This office lease provision refers to a tenant that is a partnership or if the tenant's interest in the lease shall be assigned to a partnership. Any such partnership, professional corporation and such persons will be held by this provision of the lease.

Idaho Standard Provision to Limit Changes in a Partnership Entity

Description

How to fill out Standard Provision To Limit Changes In A Partnership Entity?

Have you been within a situation in which you will need files for both enterprise or personal uses almost every time? There are plenty of lawful file themes available on the net, but discovering kinds you can trust is not simple. US Legal Forms delivers thousands of form themes, such as the Idaho Standard Provision to Limit Changes in a Partnership Entity, which can be written in order to meet state and federal specifications.

When you are currently knowledgeable about US Legal Forms web site and also have a merchant account, merely log in. After that, it is possible to down load the Idaho Standard Provision to Limit Changes in a Partnership Entity web template.

Unless you come with an accounts and want to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is for the proper city/county.

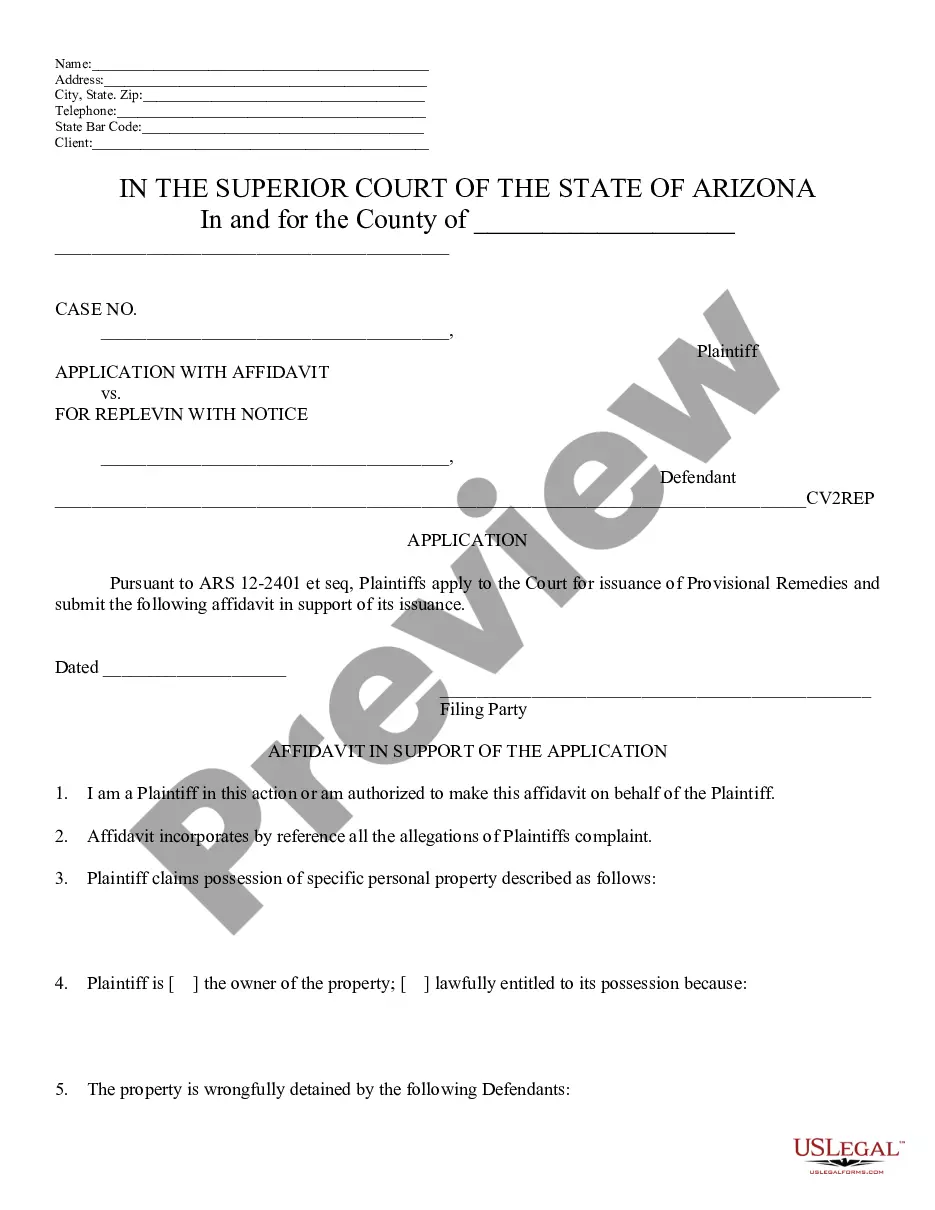

- Make use of the Review switch to analyze the form.

- Read the information to ensure that you have chosen the right form.

- In the event the form is not what you are seeking, take advantage of the Research area to find the form that meets your needs and specifications.

- Whenever you obtain the proper form, just click Purchase now.

- Pick the costs plan you desire, fill in the specified info to create your money, and pay money for the transaction using your PayPal or charge card.

- Choose a convenient data file format and down load your backup.

Discover all of the file themes you may have purchased in the My Forms food selection. You can obtain a more backup of Idaho Standard Provision to Limit Changes in a Partnership Entity any time, if possible. Just click on the needed form to down load or print out the file web template.

Use US Legal Forms, the most extensive selection of lawful forms, to save lots of time as well as steer clear of faults. The assistance delivers skillfully produced lawful file themes which can be used for an array of uses. Create a merchant account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Idaho Civil Statutes of Limitations at a Glance The state of Idaho imposes a two-year time limit for personal injury and medical malpractice claims. However, laws of the state also set a statute of limitations of three years for claims related to fraud, injury to personal property, and trespassing.

In a limited partnership (LP), at least one partner has unlimited liability?the general partner(s). The other partners (limited partners) have limited liability, meaning their personal assets typically cannot be used to satisfy business debts and liabilities.

A limited liability partnership is similar to a limited liability company (LLC) in that all partners are granted limited liability protection. However, in some states the partners in an LLP get less liability protection than in an LLC. LLP requirements vary from state to state.

(a) The name of a business corporation must contain the word "corporation," "incorporated," "company," or "limited," or the abbreviation "Corp.," "Inc.," "Co.," or "Ltd.," or words or abbreviations of similar import in another language; provided however, that if the word "company" or its abbreviation is used it shall ...

A limited partnership allows each partner to restrict their liability, which depends on the amount of their initial business investment.

Limited partnership (LP) is a type of partnership organization that limits the personal liability of some partners. In general partnerships, every partner remains personally liable for the debts and obligations of the partnership.

Under Idaho Code 30-21-301, the name must include ?Limited Liability Company?, ?Limited Company? or the abbreviation ?L.L.C.?, ?L.C.? or ?LLC?. The complete mailing address and Principal Office will be recorded on the ID LLC Articles of Organization. A person or company can act as your Registered Agent in Wyoming.

Limited Liability Partnership As it is a separate legal entity, the partners are not personally liable for any debts of the LLP. Their liability is limited to the capital that they have introduced.