Idaho Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

If you want to comprehensive, download, or print legal record layouts, use US Legal Forms, the biggest assortment of legal types, which can be found on the web. Make use of the site`s simple and easy practical search to get the papers you need. Various layouts for enterprise and specific uses are categorized by types and states, or keywords and phrases. Use US Legal Forms to get the Idaho Shared Earnings Agreement between Fund & Company in a few clicks.

In case you are currently a US Legal Forms customer, log in to your account and then click the Download key to have the Idaho Shared Earnings Agreement between Fund & Company. Also you can entry types you formerly downloaded inside the My Forms tab of the account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for your appropriate metropolis/region.

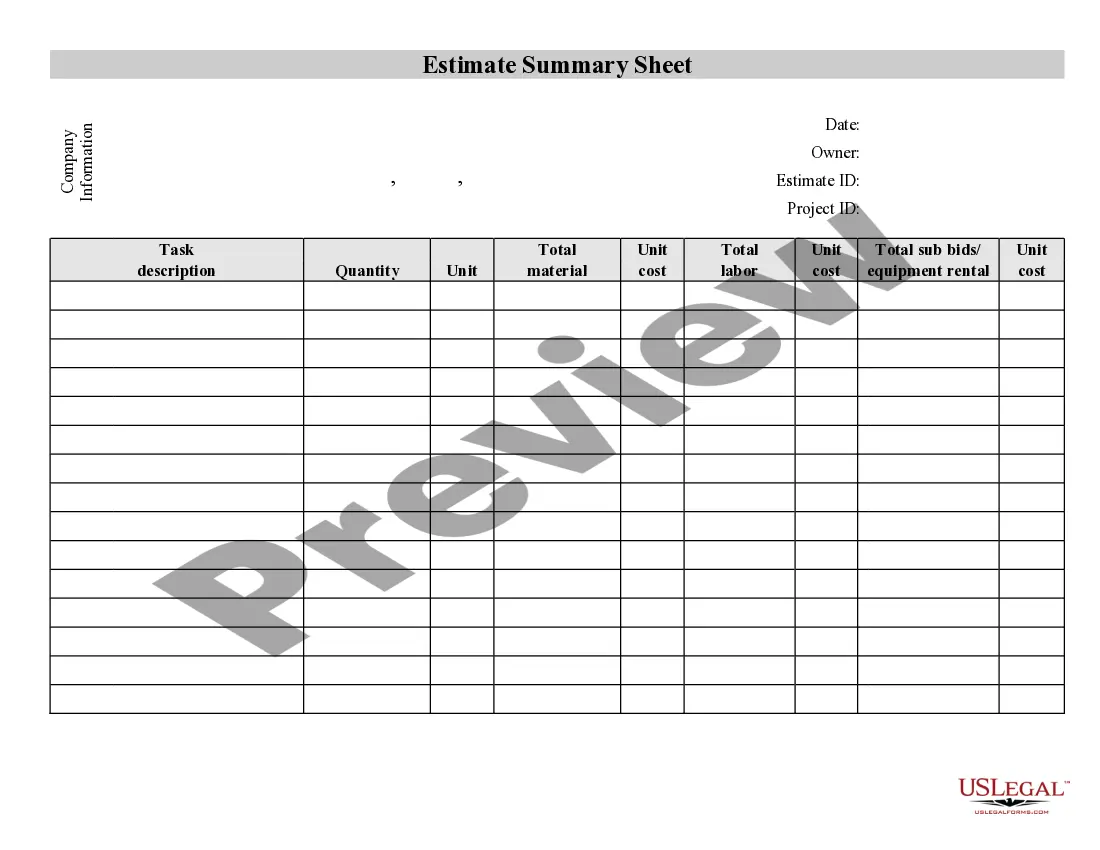

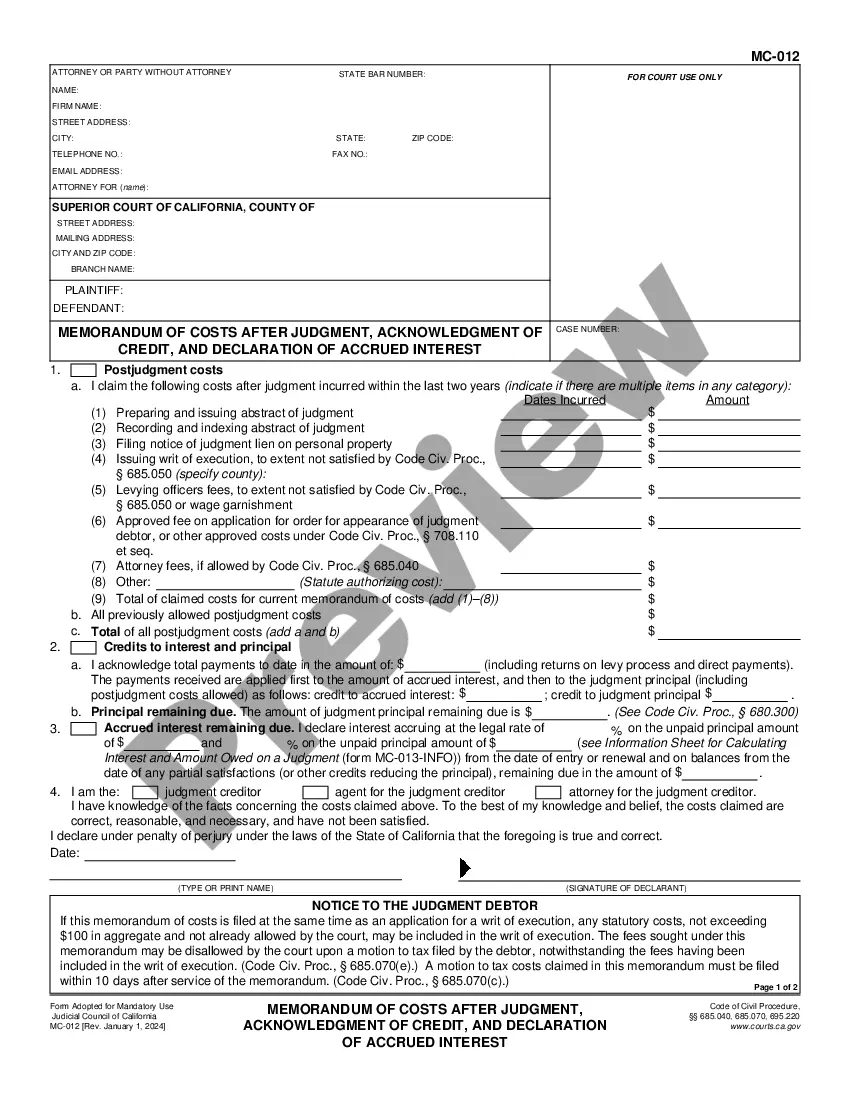

- Step 2. Utilize the Review option to look through the form`s articles. Don`t forget about to learn the description.

- Step 3. In case you are not happy together with the type, use the Research field towards the top of the display screen to locate other variations of the legal type template.

- Step 4. Upon having located the form you need, go through the Buy now key. Pick the prices prepare you like and include your credentials to sign up to have an account.

- Step 5. Procedure the financial transaction. You should use your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the formatting of the legal type and download it on your own system.

- Step 7. Complete, revise and print or signal the Idaho Shared Earnings Agreement between Fund & Company.

Each and every legal record template you acquire is your own for a long time. You have acces to every type you downloaded within your acccount. Click on the My Forms segment and choose a type to print or download once again.

