax incentive program that provides homeowners with a limited reduction in their property taxes. The amount of the homestead exemption varies from county to county and is based on the assessed value of the home. The application is available online from the Illinois Department of Revenue website. There are two types of homestead exemption available in Illinois: the General Homestead Exemption and the Senior Citizens Homestead Exemption. The General Homestead Exemption is for homeowners aged 65 or older or who have a disability, and provides a reduction of up to $6,000 on the assessed value of the home. The Senior Citizens Homestead Exemption is for homeowners aged 65 or older and provides a reduction of up to $8,000 on the assessed value of the home. In order to qualify for either exemption, homeowners must meet certain income requirements. The application must be filed before the first day of the tax year in order to receive the exemption.

Illinois application For Homestead Exemption Limited

Description

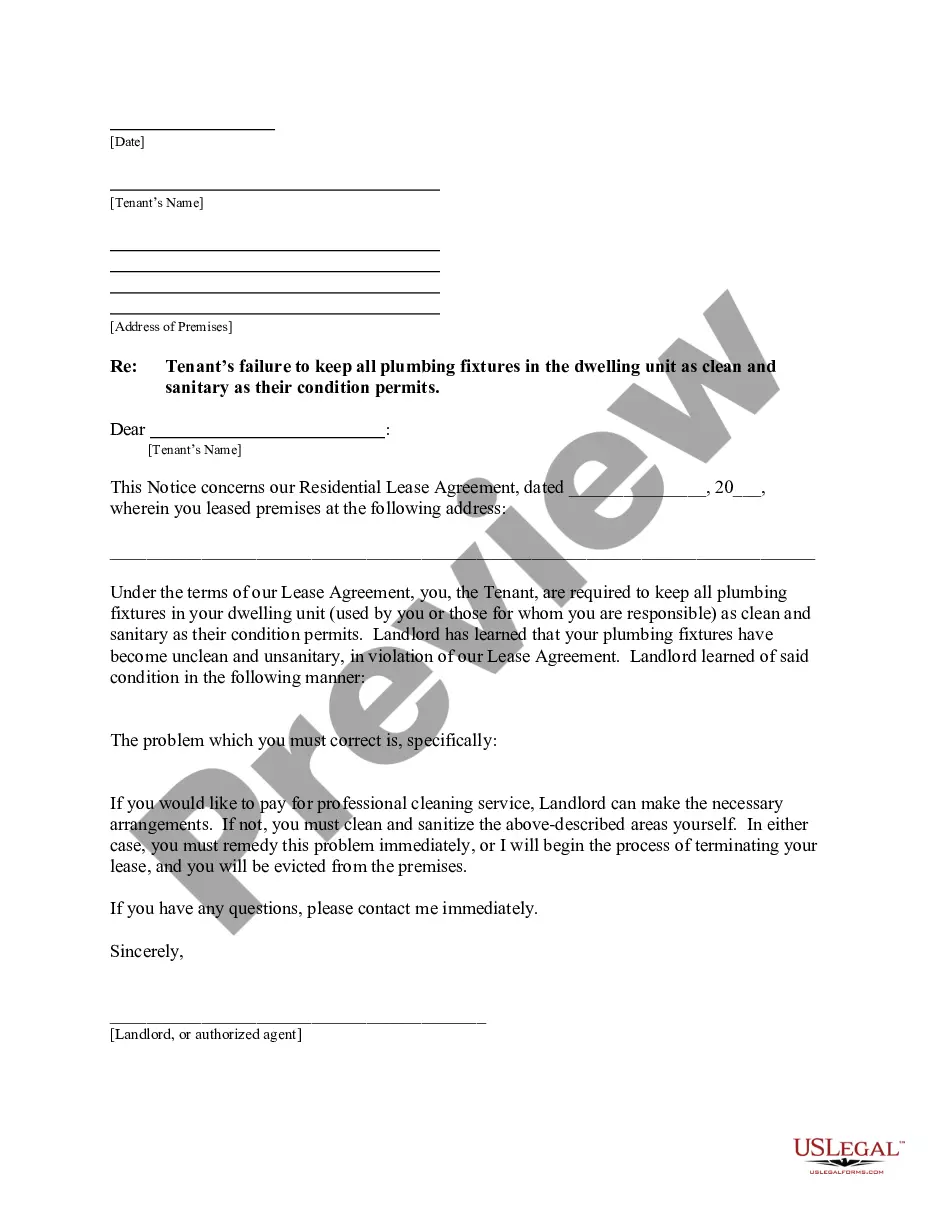

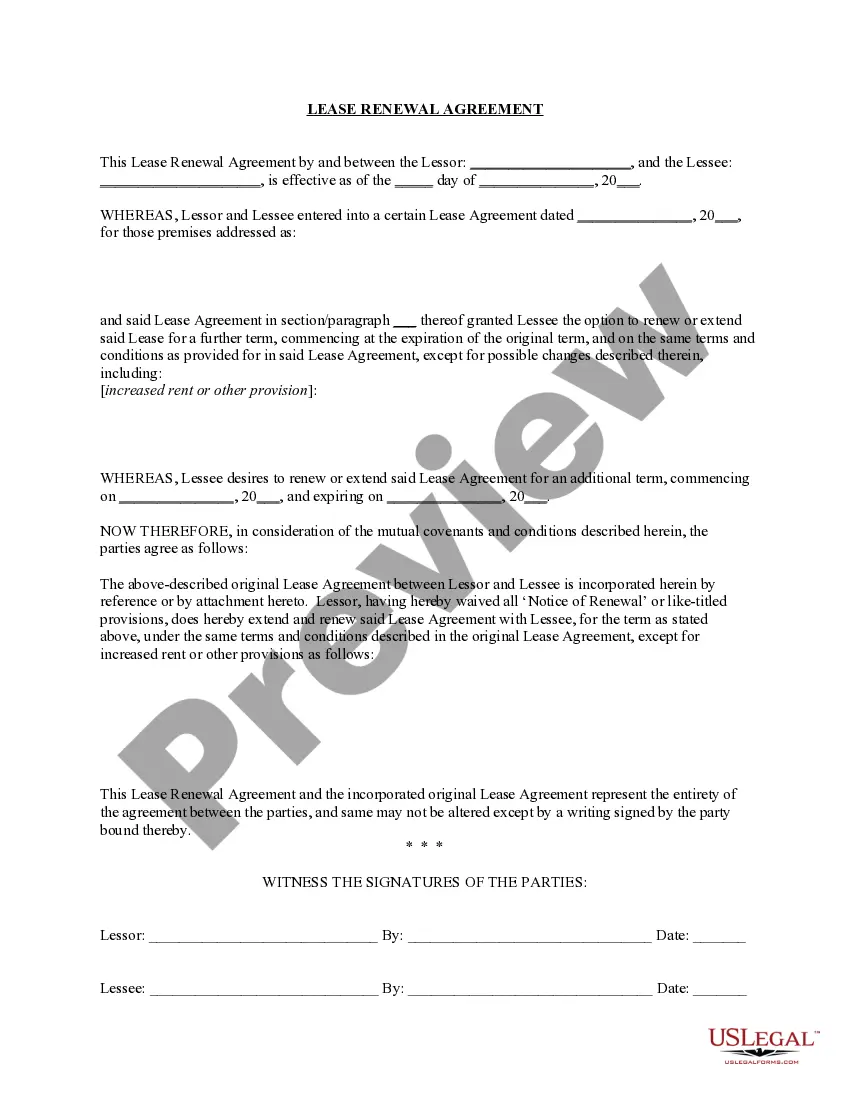

How to fill out Illinois Application For Homestead Exemption Limited?

US Legal Forms is the simplest and most rewarding method to find appropriate formal templates.

It’s the most comprehensive online repository of business and personal legal documents created and validated by lawyers.

Here, you can discover printable and fillable forms that adhere to federal and local regulations - just like your Illinois application for Homestead Exemption Limited.

Review the form details or preview the document to verify you’ve selected the one that meets your needs, or search for an alternative using the search feature above.

Click Buy now when you’re confident of its alignment with all the specifications, and select the subscription plan that suits you best.

