Idaho Self-Employed Independent Contractor Payment Schedule

Description

How to fill out Self-Employed Independent Contractor Payment Schedule?

If you desire to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest variety of legal forms, available online.

Take advantage of the website's simple and convenient search to find the documents you require.

Numerous templates for commercial and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Idaho Self-Employed Independent Contractor Payment Schedule. Every legal document template you purchase is yours forever. You can access every form you downloaded in your account. Click the My documents section and select a form to print or download again. Compete and acquire, and produce the Idaho Self-Employed Independent Contractor Payment Schedule with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to locate the Idaho Self-Employed Independent Contractor Payment Schedule in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Idaho Self-Employed Independent Contractor Payment Schedule.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have chosen the form for the correct city/region.

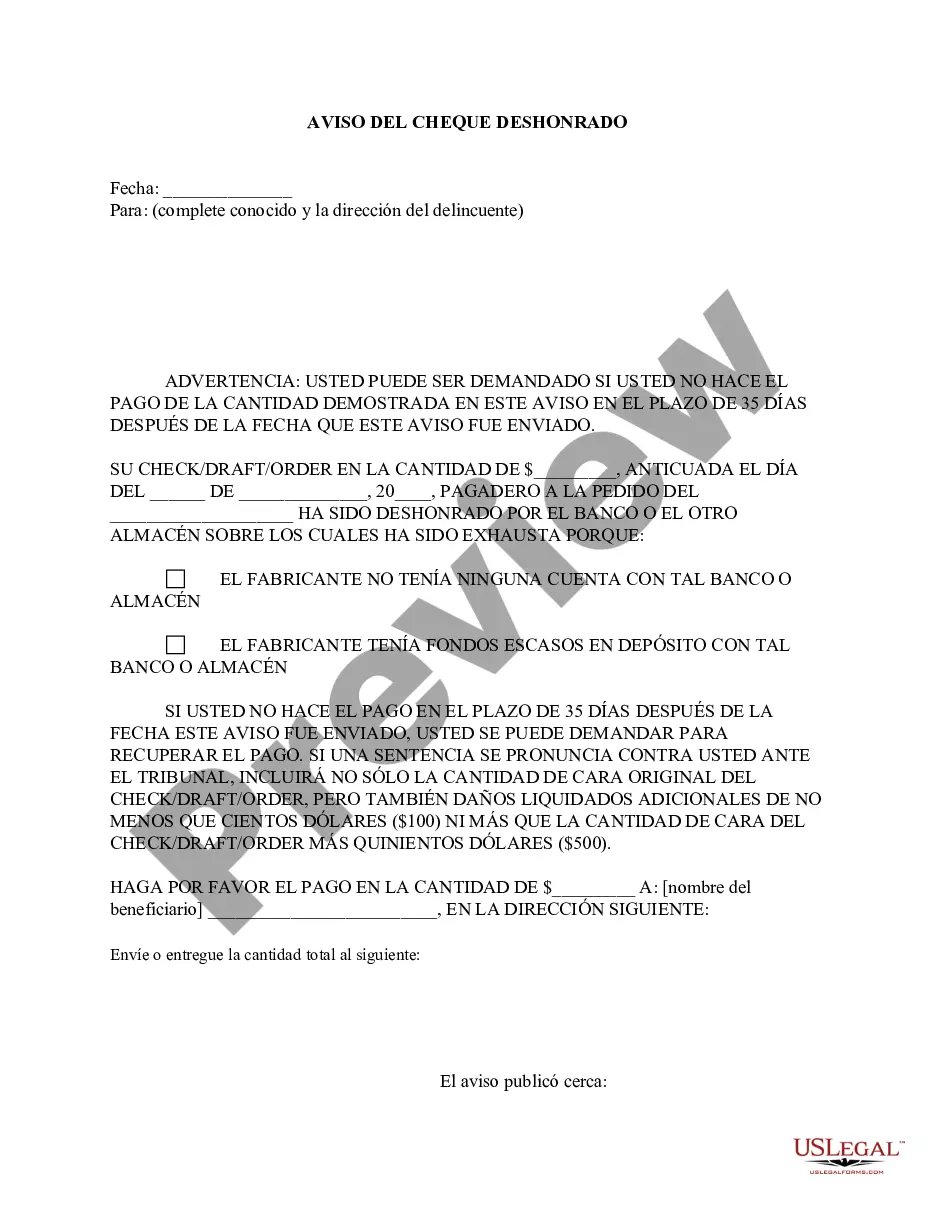

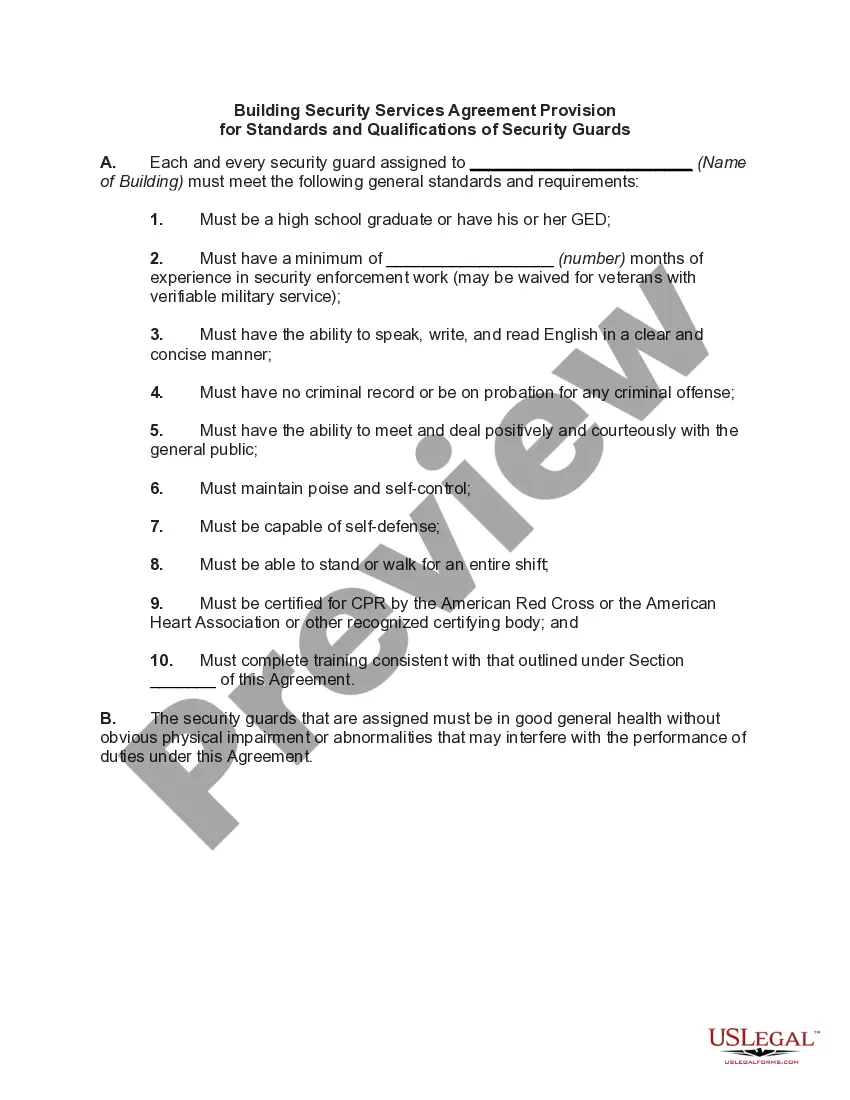

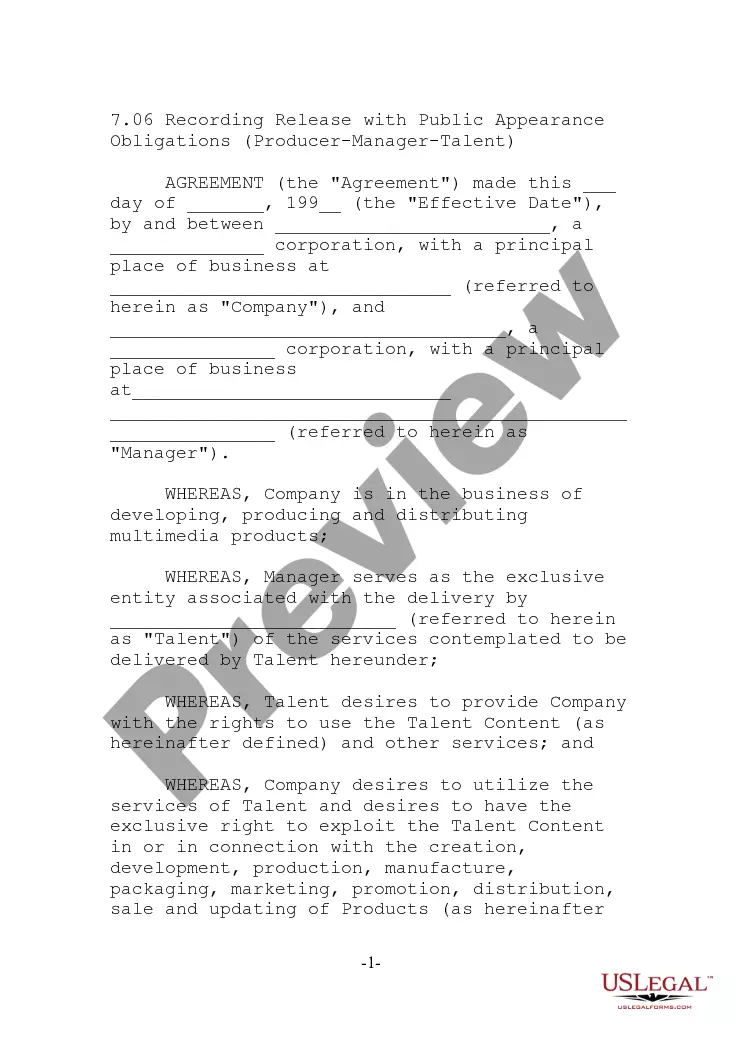

- Step 2. Use the Review option to examine the form's details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

Typically, self-employed individuals should report their income using Schedule C along with their Form 1040. This applies to those fulfilling the Idaho self-employed independent contractor payment schedule. It’s essential to keep detailed records of your earnings and expenses for accurate reporting. Using tools from platforms like uslegalforms can simplify this process and ensure you meet all requirements.

