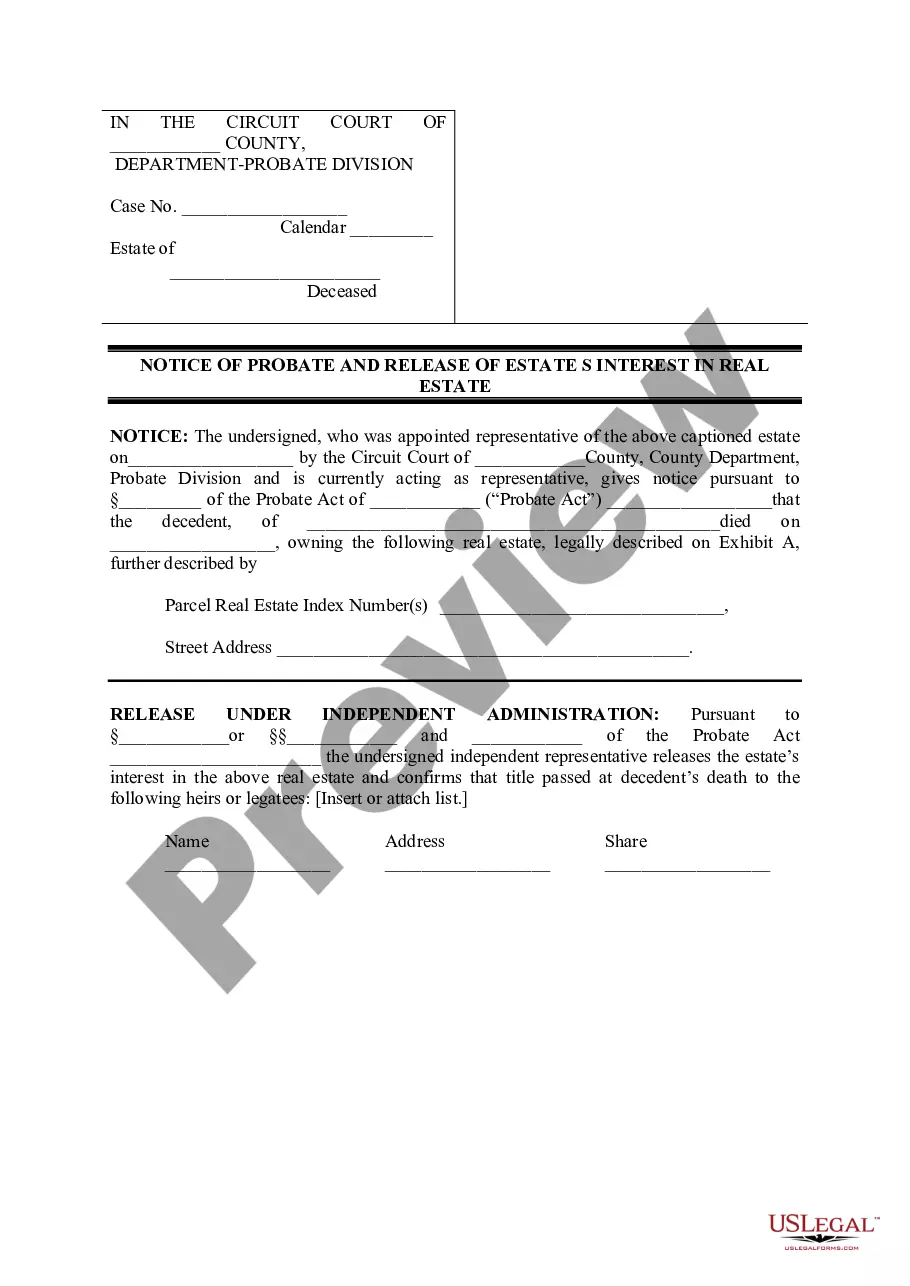

Illinois Notice Of Probate and Release Of Estates Interest In Real Estate is a legal document that is used to inform the public that an estate is being probated and that the estate’s interest in real estate has been released from the probate process. The document is filed with the local county recorder or registrar to provide notice to all interested parties of the estate’s interest in real estate. There are two types of Illinois Notice Of Probate and Release Of Estates Interest In Real Estate. The first type is the Notice of Probate which is filed when a decedent's estate is opened for probate and the second type is the Release of Estates Interest in Real Estate which is filed when the estate has been settled and the estate’s interest in real estate has been released from the probate process. The Notice of Probate typically includes the name of the decedent, the names of the executor and/or administrator of the estate, the court in which the estate is being probated, and the date of the filing. The Release of Estates Interest in Real Estate includes the name of the decedent, the names of the executor and/or administrator of the estate, a description of the real estate released, and the date of the filing.

