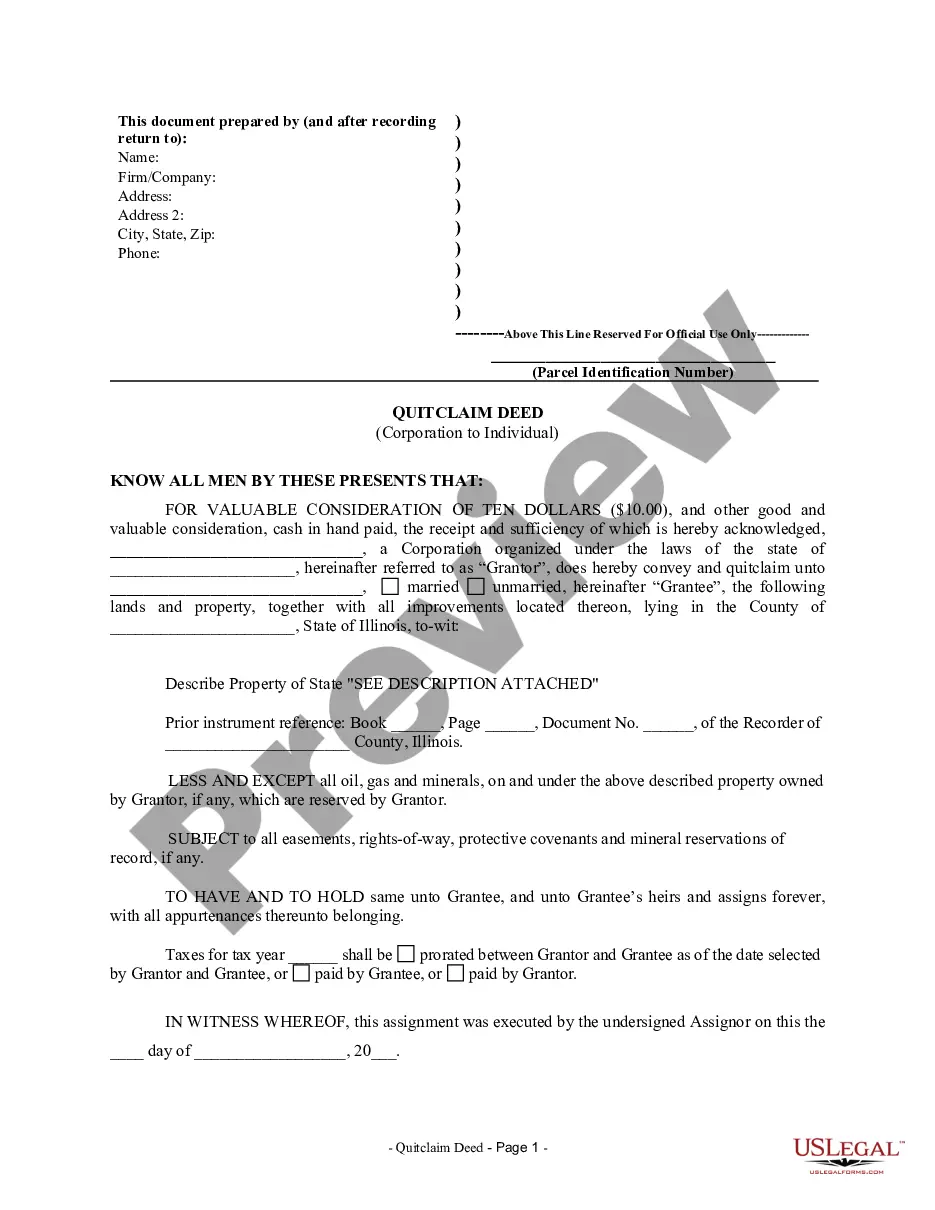

Illinois Quitclaim Deed from Corporation to Individual

Definition and meaning

The Illinois Quitclaim Deed from Corporation to Individual is a legal document used to transfer property ownership from a corporation to an individual. This deed allows the corporation (referred to as the Grantor) to convey any interest it holds in the specified property to the individual (the Grantee) without making any warranties about the title. It is important to note that a quitclaim deed does not guarantee that the property is free of liens or other claims.

Key components of the form

The Illinois Quitclaim Deed includes several critical components:

- Grantor Information: The name and details of the corporation transferring the property.

- Grantee Information: The name and details of the individual receiving the property.

- Description of Property: A precise description of the property being transferred, including the Parcel Identification Number.

- Notary Section: A space for a notary public to validate the document.

- Execution Date: The date on which the deed is signed and notarized.

- Tax Statements: Instructions on where to send tax statements related to the property.

How to complete a form

Completing the Illinois Quitclaim Deed involves several steps:

- Fill in the Grantor's name and corporate information.

- Enter the Grantee's name, including their marital status.

- Describe the property accurately, ensuring to refer to an attached description if needed.

- Specify any prior instruments related to the property.

- Detail how taxes will be handled.

- Have the appropriate corporation officer sign the deed.

- Finalize the document with notarization.

Common mistakes to avoid when using this form

When completing an Illinois Quitclaim Deed, avoid the following common mistakes:

- Neglecting to provide a complete property description.

- Failing to include the correct names and details of both the Grantor and Grantee.

