Idaho Job Sharing Agreement Form

Description

How to fill out Job Sharing Agreement Form?

Are you situated in a location where you need documentation for both business or specific reasons almost every day.

There are numerous legal document templates accessible online, yet locating reliable ones isn't straightforward.

US Legal Forms offers thousands of form templates, such as the Idaho Job Sharing Agreement Form, which are crafted to fulfill federal and state requirements.

If you discover the correct form, click on Get now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete the order payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the design for the Idaho Job Sharing Agreement Form.

- If you don’t possess an account and wish to begin using US Legal Forms, follow these instructions.

- Search for the form you need and verify it is appropriate for your specific area/region.

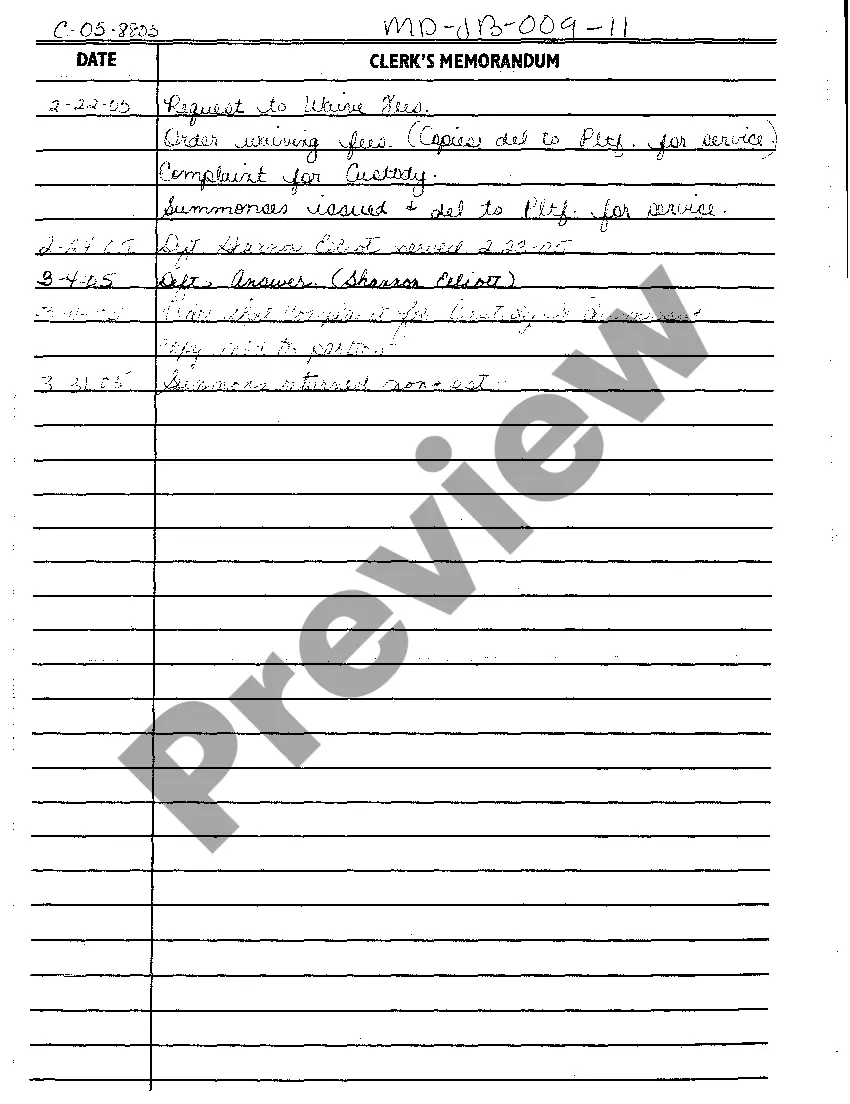

- Utilize the Preview option to review the document.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup field to find the form that meets your requirements.

Form popularity

FAQ

Job Share Advantages for the Employer You gain two brains, two sets of enthusiasm and creativity, and two employees committed to your success. Employees who are comfortable balancing life responsibilities experience less stress and more work satisfaction.

Retention of valued employees: Job sharing keeps workers seeking reduced hours, such as working parents, from being forced to quit your company to get time off. It can greatly reduce expensive employee turnover, which is especially important in key positions.

Employee stock ownership, or employee share ownership, is where a company's employees own shares in that company (or in the parent company of a group of companies). US Employees typically acquire shares through a share option plan.

Employees can receive shares that give only voting rights, only equity rights, or both, and with any percentage of the total voting or equity stake.

It's worth internalizing these pros and cons if you're considering an employee stock ownership plan for your closely-held company.PRO: Sellers are Paid Fair Market Value (FMV)CON: ESOPs Cannot Offer More than FMV.PRO: An Employee Trust is a Known Buyer.CON: An ESOP Transaction Process is Highly Structured.More items...

Job sharing is a working arrangement that normally involves two (and not more than three) people voluntarily sharing the responsibilities and tasks of one job. Job sharers like part time workers have their own individual contracts of employment and share the pay and benefits of the whole post on a pro-rata basis.

An employer can set up a multi-year vesting schedule. For example, the employee may be vested in 400 shares each year, over a space of five years. That means that the employee would be vested in the first 400 shares after one year of service, than 800 shares after two years, and so on, up to 2,000 shares.

A special agreement that gives an employee the right to buy company shares for a particular price by a particular date, sometimes offered as a reward or instead of pay: If employee share options are cashed in early, you may lose the income tax break that the options normally carry.

Five tips for managing a successful job shareDivide the role in the most effective way possible.Make the most of potential flexibility.Minimise common problems.Have clear contractual arrangements.Ensure arrangements for one job share partner leaving are clear.

How to Make a Job Sharing Situation WorkWhat the Experts Say.Choose the right partner.Decide how to divide up the work.Communicate, communicate, communicate.Secure your supervisor's support.Manage expectations and perceptions.Battle the bias.Give it time.More items...?