Idaho Electrologist Agreement - Self-Employed Independent Contractor

Description

How to fill out Electrologist Agreement - Self-Employed Independent Contractor?

Have you found yourself in a situation where you need documentation for either organizational or personal reasons almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust isn't straightforward.

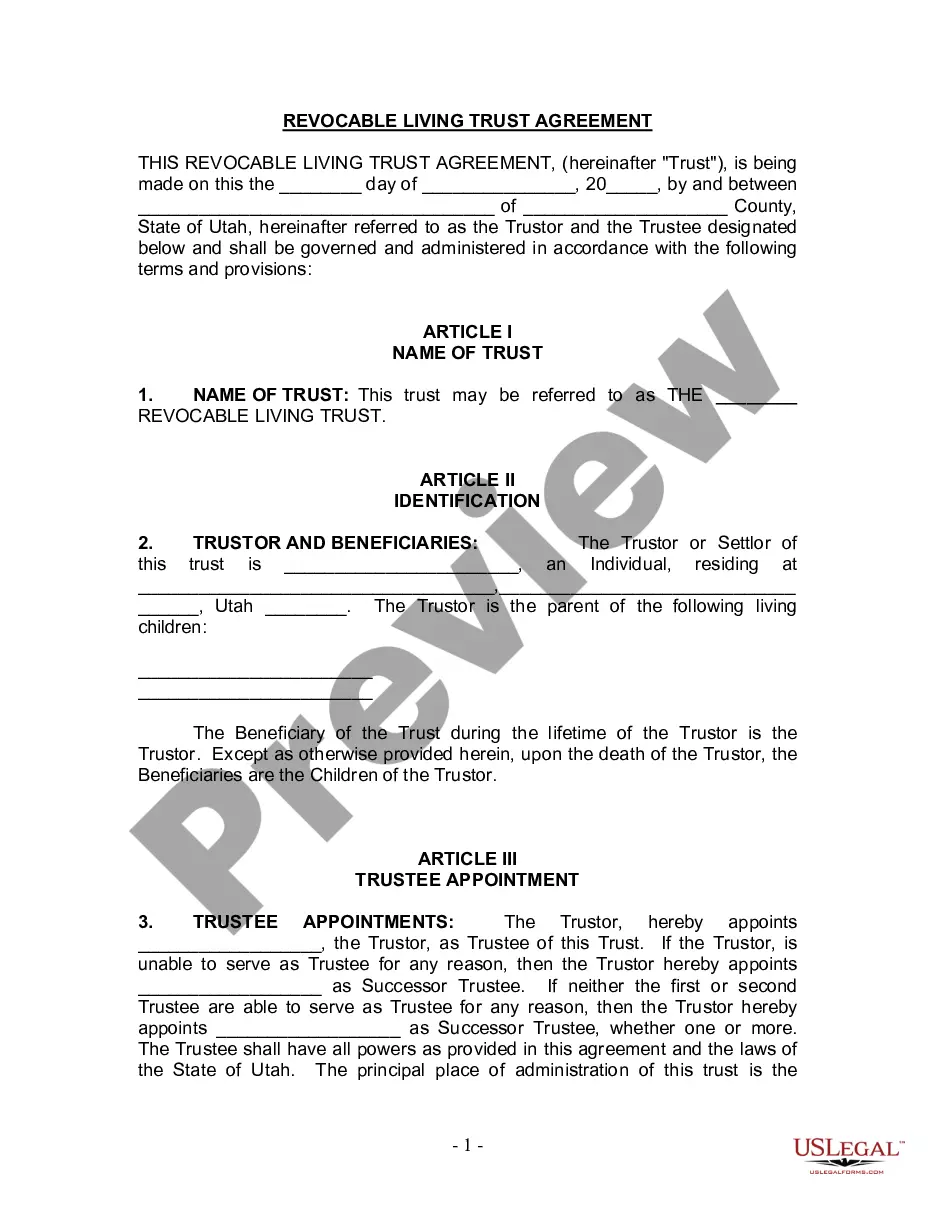

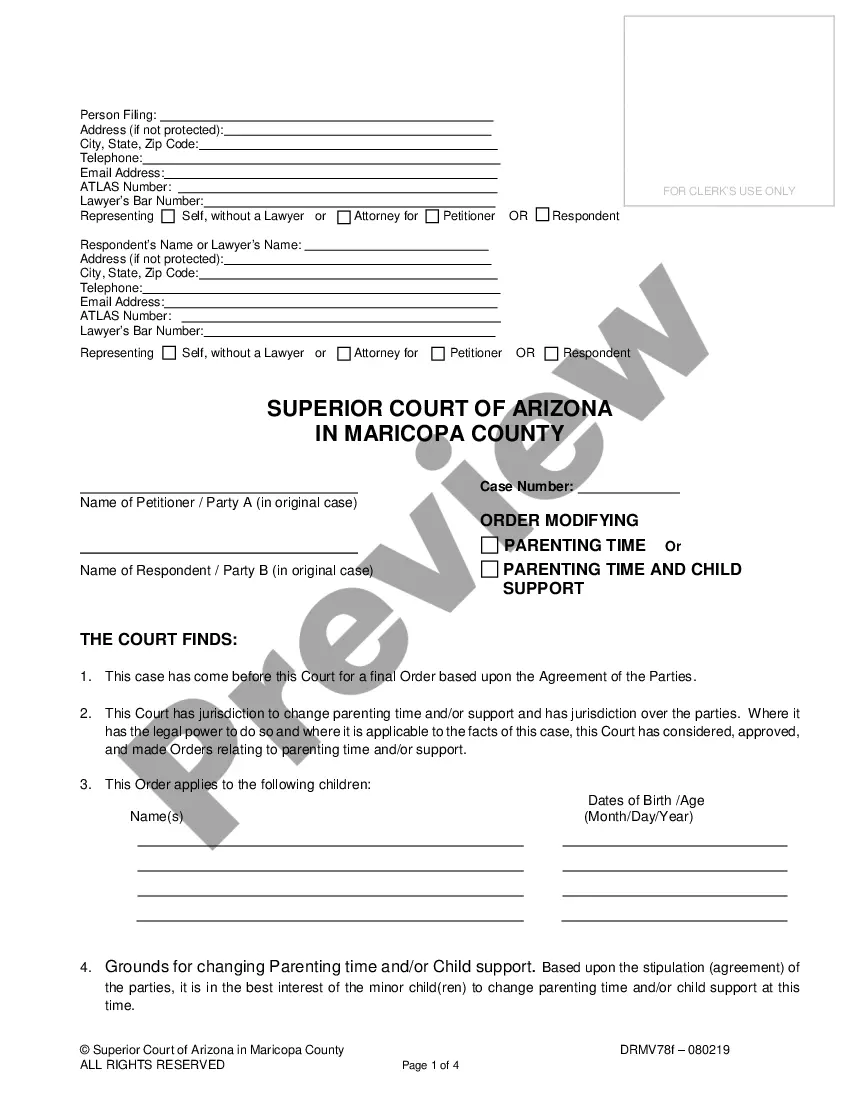

US Legal Forms offers a vast collection of form templates, such as the Idaho Electrologist Agreement - Self-Employed Independent Contractor, which are designed to comply with state and federal regulations.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you're already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Idaho Electrologist Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you require and ensure it corresponds to the correct city/state.

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the right form.

- If the document isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

- Once you find the correct form, click Acquire now.

- Select the pricing plan you desire, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can download another copy of Idaho Electrologist Agreement - Self-Employed Independent Contractor whenever needed. Simply click the desired form to download or print the document template.

- Utilize US Legal Forms, the largest collection of legal forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Yes, independent contractors file as self-employed individuals. This means you will report your income and expenses on your personal tax return using Schedule C. When you enter into an Idaho Electrologist Agreement - Self-Employed Independent Contractor, you take on the responsibility of managing your own taxes. It is essential to keep accurate records of your earnings and expenses to ensure compliance with tax regulations.

Yes, an independent contractor is generally considered to be self-employed. This definition aligns with work under the Idaho Electrologist Agreement - Self-Employed Independent Contractor. As an independent contractor, you have the autonomy to manage your business and finances, distinguishing you from traditional employees.

Yes, independent contractors in Idaho may need a business license depending on the type of services they provide. This is especially relevant when operating under the Idaho Electrologist Agreement - Self-Employed Independent Contractor. To ensure compliance with local regulations, check with your city or county to determine if a license is necessary for your specific profession.