Remain competitive and download, and print the Idaho Shared Earnings Agreement between Fund & Company with US Legal Forms. There are many skilled and express-specific types you can utilize for your personal enterprise or specific requires.

Form popularity

FAQ

The pass- through deduction is generally 20% of a taxpayer's QBI from a partnership, S corporation, or sole proprietorship, plus 20% of the taxpayer's qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

50% of W-2 wages paid by that trade or business to generate the QBI, or if greater, 25% of W-2 wages paid by the trade or business plus 2.5% of the unadjusted basis of the qualified property used by the trade or business.

199A, ?Qualified Business Income,? under which a non-corporate taxpayer, including a trust or estate, who has qualified business income (QBI) from a partnership, S corporation, or sole proprietorship is allowed a deduction. California does not conform to the deduction for qualified business income of pass-through ...

Filers in Idaho can claim itemized deductions or the standard deduction, whichever is greater. The standard deduction is equal to the federal standard deduction, which for the 2022 tax year is $12,950 for single filers and $25,900 for joint filers.

Log into your TAP account and make sure you see the balance due for income tax. Click More. Scroll down to the Payment Plans panel and choose Request a Payment Plan. Complete and submit your request.

Follow these five steps to start an Idaho LLC and elect Idaho S corp designation: Name Your Business. Choose a Registered Agent. File the Idaho Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Idaho S Corp Tax Designation.

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

2023 Section 199A Qualified Business Income (QBI) Deduction Wage/Capital ThresholdMarried Filing Jointly, Surviving Spouse$ 364,200Single, Head of Household, Married Filing Separately$ 182,100Phase-In CeilingMarried Filing Jointly, Surviving Spouse$ 464,2001 more row