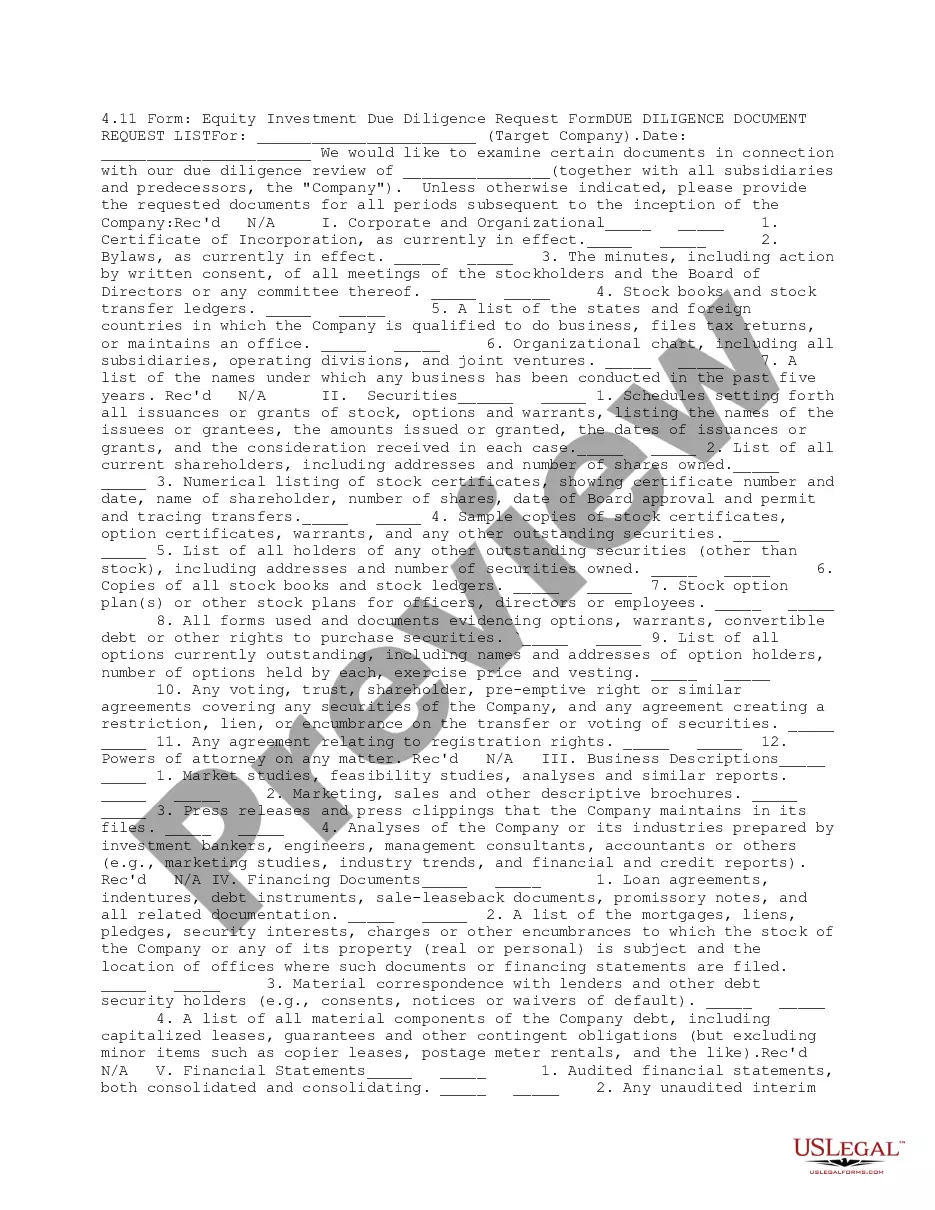

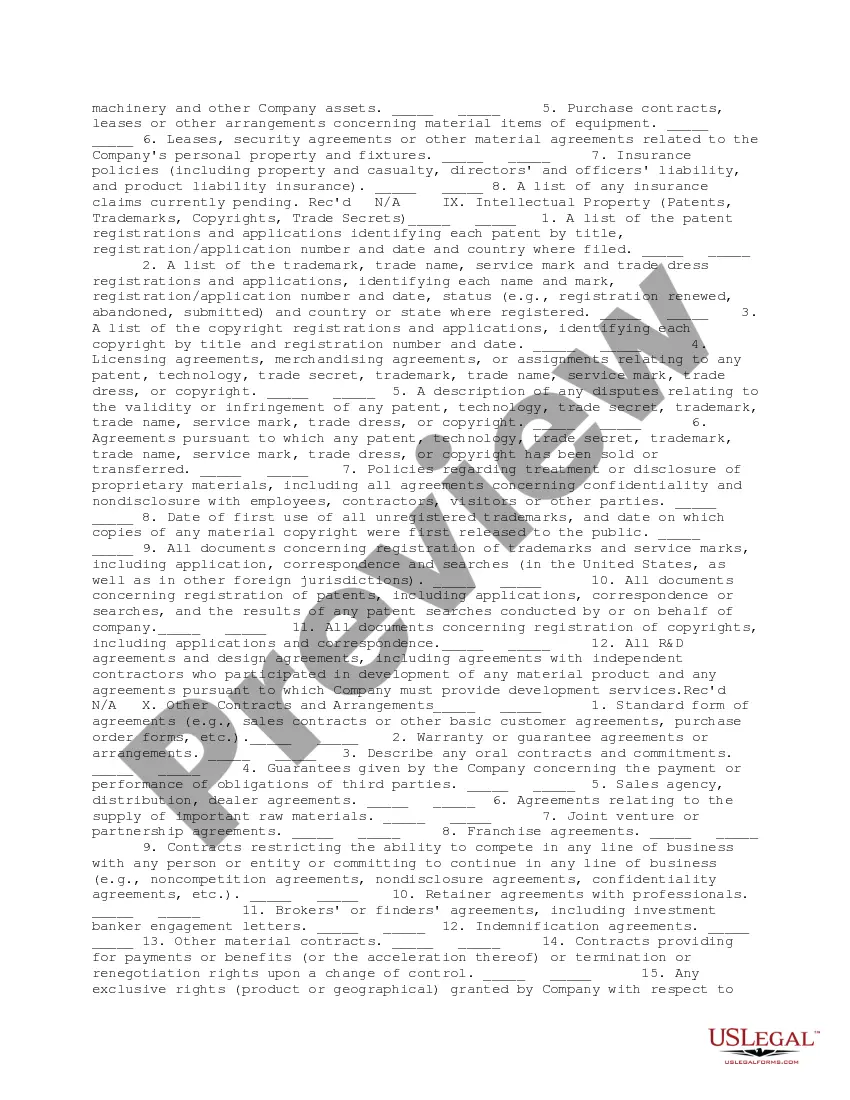

This is a due diligence document request list requesting certain documents to be used in the due diligence review. It asks for corporate and organizational documents, securities documents, business descriptions, financing documents, and other documents necessary for the due diligence review.

Idaho Equity Investment Due Diligence Request Form

Description

How to fill out Equity Investment Due Diligence Request Form?

If you want to total, obtain, or produce legal record themes, use US Legal Forms, the most important collection of legal types, which can be found online. Take advantage of the site`s simple and handy lookup to discover the documents you will need. Numerous themes for business and personal functions are sorted by types and states, or keywords. Use US Legal Forms to discover the Idaho Equity Investment Due Diligence Request Form in just a number of click throughs.

In case you are currently a US Legal Forms consumer, log in to the bank account and then click the Obtain key to have the Idaho Equity Investment Due Diligence Request Form. You can also entry types you formerly saved in the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for your right area/region.

- Step 2. Make use of the Preview solution to look over the form`s content. Do not forget about to see the description.

- Step 3. In case you are unhappy together with the develop, utilize the Lookup discipline at the top of the screen to discover other variations from the legal develop template.

- Step 4. After you have discovered the shape you will need, select the Buy now key. Choose the costs strategy you favor and put your credentials to sign up to have an bank account.

- Step 5. Method the financial transaction. You may use your credit card or PayPal bank account to complete the financial transaction.

- Step 6. Find the structure from the legal develop and obtain it on your system.

- Step 7. Comprehensive, edit and produce or signal the Idaho Equity Investment Due Diligence Request Form.