Writing an independent contractor agreement involves outlining the terms of the working relationship, including payment details, responsibilities, and timelines. When creating an Idaho Electrologist Agreement - Self-Employed Independent Contractor, you should include specifics about the services provided, confidentiality clauses, and payment methods. Making it clear will protect both parties and establish professional expectations.

Receiving a 1099 form typically indicates that you are considered self-employed, especially if it is issued for your services under the Idaho Electrologist Agreement - Self-Employed Independent Contractor. This form reports non-employee compensation, which is common for independent contractors. However, it’s important to understand your relationship with any clients to confirm your self-employed status.

You are considered self-employed if you run your own business and earn income directly from your clients, rather than through an employer. This includes situations covered by the Idaho Electrologist Agreement - Self-Employed Independent Contractor, where you choose your hours and clients, and are responsible for your taxes. If you control your work and are not restricted by an employer, you fit the self-employed criteria.

In the context of the Idaho Electrologist Agreement - Self-Employed Independent Contractor, both terms describe similar work arrangements. However, 'self-employed' generally refers to individuals who operate their own business, while 'independent contractor' emphasizes the nature of the work, where you're contracted to provide services. Clarifying the terminology can help ensure both you and your clients understand your role.

To fill out an independent contractor agreement, include essential information such as the parties involved, the specific work to be performed, and payment details. Make sure to incorporate terms that reflect the Idaho Electrologist Agreement - Self-Employed Independent Contractor. A well-structured agreement protects your interests and sets clear expectations.

When filling out an independent contractor form, provide your name, address, and details about the services you offer. Ensure you include relevant payment information and the terms of your agreement as specified in the Idaho Electrologist Agreement - Self-Employed Independent Contractor. This information helps establish a clear business relationship with your clients.

Filling out a declaration of independent contractor status form involves providing your personal information, business details, and the nature of your services. Make sure you state that you follow the criteria set in the Idaho Electrologist Agreement - Self-Employed Independent Contractor. Accurately filling out this form helps clarify your status and protects your rights.