Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

It is feasible to invest numerous hours online searching for the official document template that meets the federal and state requirements you require. US Legal Forms offers a vast array of official forms that can be examined by professionals.

You can easily obtain or generate the Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor through our service. If you already possess a US Legal Forms account, you can Log In and click the Download button. Subsequently, you can complete, modify, print, or sign the Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor.

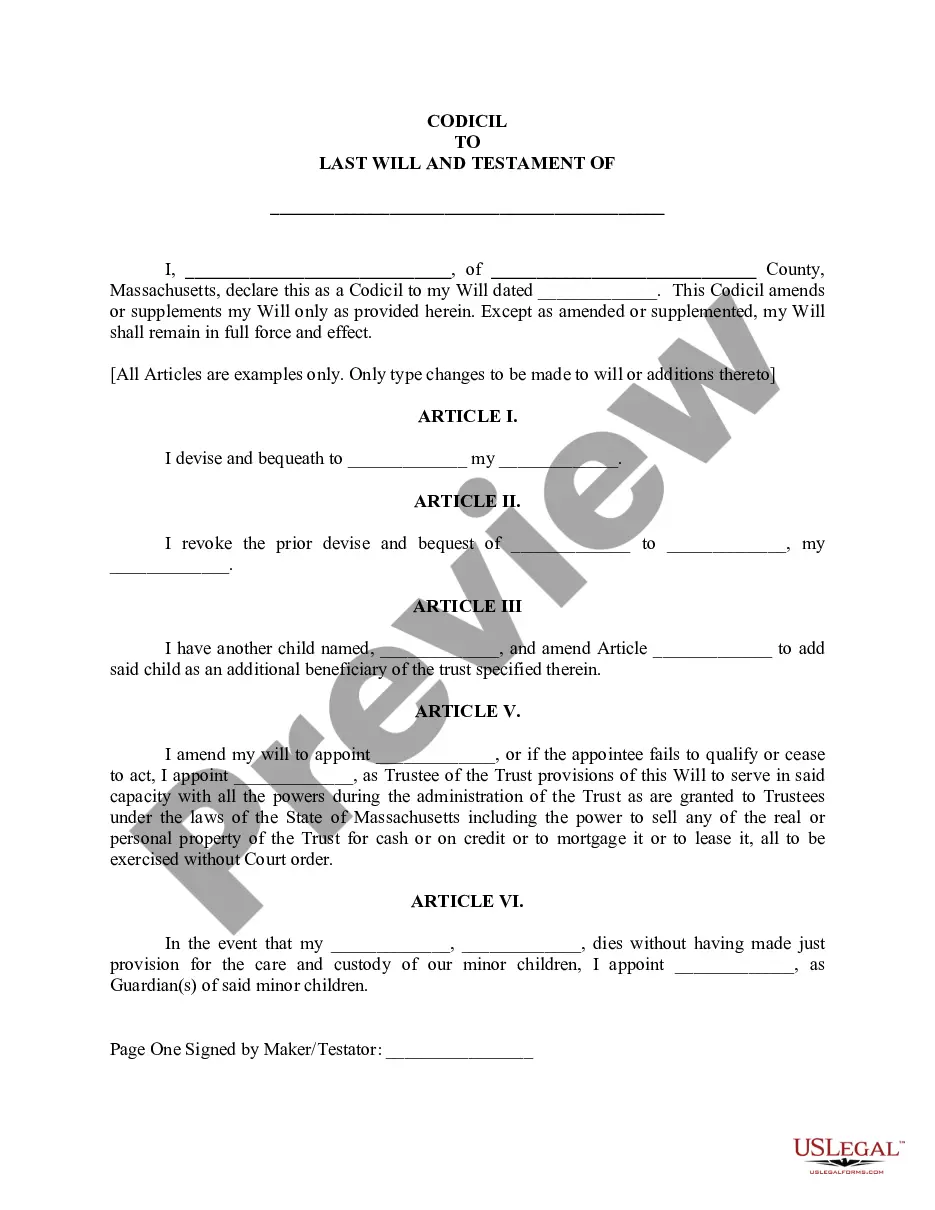

Every official document template you acquire is yours indefinitely. To obtain another copy of any purchased form, navigate to the My documents tab and click the corresponding button. If you're using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the county/city of your choice. Review the form details to confirm you have chosen the right form. If available, utilize the Review button to look through the document template as well.

- If you wish to obtain another version of the form, use the Search field to find the template that suits your needs and requirements.

- Once you have located the template you need, click Get now to proceed.

- Select the pricing plan you want, enter your details, and register for a free account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the official form.

- Choose the format of the document and download it to your device.

- Make alterations to your document if necessary. You can complete, modify, and sign and print the Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- Download and print numerous document templates using the US Legal Forms site, which provides the largest selection of official forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

To become an interpreter in Idaho, you typically need to meet certain qualifications and gain experience in the field. Start by familiarizing yourself with the Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor, which outlines the expectations and requirements for independent interpreters. Pursue relevant education, training, or certifications in interpretation, and then seek opportunities to build your experience. Lastly, remember that being self-employed means you will need to manage contracts, which the Idaho Translator And Interpreter Agreement can help clarify for you.

To become a certified translator in Idaho, you should first gain proficiency in your language pair, as strong language skills are essential. Next, you may consider completing a formal training program or obtaining a degree in translation or a related field to enhance your knowledge. After that, obtain certification from a recognized professional organization, which validates your expertise. Additionally, you can leverage the Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor to create formal contracts for your freelance work, ensuring your services are clearly outlined and legally recognized.

Yes, interpreters often operate as independent contractors, especially when working under an Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor. This arrangement allows interpreters to manage their own schedules and choose their clients. Furthermore, as independent contractors, interpreters have the flexibility to provide services to multiple clients while being responsible for their taxes and business expenses. This independence can enhance your career while increasing job opportunities.

Billing insurance for interpreter services can be straightforward when you follow specific guidelines. First, ensure that you have the proper Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor in place, as it will outline your services and rates. Next, collect necessary patient information and detailed service records, including the date and duration of the interpretation. Lastly, submit your claims using the appropriate insurance forms, noting that clear documentation will help your claim process smoothly.

An interpreter facilitates communication between people who speak different languages. They often work in various settings, such as legal, medical, and business environments. To succeed as an interpreter, one must have strong language skills and cultural understanding. When entering this profession, it's crucial to have an Idaho Translator And Interpreter Agreement - Self-Employed Independent Contractor to outline your responsibilities and rights.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Interpreters and translators in California have been granted an exemption from AB 5. It's been almost 9 months since the controversial AB 5 bill went into effect, which reclassified independent interpreters and translators in California as employees, and no longer as independent contractors.

There is no licensing requirement for translators.

Freelance interpreters or translators work on a self-employed basis converting written texts from one language to another or providing verbal translations in live situations, such as conferences, performances, or meetings.

The bill does exempt freelance creatives from employee classification if they complete no more than 35 submissions in a calendar year. That means a writer can only submit 35 articles to a single client before they are considered an employee.