Many states require individuals to make estimated tax payments to avoid penalties throughout the year. This is particularly important for Idaho self-employed independent contractors, as they must manage their tax payments carefully. Knowing your state's requirements can help you stay compliant and avoid sudden tax bills. Stay informed about your specific obligations to ensure smooth financial planning.

In Idaho, seniors can benefit from property tax exemptions at the age of 65. This can significantly alleviate their financial burden, especially for self-employed individuals. If you are an Idaho self-employed independent contractor, understanding these benefits may help you manage your expenses and plan effectively. Always consult local regulations for the most accurate information.

In Idaho, self-employment tax rates align with federal guidelines. As an independent contractor, you'll typically face a self-employment tax rate of 15.3% on your net earnings, which covers Social Security and Medicare. It's essential to plan your Idaho Self-Employed Independent Contractor Payment Schedule accordingly, as this tax impacts your overall earnings. Utilizing tools like US Legal Forms can help you manage your payment schedule effectively and stay compliant with all tax obligations.

Yes, Idaho does require individual estimated tax payments if you expect to owe $500 or more in state tax. By following your Idaho Self-Employed Independent Contractor Payment Schedule, you can ensure compliance with state tax laws. This proactive approach helps you avoid penalties and interest. You can find helpful resources on uslegalforms to manage your estimated taxes efficiently.

To avoid owing taxes on your 1099, keep track of your income and expenses throughout the year. This practice helps you stay organized and demonstrate your earnings accurately during tax time. Additionally, consider making estimated tax payments based on your Idaho Self-Employed Independent Contractor Payment Schedule. Using tools from platforms like uslegalforms can simplify the management of your tax obligations.