- Obtaining your template requires only a few straightforward steps.

- Users with an existing account and active subscription simply need to Log In to the online platform and download the document onto their device.

- Once it's downloaded, you can locate it in your profile under the My documents section.

- Here’s how to get a professionally prepared Illinois application for Homestead Exemption Limited if you are a first-time user of US Legal Forms.

Form popularity

FAQ

The exemption must be renewed each year by filing Form PTAX-343-R, Annual Verification of Eligibility for the Homestead Exemption for Persons with Disabilities, with the Chief County Assessment Office.

What is the Homestead Exemption in Illinois? The Illinois homestead exemption protects up to $15,000 of equity in your home. For example, if you own a home with an original mortgage of $100,000, and you now only owe $85,000, the $15,000 in equity will receive protection if you file.

Taxpayers are only entitled to one homestead exemption on their primary residence for any given tax year. If you received a notice of discovery for your primary residence, please contact the Assessor's Office if you have not already done so.

General Homestead Exemption (General or Homestead Exemption) The amount of exemption is the increase in the current year's equalized assessed value (EAV), above the 1977 EAV, up to a maximum of $6,000. The General Homestead Exemption is granted automatically in most cases.

Following the Illinois Property Tax Code, this exemption lowers the equalized assessed value of the property by $8,000. These changes will be reflective for 2023 payable in 2024.

To qualify for the Illinois homestead exemption, you must live in the state for at least 730 days. If you haven't lived in the state for at least this long, you will be required to use the exemptions from the state where you previously lived.