Idaho Hourly Employee Evaluation

Description

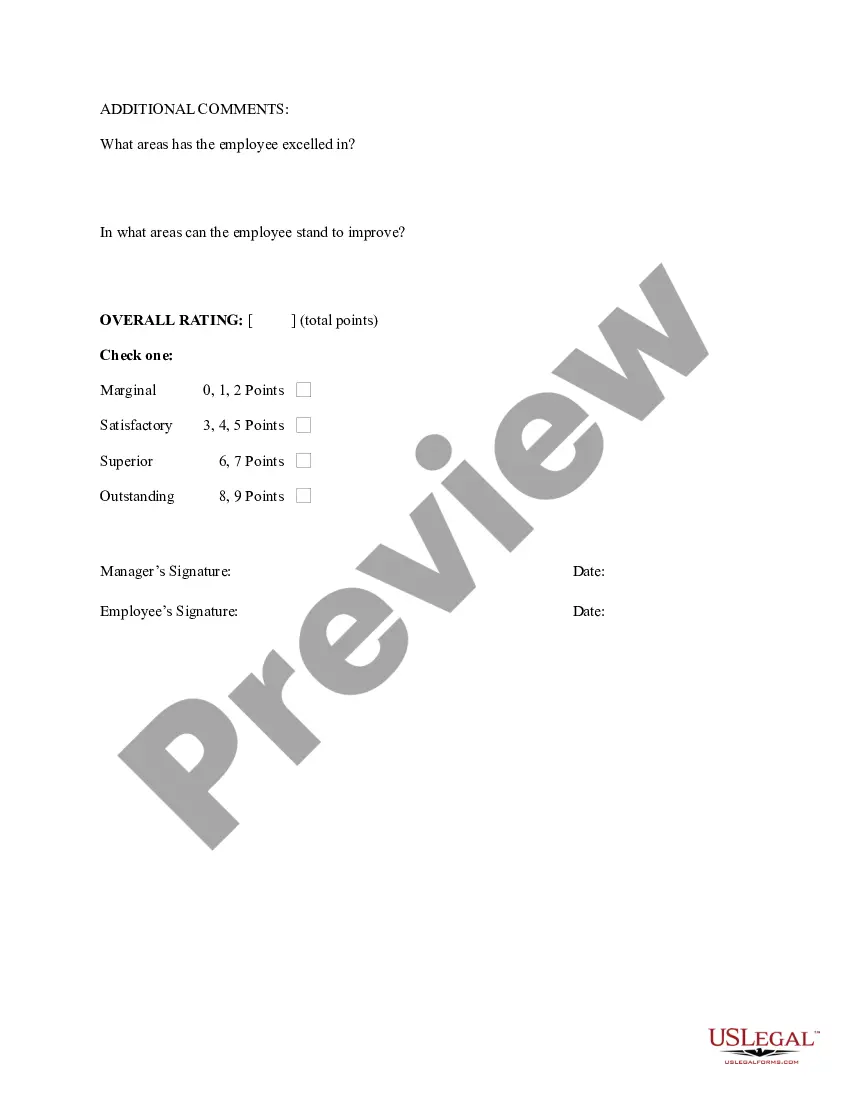

How to fill out Hourly Employee Evaluation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the site, you can access thousands of templates for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents like the Idaho Hourly Employee Evaluation in just minutes.

If you have a membership, Log In to download the Idaho Hourly Employee Evaluation from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained forms in the My documents tab of your profile.

Complete the transaction. Use your credit card or PayPal account to finish the purchase.

Select the file format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Idaho Hourly Employee Evaluation. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Idaho Hourly Employee Evaluation through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/state.

- Click the Preview option to review the content of the document.

- Check the description of the form to ensure it is the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select a pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Alberta Overtime Pay Rate. Like most provinces, Alberta's overtime pay rate is 1½ times an employee's regular pay rate. Employees in Alberta qualify for overtime pay after working more than eight hours in a day or more than 44 hours in a week (whichever is greater). This is sometimes known as the 8/44 rule.

Do Idaho employers have to provide breaks or meal periods to employees? Idaho law does not require employers to give breaks or meal periods. Employees would only be entitled to breaks if it is the employer's policy to provide them.

Generally, when you are employed in Idaho, it is at will. This means an employer can terminate a worker at any time for any reason, as long as that reason does not infringe upon the worker's rights or an employment contract.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

The Exception: Gross Misconduct The only exception, regardless of the length of service, is that an employee can be dismissed without notice where that employee has committed gross misconduct. In those cases, an employee can be summarily dismissed, without notice.

California is an at-will state, which implies that at any moment of jobs with or without reason an employer can terminate you for any reason. This means that if your employer doesn't like your personality if you run out of work, think you're lazy or just don't want staff anymore, they can fire you at any moment.

At-will employment is an employer-employee agreement in which a worker can be fired or dismissed for any reason, without warning, and without explanation.

If your Idaho employer fires you for discriminatory reasons, in violation of an employment contract, or in retaliation for exercising your rights, for example, you may have a legal claim against your employer for wrongful termination.

For the purpose of overtime payment, each work- week stands alone; there can be no averaging of two or more workweeks. Unless specifically exempt under the provisions of the feder- al law, salaried employees must be paid time and one-half for all hours worked in excess of 40 hours in a workweek.

Idaho Overtime Law Instead of having a state overtime law, Idaho follows federal law contained in the Fair Labor Standards Act (FLSA). The FLSA provides covered, non-exempt employees overtime pay for any hours worked beyond 40 in a workweek. The overtime rate is set at 1.5 times an employee's regular wage.