Illinois Notice Of Probate and Release Of Estates Interest In Real Estate

Description

Understanding Notice of Probate and Release of Estates Interest

Notice of probate is a formal legal notice issued upon the death of an individual, indicating the commencement of the probate process. It is vital for handling the decedent's assets, ensuring the will's execution, and addressing any creditors' claims. The release of estates interest refers to the process whereby potential heirs or claimants release their claims or interests in the estate's assets to facilitate a smoother execution of the will and asset distribution.

Steps Involved in Notice of Probate and Release of Estates Interest in Illinois

- File a petition for probate in the local Illinois probate court to begin the Illinois probate process.

- Issue a notice probate to all potential creditors and heirs, informing them of the decedent's death and the ongoing probate processes.

- Negotiate or handle any creditors claims against the estate's assets.

- Achieve closure through independent administration, allowing the executor or assets representative greater control with minimal court intervention.

- Upon settlement, implement the release of estates interest, formally relinquishing any claims by stakeholders in a legally binding manner.

Risk Analysis: Notice of Probate and Estate Release

- Legal disputes: Failure to properly notify candidates can result in legal delays or litigation.

- Delay in asset distribution: Probate can be lengthy, affecting the timely distribution of the estate.

- Creditors' interference: Insufficient notice can lead to incomplete closure of creditors' claims, risking the assets of the estate.

Comparative Analysis: Independent vs. Dependent Administration

| Administration Type | Advantages | Disadvantages |

|---|---|---|

| Independent Administration | Less court interference, faster resolution | Higher responsibility on executor |

| Dependent Administration | Court supervised, structured | Time-consuming, possible higher costs |

How to fill out Illinois Notice Of Probate And Release Of Estates Interest In Real Estate?

How much effort and resources do you typically allocate to drafting formal documentation.

There’s a better alternative to acquiring such forms than hiring legal professionals or spending hours searching the internet for an appropriate template.

Create an account and settle your subscription fee. You can complete your payment with your credit card or through PayPal - our service guarantees security for that.

Download your Illinois Notice Of Probate and Release Of Estates Interest In Real Estate onto your device and complete it either on a printed hard copy or electronically.

- US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal documents for any intention, such as the Illinois Notice Of Probate and Release Of Estates Interest In Real Estate.

- To acquire and prepare a suitable Illinois Notice Of Probate and Release Of Estates Interest In Real Estate template, follow these straightforward steps.

- Examine the form content to ensure it aligns with your state regulations. To do so, review the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find a different one using the search bar at the top of the page.

- If you are already signed up with our service, Log In and download the Illinois Notice Of Probate and Release Of Estates Interest In Real Estate. Otherwise, continue to the following steps.

- Click Buy now when you discover the appropriate document. Select the subscription plan that best fits your needs to access the complete features of our library.

Form popularity

FAQ

Starting the probate process in Illinois involves filing the necessary documents with the probate court. First, gather the decedent's will and other relevant documents, and then complete the forms required by the court. Remember to file the Illinois Notice Of Probate and Release Of Estates Interest In Real Estate if estates involve real property. Using platforms like USLegalForms can simplify this process for you.

This statement of the decedent's intent is commonly known as that person's "Will." Under Illinois law, it is required that any person who possesses the Will of a decedent file it with the Clerk of the Circuit Court of the county in which that individual resided within 30 days after the death of the testator is known to

It does not depend on whether or not there is a valid will. Generally, a formal probate court proceeding is necessary in Illinois only if: there are assets that the deceased person owned solely (not jointly), and. all of the probate assets, together, are worth more than $100,000.

Notice of Probate for Real Estate in Illinois If the personal representative does not sell or transfer the decedent's real estate during administration of the estate, the personal representative must file a notice of probate with the County Recorder's office in the county in which the real estate is located.

Probate is typically necessary in Illinois when the decedent owns any real estate or more than $100,000.00 of non-real-estate assets outside of a trust.

The right to disclaim property or a part thereof or an interest therein shall be barred by (1) a judicial sale of the property, part or interest before the disclaimer is effected; (2) an assignment, conveyance, encumbrance, pledge, sale or other transfer of the property, part or interest, or a contract therefor, by the

Within 42 days after the effective date of the original order of admission, you may file a petition with the court to require proof of the will by testimony of the witnesses to the will in open court or other evidence, as provided in section 6-21 of the Probate Act of 1975 755 ILCS 5/6-21).

?Within 14 days of the will being admitted to probate, the executor's attorney must mail to the heirs and legatees: (1) the petition for probate; (2) the order admitting the will to probate and appointing the executor; (3) a notice regarding the rights of the heirs and legatees.

Notice to Heirs and Legatees - This is a notice that must be sent to all heirs (people entitled to inherit in the absence of a will) and legatees (people named as beneficiaries of the will) informing them of the opening of the probate estate.