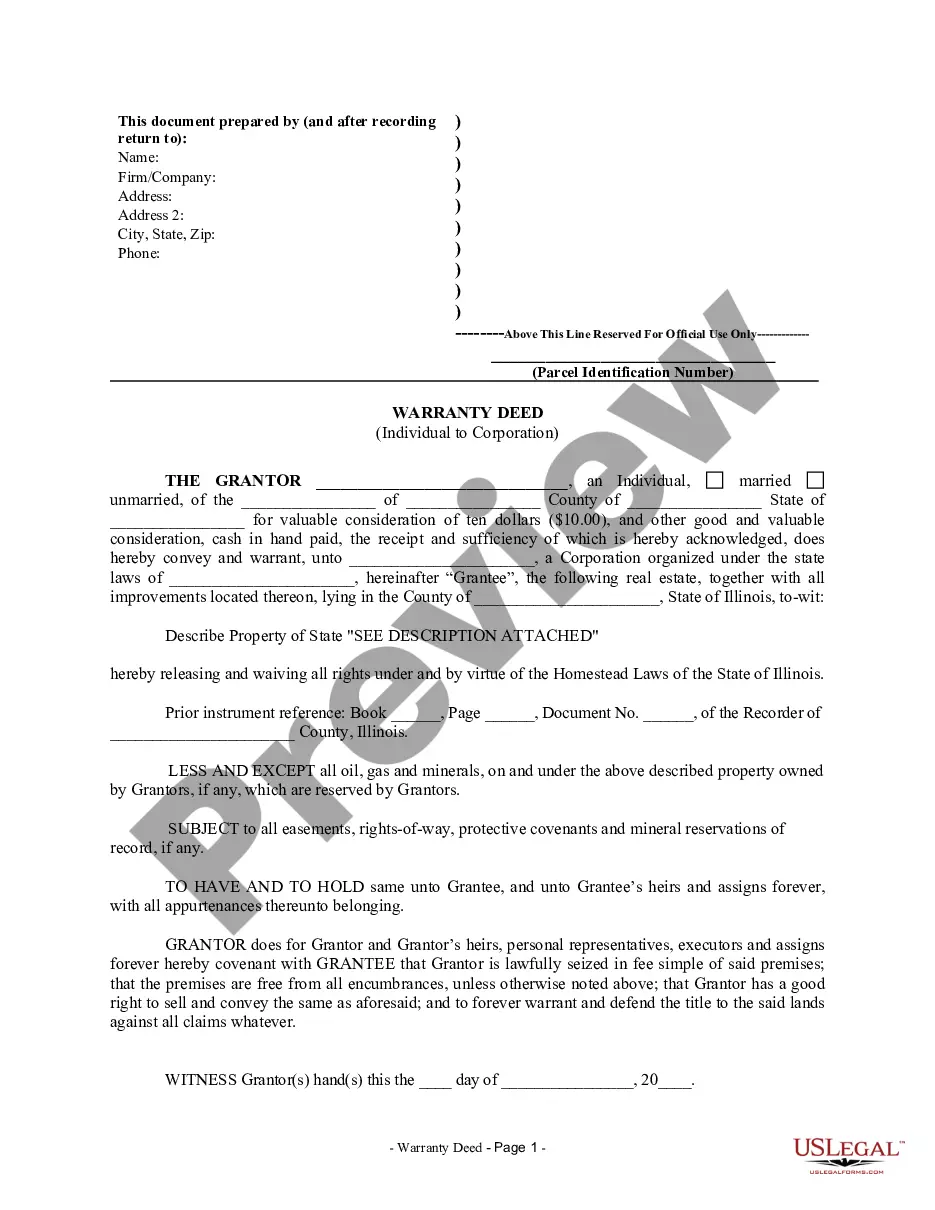

Illinois Warranty Deed from Individual to Corporation

Description

How to fill out Illinois Warranty Deed From Individual To Corporation?

Searching for Illinois Warranty Deed from Individual to Corporation templates and completing them can be a task. To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate example specifically for your state with just a few clicks. Our lawyers draft each document meticulously, so you simply need to complete them. It is genuinely that easy.

Sign in to your account and navigate back to the form's page to save the template. All your saved templates are stored in My documents and they are accessible at any time for future use. If you haven’t registered yet, you should enroll.

Review our comprehensive guidelines on how to obtain the Illinois Warranty Deed from Individual to Corporation sample in just a few minutes.

You can now print the Illinois Warranty Deed from Individual to Corporation form or complete it using any online editor. Don’t fret about typographical errors, as your form can be used and submitted, and printed multiple times as needed. Explore US Legal Forms for access to nearly 85,000 state-specific legal and tax documents.

- To acquire a qualified sample, verify its relevance for your state.

- Examine the sample using the Preview feature (if available).

- If there’s a description, peruse it to understand the particulars.

- Click Buy Now if you have discovered what you’re seeking.

- Select your plan on the pricing page and establish your account.

- Choose your payment method, either by card or by PayPal.

- Save the template in your desired file format.

Form popularity

FAQ

Yes, a corporation must sign the deed when transferring ownership of property. For an Illinois Warranty Deed from Individual to Corporation, the authorized representatives of the corporation need to provide their signatures. This step confirms the corporation's consent to the transaction and helps to avoid any future disputes regarding ownership. It's wise to involve legal professionals to ensure compliance with all formalities.

It's important to note that a warranty deed does not actually prove the grantor has ownership (a title search is the best way to prove that), but it is a promise by the grantor that they are transferring ownership and if it turns out they don't actually own the property, the grantor will be responsible for compensating

The mortgage company usually prepares this deed as part of the loan package and delivers it to the title company for you to sign at closing. The title company is commonly the trustee to the deed and holds legal title to the property until the loan gets fully repaid.

A statutory warranty deed is different from a warranty deed because it is a shorter form made available through your state's statutes and it may not outright list the promise that the title is guaranteed to be clear. Instead, because it is a statutory form, this guarantee is implied and is still legally enforceable.

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

After your Warranty Deed has been recorded at the County Clerk's Office, it can be sent to the grantee. However, any person or corporation can be designated as the recipient of the recorded Warranty Deed.

The original deed is returned to the owner of the property from the office of the recorder after proper entry. The office of the Recorder of Deeds maintains a set of indexes about each deed recorded, for an easy search. Almost all states have a grantor-grantee index including a reference to all documents recorded.

Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded. These are your original copies and should be kept in a safe place, such as a fireproof lockbox or a safe deposit box at a financial institution.

Corporate warranty deeds offer the seller's guarantee to the buyer in regards to the validity of the chain of title. Generally, special warranty deeds only protect against problems occurring since the seller purchased the property.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.