Idaho Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest

Description

How to fill out Assignment Of Oil And Gas Leases Of All Interest, Reserving An Overriding Royalty Interest?

Have you been within a situation in which you need to have papers for both organization or individual functions just about every time? There are plenty of authorized file layouts available on the net, but getting kinds you can trust is not effortless. US Legal Forms offers thousands of develop layouts, just like the Idaho Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest, that are composed to meet state and federal needs.

Should you be currently informed about US Legal Forms site and also have a merchant account, basically log in. Afterward, it is possible to acquire the Idaho Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest web template.

If you do not come with an account and need to begin using US Legal Forms, adopt these measures:

- Get the develop you require and ensure it is for your proper metropolis/state.

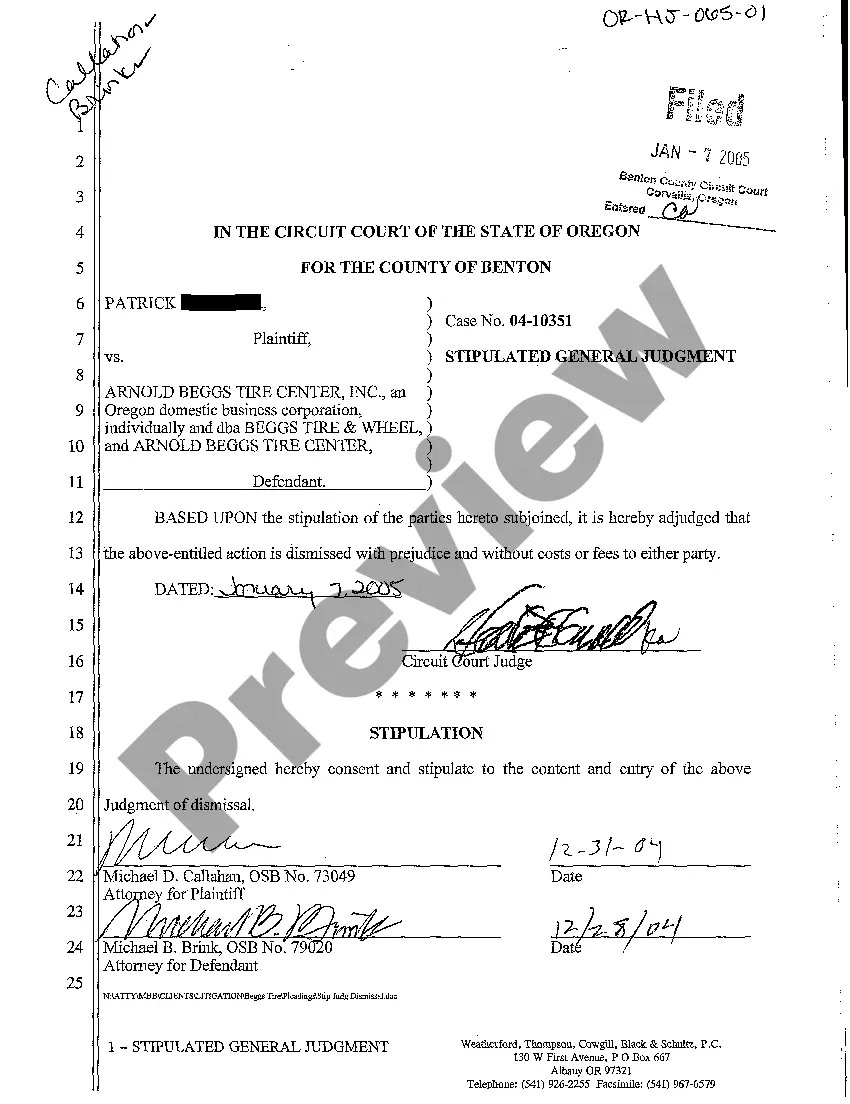

- Make use of the Preview button to examine the shape.

- Look at the explanation to actually have selected the appropriate develop.

- When the develop is not what you`re seeking, take advantage of the Research field to discover the develop that suits you and needs.

- Once you obtain the proper develop, click Acquire now.

- Select the costs plan you desire, fill in the required information to create your account, and pay money for your order using your PayPal or charge card.

- Select a convenient data file structure and acquire your backup.

Get each of the file layouts you possess bought in the My Forms menu. You can aquire a further backup of Idaho Assignment of Oil and Gas Leases of all Interest, Reserving An Overriding Royalty Interest at any time, if required. Just go through the needed develop to acquire or produce the file web template.

Use US Legal Forms, probably the most substantial assortment of authorized forms, in order to save efforts and stay away from faults. The services offers skillfully made authorized file layouts which can be used for a range of functions. Create a merchant account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres. Net Royalty Acres Defined - Oil and Gas Lawyer Blog oilandgaslawyerblog.com ? net-royalty-acre... oilandgaslawyerblog.com ? net-royalty-acre...

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...