Idaho Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

It is possible to invest several hours on the web trying to find the lawful document format that meets the federal and state needs you will need. US Legal Forms supplies a huge number of lawful forms which can be evaluated by specialists. It is possible to acquire or produce the Idaho Ratification and approval of directors and officers insurance indemnity fund with copy of agreement from my service.

If you already have a US Legal Forms accounts, you can log in and click on the Down load option. Next, you can comprehensive, modify, produce, or signal the Idaho Ratification and approval of directors and officers insurance indemnity fund with copy of agreement. Every single lawful document format you acquire is your own forever. To obtain one more duplicate of the obtained form, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms website for the first time, follow the straightforward instructions below:

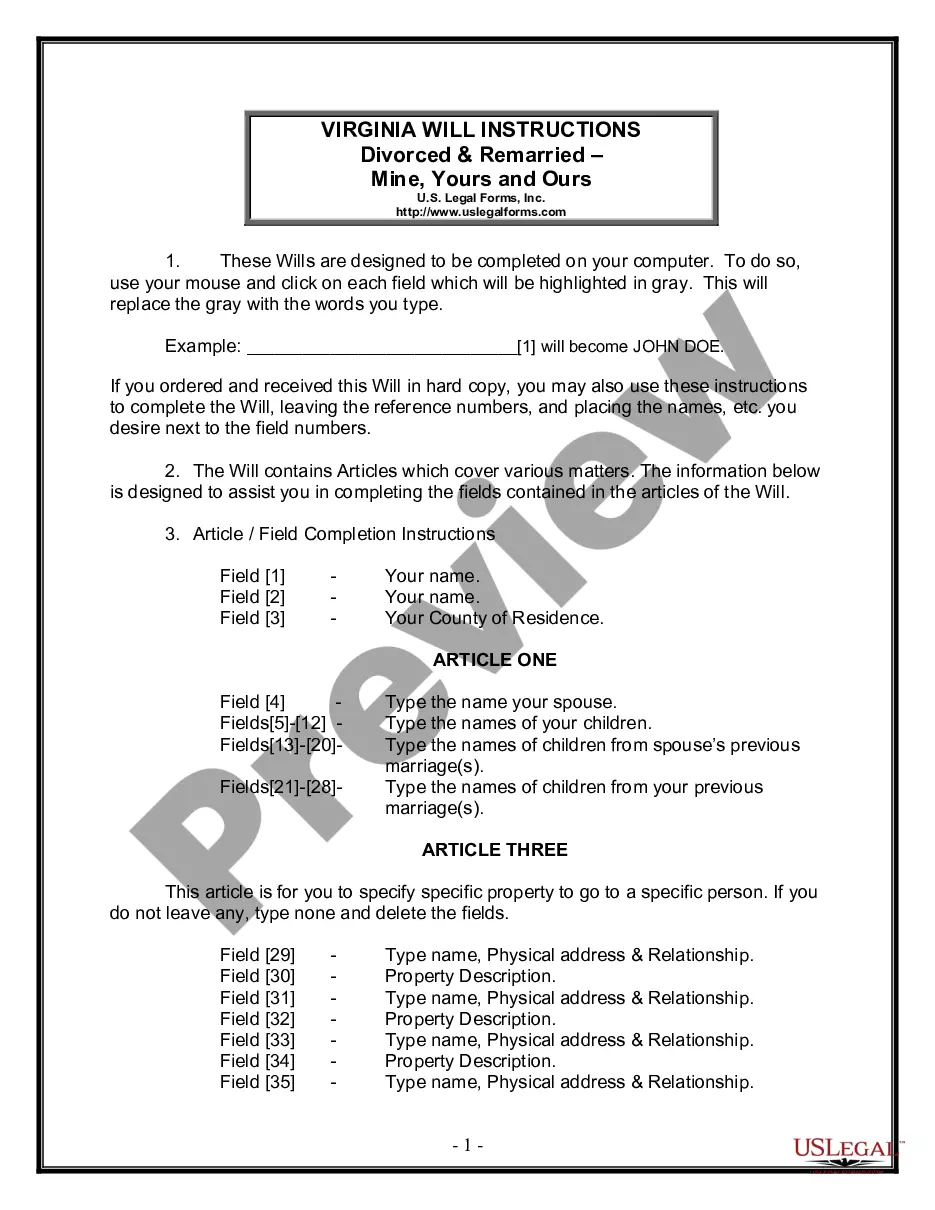

- Very first, ensure that you have chosen the correct document format for the region/town of your choosing. See the form outline to make sure you have picked the right form. If available, utilize the Preview option to appear with the document format as well.

- If you would like find one more model of the form, utilize the Lookup area to find the format that meets your needs and needs.

- When you have located the format you would like, click Purchase now to carry on.

- Pick the prices strategy you would like, enter your credentials, and register for an account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal accounts to purchase the lawful form.

- Pick the structure of the document and acquire it for your device.

- Make adjustments for your document if possible. It is possible to comprehensive, modify and signal and produce Idaho Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

Down load and produce a huge number of document themes using the US Legal Forms web site, which provides the biggest selection of lawful forms. Use specialist and express-distinct themes to tackle your organization or personal requires.

Form popularity

FAQ

There are two parties in an indemnity relationship ? an indemnitor and an indemnitee. An indemnitor gives indemnity while the indemnitee receives indemnity. When a duty to indemnify is triggered, the indemnitor undertakes the obligation to cover the loss or damage that has been or might be incurred by the indemnitee.

For example, in a surety bond agreement, the indemnitor is typically the party that provides the financial backing and assumes responsibility for any losses that may occur if the bonded party fails to fulfill their contractual obligations.

An indemnitor is a party who agrees to indemnify certain losses for another party. In doing so, they are legally required to compensate them when these losses are incurred. Insurance companies assume the role of the indemnitor in insurance contracts, agreeing to compensate the insured for specific losses.

The indemnitor, also called the indemnifier, or indemnifying party, is the person who is obligated to hold harmless the other party for its conduct, or another person's conduct.

A D&O policy protects a director or officer's assets and reimburses them for settlements and legal expenses resulting from such litigation and cases. The purpose of professional indemnity insurance is to protect professionals against claims resulting from mistakes or omissions they have made.

Indemnity Agreement: Although similar to a hold harmless agreement, an indemnity agreement is an arrangement whereby one party agrees to pay the other party for any damages regardless of who is at fault.

An indemnity agreement has two parties: Indemnitor: The party that holds another harmless in a contract. Indemnitee: The party that is protected by the indemnitor against liabilities.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.