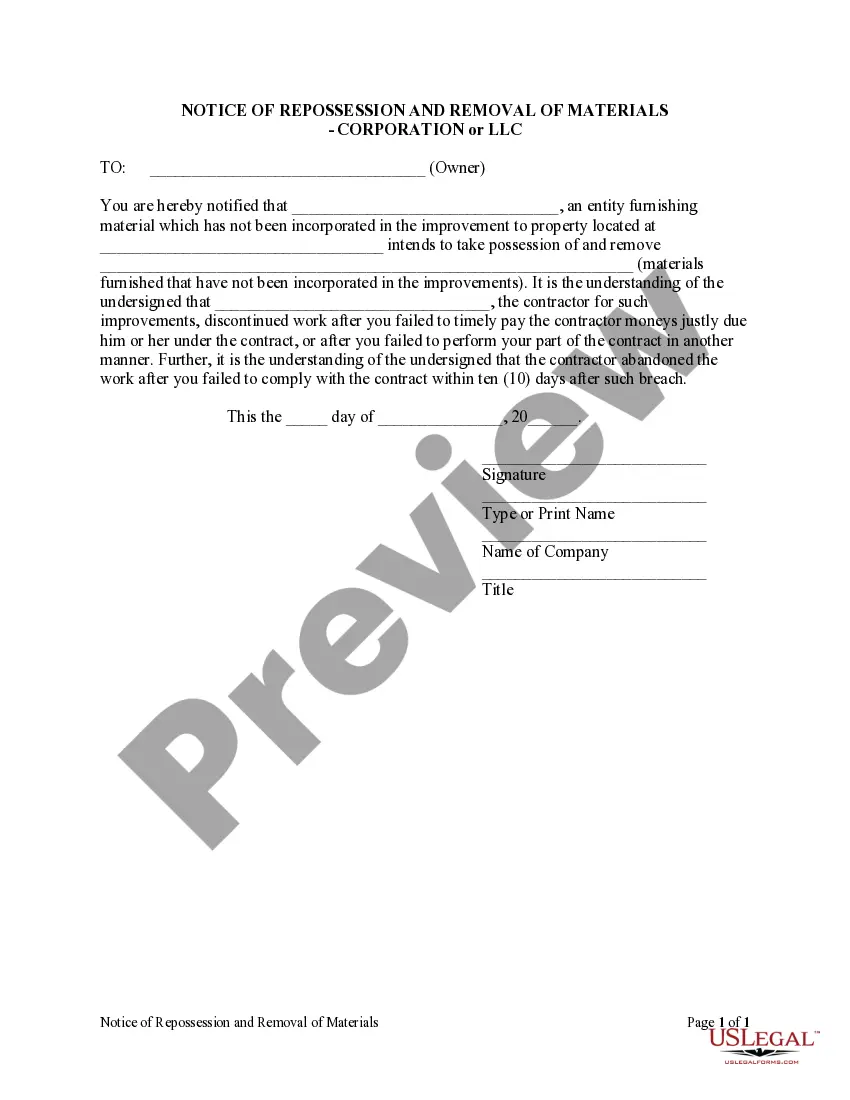

Illinois Notice of Repossession and Removal of Materials - Corporation or LLC

Description

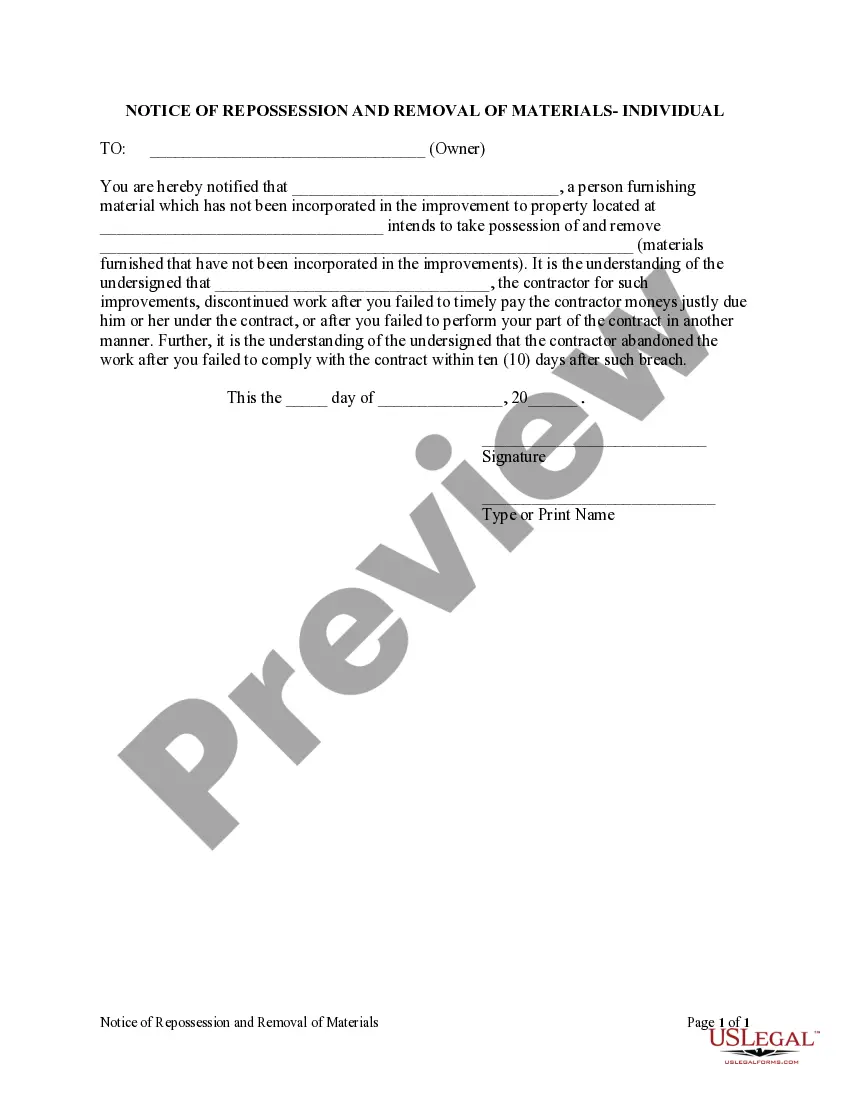

How to fill out Illinois Notice Of Repossession And Removal Of Materials - Corporation Or LLC?

Searching for Illinois Notification of Repossession and Removal of Assets - Corporation or LLC forms can prove to be quite difficult.

To conserve time, money, and effort, utilize US Legal Forms to locate the appropriate template specifically for your region within a few clicks.

Our attorneys prepare each document, so all you need to do is complete them. It's truly that easy.

You can now print the Illinois Notification of Repossession and Removal of Assets - Corporation or LLC template or complete it using any online editor. Don't worry about making mistakes, as your template can be utilized, submitted, and printed as many times as you want. Try US Legal Forms and access over 85,000 state-specific legal and tax documents.

- Log into your account and navigate back to the form's page to save the template.

- All your downloaded forms are kept in My documents and are always available for future use.

- If you haven't subscribed yet, you'll need to sign up.

- Review our detailed guidelines on how to obtain your Illinois Notification of Repossession and Removal of Assets - Corporation or LLC form within minutes.

- To get a titled template, verify its validity for your jurisdiction.

- Examine the sample using the Preview feature (if available).

- If there's a description, read through it to grasp the details.

- Click on Buy Now button if you found what you need.

- Choose your plan on the pricing page and create an account.

- Select your payment method via credit card or PayPal.

- Download the template in your desired file format.

Form popularity

FAQ

In Illinois, a repo man can enter private property to repossess a vehicle, but they must do so without breaking any laws. It's essential to avoid any form of breach of peace while conducting the repossession. This means they must not use threats, violence, or move past locked gates. Understand that you may receive an Illinois Notice of Repossession and Removal of Materials - Corporation or LLC which outlines your rights in this situation.

