Idaho Self-Employed Drywall Services Contract

Description

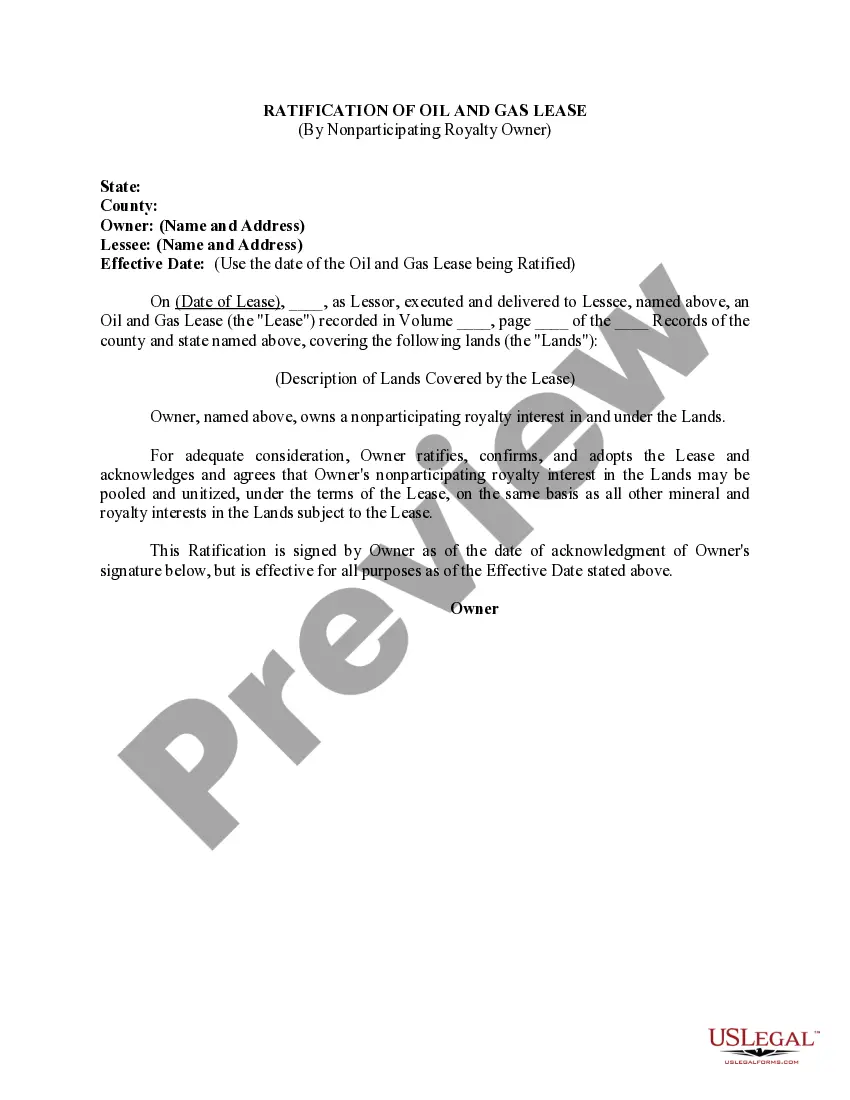

How to fill out Self-Employed Drywall Services Contract?

Finding the appropriate legal document format can be a challenge. Obviously, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Idaho Self-Employed Drywall Services Contract, which you can utilize for both business and personal purposes. All forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, sign in to your account and click on the Download button to retrieve the Idaho Self-Employed Drywall Services Contract. Use your account to review the legal documents you have acquired previously. Navigate to the My documents tab in your account to obtain another copy of the documents you need.

If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can examine the form using the Review button and read the form description to ensure it is suitable for your needs. If the form does not satisfy your requirements, use the Search field to find the appropriate form. Once you are confident the form is appropriate, click the Purchase now button to obtain the form. Choose the pricing plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired Idaho Self-Employed Drywall Services Contract.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Utilize the service to obtain professionally crafted papers that comply with state regulations.

- Ensure you have the right form for your specific needs.

- Review the form description carefully before finalizing your choice.

- Utilize the search function for easier navigation of forms.

- Download and sign the required contract once obtained.

Form popularity

FAQ

Yes, construction services, including those provided under an Idaho Self-Employed Drywall Services Contract, are usually subject to sales tax in Idaho. Understanding the tax implications of your services is crucial for compliance and financial planning. You should consult the Idaho State Tax Commission for detailed information on tax obligations. This knowledge can help you maintain transparency with clients and avoid unexpected expenses.

Yes, if you plan to subcontract work in Idaho, you generally need a license. This requirement applies even when operating under an Idaho Self-Employed Drywall Services Contract. Having the proper license protects you and ensures compliance with state regulations. It also reassures your clients of your commitment to quality and professionalism.

Yes, you need a license to work as a contractor in Idaho. This applies if you are executing an Idaho Self-Employed Drywall Services Contract or any other contracting work. Having a valid license ensures that you meet the state’s standards for quality and safety. Therefore, take the time to research and obtain the necessary credentials.

Yes, independent contractors in Idaho typically need a business license to operate legally. If you are engaged in an Idaho Self-Employed Drywall Services Contract, obtaining a business license not only legitimizes your work but also helps you build credibility with clients. Consider applying for a license through local government offices to ensure compliance. This step can enhance your professional reputation.

In Idaho, performing contractor work without a license can lead to legal issues. If you plan to enter into an Idaho Self-Employed Drywall Services Contract, it is essential to ensure that you are properly licensed. Operating without the necessary credentials may result in fines or penalties. Always check local regulations before starting your project.

Subcontracting without a license in Idaho is not advisable and can lead to serious legal repercussions. Licensing is crucial for compliance with state laws and for protecting your business interests. If you are considering an Idaho Self-Employed Drywall Services Contract, ensure that your subcontractors are properly licensed to avoid complications. US Legal Forms offers resources to help you understand licensing requirements and provide the correct documentation.

Yes, subcontractors in Idaho typically need a license to operate legally. This requirement helps maintain industry standards and protects both the subcontractor and the client. When entering into an Idaho Self-Employed Drywall Services Contract, ensuring that all parties have the appropriate licenses can prevent legal issues down the line. US Legal Forms can help you navigate the licensing process and access the necessary forms.

In Idaho, you cannot legally operate as a contractor without obtaining the necessary license. This requirement ensures that all contractors meet specific standards for quality and safety. If you are looking to work under an Idaho Self-Employed Drywall Services Contract, having a license can enhance your credibility and trustworthiness with clients. For assistance, consider using US Legal Forms, which provides the necessary documents and guidance for licensing.

To operate as an independent contractor in Idaho, you must comply with several legal requirements. First, you need to register your business with the state and obtain any necessary licenses related to your drywall services. Additionally, you should understand tax obligations, such as self-employment taxes and withholding taxes for any employees. Using an Idaho Self-Employed Drywall Services Contract can help clarify the terms of your work, ensuring that both you and your clients understand your responsibilities.

For a contract to be legally binding in Idaho, it must include certain essential elements, such as mutual agreement, a lawful purpose, and consideration. Both parties must sign the Idaho Self-Employed Drywall Services Contract willingly, indicating their intent to be bound by its terms. Additionally, clarity in the terms and conditions helps prevent disputes later. Ensure that you understand these requirements to protect your interests.