- Not having the document notarized, which could invalidate the deed.

- Overlooking tax details that could lead to confusion regarding tax responsibilities.

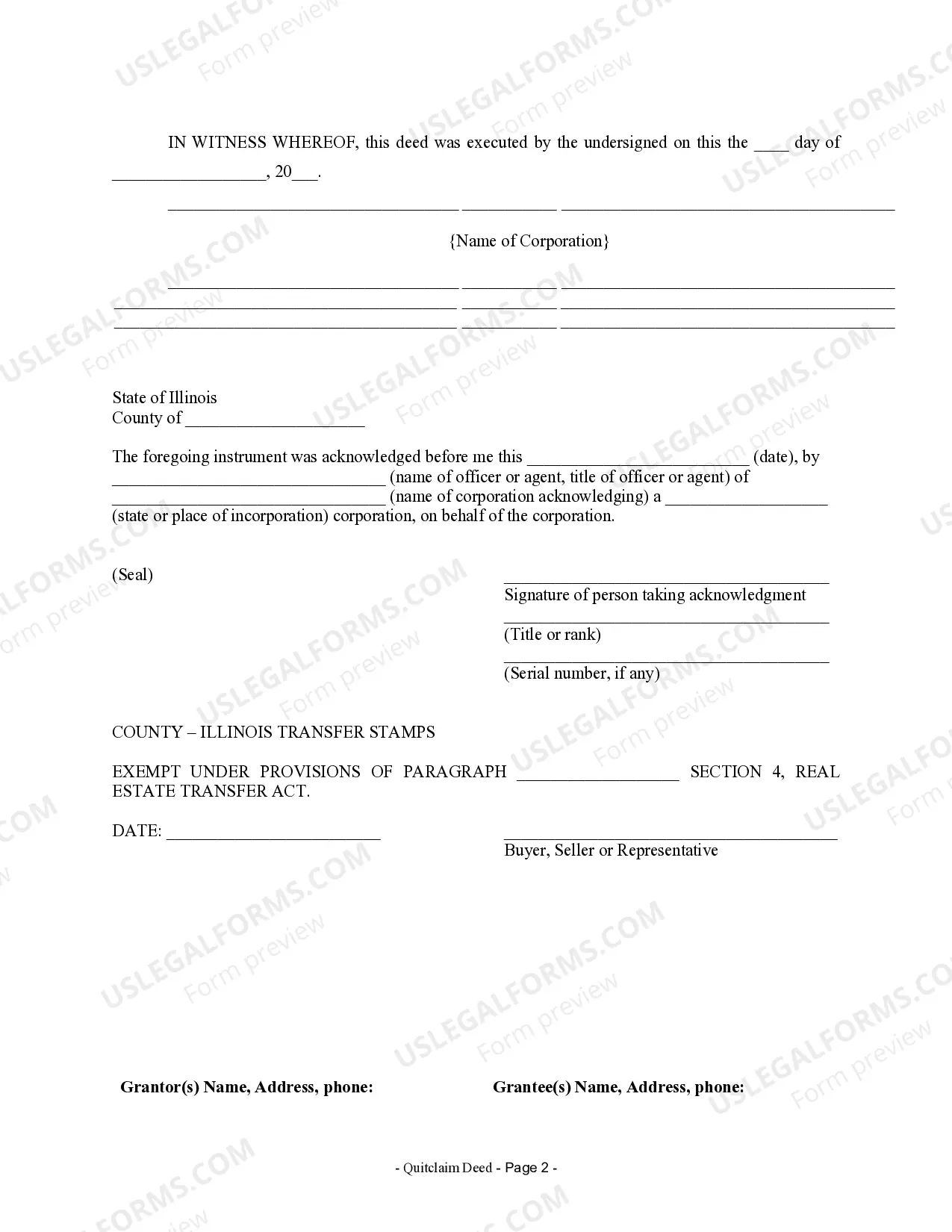

What to expect during notarization or witnessing

When finalizing the Illinois Quitclaim Deed, the following occurs during notarization:

- The Grantor or representative must present valid identification to the notary.

- The signing of the deed takes place in the presence of the notary.

- The notary will confirm the identities and willingness of the parties to sign.

- The notary will then add their seal and signature to validate the document.

Form popularity

FAQ

Yes, you can use a Quitclaim Deed to transfer a gift of property to someone. You must still include consideration when filing your Quitclaim Deed with the County Recorder's Office to show that title has been transferred, so you would use $10.00 as the consideration for the property.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Transfer property quickly and easily using this simple legal form. You can use a quitclaim deed to:transfer property you own by yourself into co-ownership with someone else. change the way owners hold title to the property.

Recording - A quit claim deed in Illinois is to be filed with the appropriate County Recorder's Office along with the appropriate fees (if they haven't already been paid). Signing - Before being filed with the County Recorder's Office, a quit claim deed must be signed by the Grantor in the presence of a Notary Public.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

Once you sign a quitclaim deed and it has been filed and recorded with the County Clerks Office, the title has been officially transferred and cannot be easily reversed. In order to reverse this type of transfer, it would require your spouse to cooperate and assist in adding your name back to the title.

Quitclaim deeds are most often used to transfer property between family members.Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners divorce and one spouse's name is removed from the title or deed.