If you fail to abide by the court order, you may be subject to both civil and criminal penalties. The creditor can also get a money judgment against you, usually for the balance owed on the loan or lease, along with charges and costs.

Name Your Illinois LLC. Choose a Registered Agent. File the Articles of Organization. Create an Operating Agreement. Get an EIN.

Illinois requires auto lenders to wait 21 days after sending out the Notice of Redemption before they can resell the vehicle. This gives the debtor a chance to: Redeem the value of the loan, in order to buy back the vehicle; or. File an Affidavit of Defense to the Creditor, which sends the case to court.

If the repo man can't find the car, he can't repossess it.Eventually the creditor will file papers in court to force you to turn over the car, and violating a court order to turn the vehicle over will result in accusations of theft.

The COVID-19 pandemic has affected all areas of commercial lending, including automotive loans. However, repossession of the vehicle may not be an option right now, depending on where the client lives.

As soon as you default on the loan, a lender may repossess your car in California.An employee of the legal property owner or a repo agency can repossess your car. You can avoid repossession by reinstating or refinancing the loan, selling/surrendering your car, or contacting your lender to ask for other options.

After a repo, a creditor must decide whether to keep the property or resell it. If the creditor decides to keep it or doesn't resell it according to law, then they cannot go after the debtor for any deficiency. If a creditor uses a repossessed vehicle, the law says he has kept it.

Illinois Allows Car Repossessions To Resume; One Recovery Agent Says It May Put Him In Danger.But the ability for them to conduct repossessions was mostly put on hold by the State of Illinois due to the crippling economic impacts of COVID-19.

If they repossess the vehicle, they must serve notice to the borrower and give the borrower 21 days to buy the vehicle outright. If the lender has a history of accepting late payments, they may not be able to argue before the court that your loan was in default at the time of the repossession.