For those looking to extend their tax filing in 2025, the extension typically provides you until October 15 to file your return. However, remember that this is only for filing, and you must still make any estimated tax payments by the original due dates. Understanding the implications of this can ease your financial planning. Keep the Idaho Self-Employed Independent Contractor Payment Schedule in mind as you navigate these dates.

After the October 15 tax deadline, if you have not filed your return, you may face penalties and interest on any unpaid taxes. It’s essential to communicate with the Idaho State Tax Commission regarding your situation, as they may offer options for extension or payment plans. For self-employed independent contractors, keeping track of your dues ensures that you avoid surprises. Referencing the Idaho Self-Employed Independent Contractor Payment Schedule can help guide your next steps.

The due date for self-assessment tax payments aligns with your estimated tax payment deadlines. Typically, payments are due on the 15th of each quarter, which includes April, June, September, and January. Meeting these deadlines not only keeps you in good standing with the state but also helps you avoid penalties. Following the Idaho Self-Employed Independent Contractor Payment Schedule can simplify this process.

Yes, Idaho levies a self-employment tax on individuals who are self-employed. This tax contributes to Social Security and Medicare, ensuring that you are covered under these programs. As a self-employed independent contractor, it's important to understand how this tax affects your overall financial responsibilities. Staying informed about the Idaho Self-Employed Independent Contractor Payment Schedule can help you manage this obligation effectively.