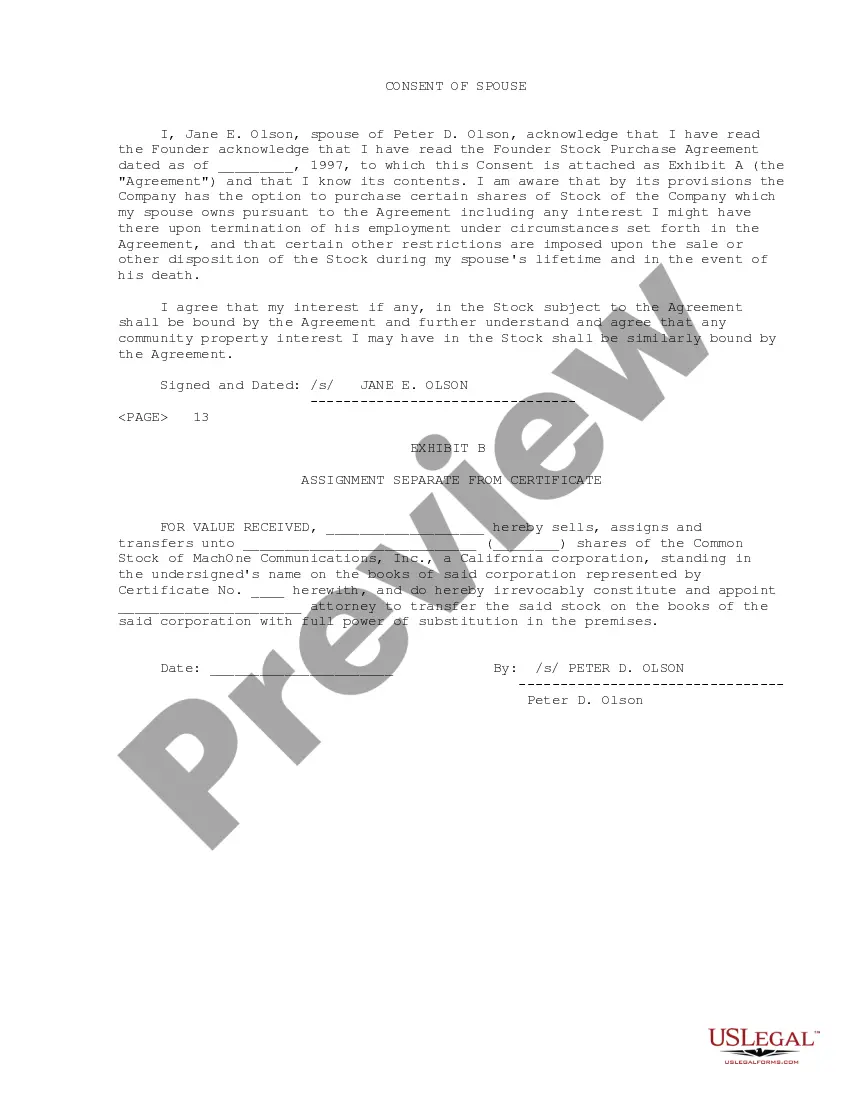

Idaho Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

Are you presently within a situation in which you will need paperwork for sometimes organization or individual purposes just about every working day? There are tons of lawful record web templates available online, but locating kinds you can rely on is not simple. US Legal Forms delivers 1000s of type web templates, just like the Idaho Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson, which can be published to fulfill state and federal specifications.

When you are presently informed about US Legal Forms web site and get a merchant account, merely log in. Next, you may down load the Idaho Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson web template.

Should you not provide an profile and want to start using US Legal Forms, adopt these measures:

- Find the type you want and make sure it is for your appropriate town/area.

- Utilize the Preview button to examine the form.

- Look at the description to actually have selected the correct type.

- In case the type is not what you are searching for, use the Research industry to find the type that meets your needs and specifications.

- When you find the appropriate type, click on Purchase now.

- Pick the prices strategy you desire, complete the necessary details to produce your bank account, and pay for your order making use of your PayPal or credit card.

- Select a hassle-free document structure and down load your version.

Discover all of the record web templates you possess bought in the My Forms menus. You may get a more version of Idaho Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson at any time, if required. Just select the necessary type to down load or print out the record web template.

Use US Legal Forms, the most considerable selection of lawful kinds, to save lots of time as well as steer clear of errors. The service delivers skillfully made lawful record web templates that can be used for a range of purposes. Produce a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

A: The most common provisions included in restricted stock purchase agreements are restrictions on when and how stock can be sold or transferred; non-compete agreements; rights of first refusal; and termination clauses which allow either party to terminate the agreement under specified conditions. Step-by-Step Guide to Drafting a Restricted Stock Purchase Agreement genieai.co ? blog ? step-by-step-guide-to-dr... genieai.co ? blog ? step-by-step-guide-to-dr...

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder. Restricted Stock Purchase Agreement (RSPA) - Vela Wood Vela Wood ? glossary-term ? restricted-stoc... Vela Wood ? glossary-term ? restricted-stoc...

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

RSUs are a type of restricted stock (which may also be known as ?letter stock? or ?restricted securities?). Restricted stock is company stock that cannot be fully transferable until certain restrictions have been met. These can be performance or timing restrictions, similar to restrictions for options. RSU vs. stock options: What's the difference? - Empower empower.com ? the-currency ? money ? sto... empower.com ? the-currency ? money ? sto...

RSUs. Restricted stock awards (RSAs) and restricted stock units (RSUs) are two alternatives to stock options (such as ISOs and NSOs) that companies can use to compensate their employees. While stock options offer employees the ?option? to buy shares at a fixed price, RSAs and RSUs are grants of stock. RSA vs RSU: Key Differences & Tax Treatments - Carta Carta ? blog ? breaking-down-rsas-and-rsus Carta ? blog ? breaking-down-rsas-and-rsus