Idaho Equal Pay Checklist

Description

How to fill out Equal Pay Checklist?

You have the capability to spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers a vast selection of legal forms that have been reviewed by experts.

You can easily download or print the Idaho Equal Pay Checklist from our services.

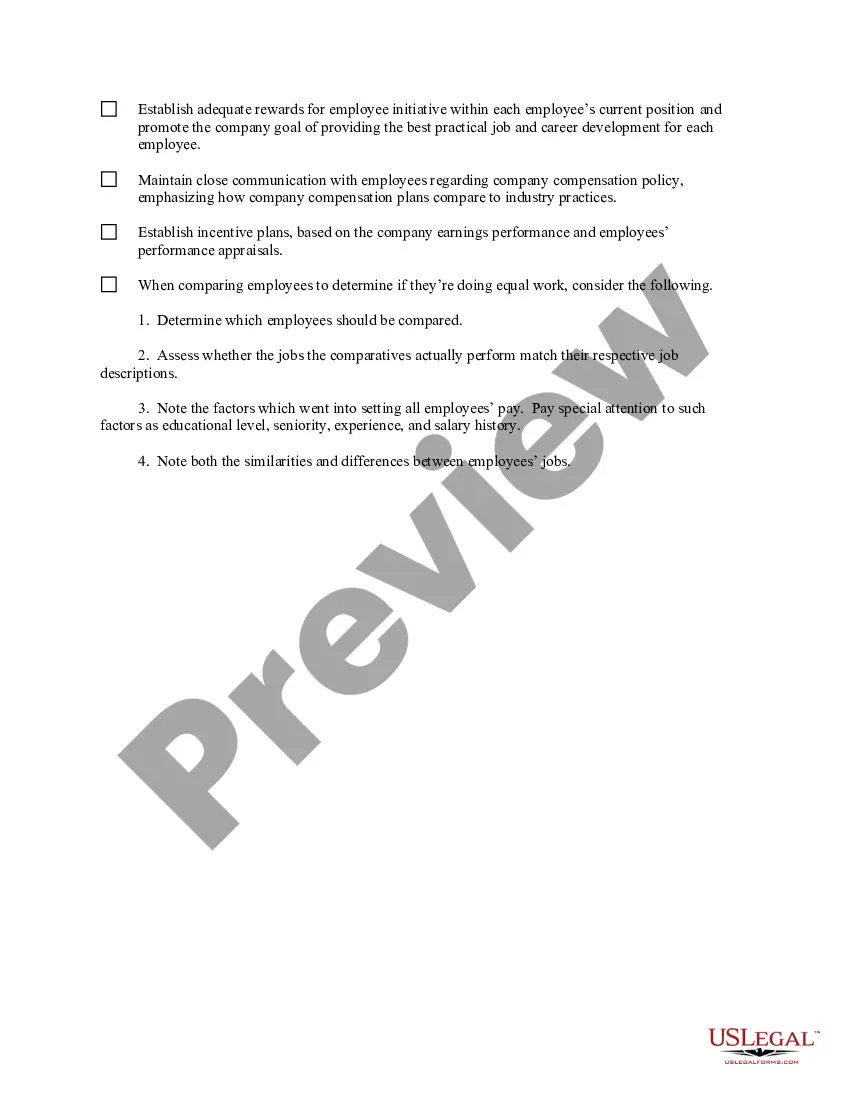

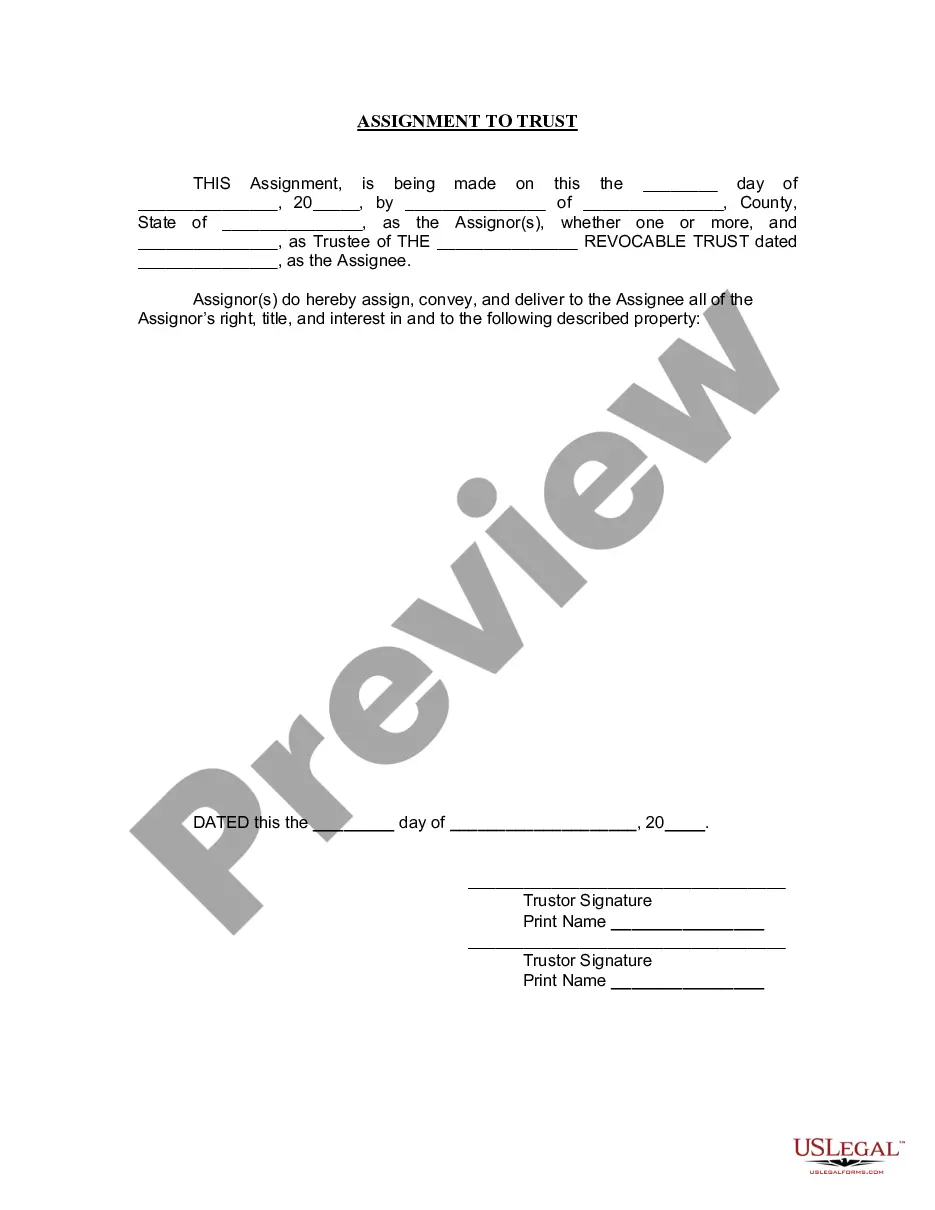

If available, utilize the Preview button to look through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can fill out, modify, print, or sign the Idaho Equal Pay Checklist.

- Every legal document template you obtain is yours permanently.

- To retrieve an additional copy of the purchased document, access the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the state/region of your choice.

- Review the document details to ensure you have chosen the appropriate form.

Form popularity

FAQ

Filing a wage claim in Idaho involves a few clear steps. First, gather your documents that prove your employment and wages, including pay stubs and your Idaho Equal Pay Checklist. Next, you must complete the wage claim form available on the Idaho Department of Labor's website. After filling out the form, submit it to the appropriate office, and keep copies for your records. It's important to be aware of the deadlines to ensure your claim is valid.

The exempt salary in Idaho refers to the minimum salary level that employees must earn to qualify for exemption from overtime pay. As of 2023, this salary threshold is set at a specific amount determined by state and federal standards. Check the Idaho Equal Pay Checklist to ensure you are aware of the current exempt salary requirements and remain in compliance with your business obligations.

Equal rights in Idaho are designed to provide all individuals with the same opportunities without discrimination. These rights include equality in employment, housing, and public services, protecting against discrimination based on gender, race, age, or disability. To navigate these rights effectively, the Idaho Equal Pay Checklist serves as a valuable resource, helping you understand your entitlements and responsibilities in the workplace.