Each and every legal record template you get is the one you have eternally. You have acces to every develop you saved within your acccount. Click on the My Forms section and choose a develop to produce or obtain once again.

Compete and obtain, and produce the Idaho Equity Investment Due Diligence Request Form with US Legal Forms. There are millions of specialist and state-particular types you can use for the business or personal requires.

Form popularity

FAQ

Top due diligence questions every VC firm should be asking General company information. Detailed company activity. Contracts and commitments. Competitor information. Accounting and finance. Asset information. Employment information. Risk and compliance.

Due diligence documents are the research and analysis of a company or organization done in preparation for a business transaction (such as a corporate merger or purchase of securities). Due diligence documents typically include the following categories; legal, financial, sales and marketing, and human resources.

A due diligence report is key to finalizing an investment, merger, acquisition, or legal agreement. The due diligence report offers a comprehensive exploration and explanation of a property, a company's financial records, or a company's overall standing in the marketplace.

An example of due diligence in law would be a Mergers and Acquisitions department of a bank carrying out a thorough investigation of a firm that another firm would like to buy. In this instance, the bank must investigate both entities and it must be fully transparent in all of its findings.

Ing to Cambridge Dictionary, Due diligence meaning is: ?The detailed examination of a company and its financial records, business transactions, done before becoming involved in a business arrangement with it.?

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

Due diligence involves taking reasonable steps to make sure that you are not making risky or poor decisions, paying too much or breaking any regulations or rules. When purchasing a business, you are responsible for assessing the business thoroughly to confirm that it is as ethical, compliant and profitable as claimed.

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.