The law 18-6710 in Idaho is part of the Equal Pay Act, which sets forth guidelines ensuring fairness in employee compensation. This law prohibits wage discrimination based on gender, requiring employers to provide equal pay for equal work. Understanding this law is crucial for both employees and employers, and utilizing the Idaho Equal Pay Checklist can help ensure compliance and fair practices within your organization.

In Idaho, the minimum salary for an employee to be exempt from overtime pay is set at $41,203 per year, or approximately $3,433 per month. When considering your compliance with the Idaho Equal Pay Checklist, it's crucial to ensure that your employee classifications align with this standard. Misclassifying employees can lead to significant legal challenges and financial penalties. By using the Idaho Equal Pay Checklist, you can effectively manage these classifications and safeguard your business against potential pitfalls.

No, you cannot be fired for discussing wages at work. The majority of employed and working Americans are protected from discipline exercised simply due to protected classes, such as age, gender, race, and so forth.

Idaho's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate. The minimum wage applies to most employees in Idaho, with limited exceptions including tipped employees, some student workers, and other exempt occupations.

Idaho Minimum Wage for 2021, 2022. Idaho's state minimum wage rate is $7.25 per hour. This is the same as the current Federal Minimum Wage rate.

For the purpose of overtime payment, each work- week stands alone; there can be no averaging of two or more workweeks. Unless specifically exempt under the provisions of the feder- al law, salaried employees must be paid time and one-half for all hours worked in excess of 40 hours in a workweek.

Under the federal Fair Labor Standards Act (FLSA), employers must pay their employees at least minimum wage (currently $7.25 per hour in Idaho), but may satisfy that requirement by claiming a tip credit when the employee's tip earnings bring their total compensation up to the minimum wage.