Idaho Waiver of the Right to be Spouse's Beneficiary

Description

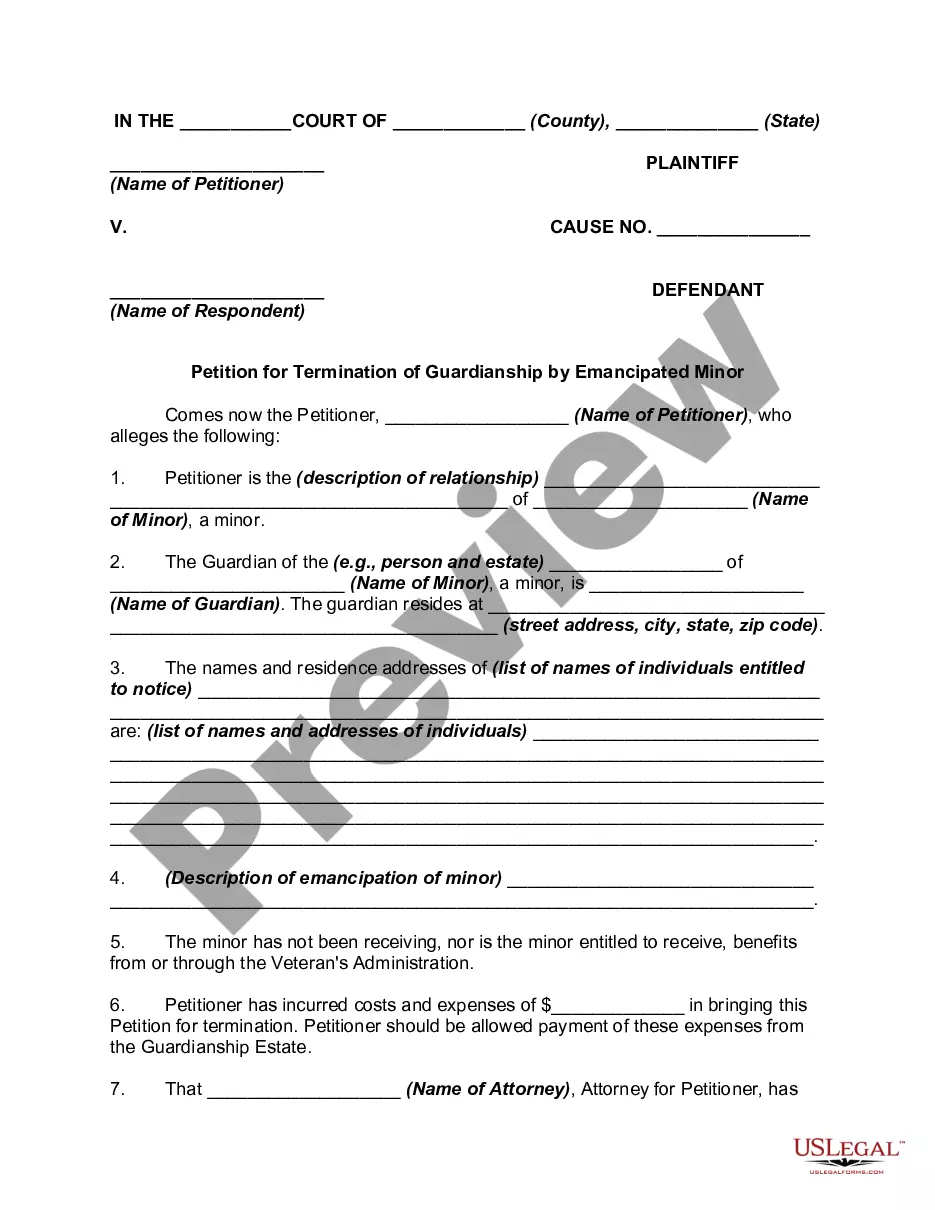

How to fill out Waiver Of The Right To Be Spouse's Beneficiary?

If you need to complete, obtain, or printing legitimate document web templates, use US Legal Forms, the biggest assortment of legitimate forms, that can be found on-line. Utilize the site`s basic and practical research to find the paperwork you will need. Various web templates for business and specific purposes are sorted by groups and claims, or keywords. Use US Legal Forms to find the Idaho Waiver of the Right to be Spouse's Beneficiary in just a few mouse clicks.

Should you be previously a US Legal Forms customer, log in for your account and then click the Download button to find the Idaho Waiver of the Right to be Spouse's Beneficiary. You can even entry forms you previously saved within the My Forms tab of your account.

Should you use US Legal Forms initially, refer to the instructions under:

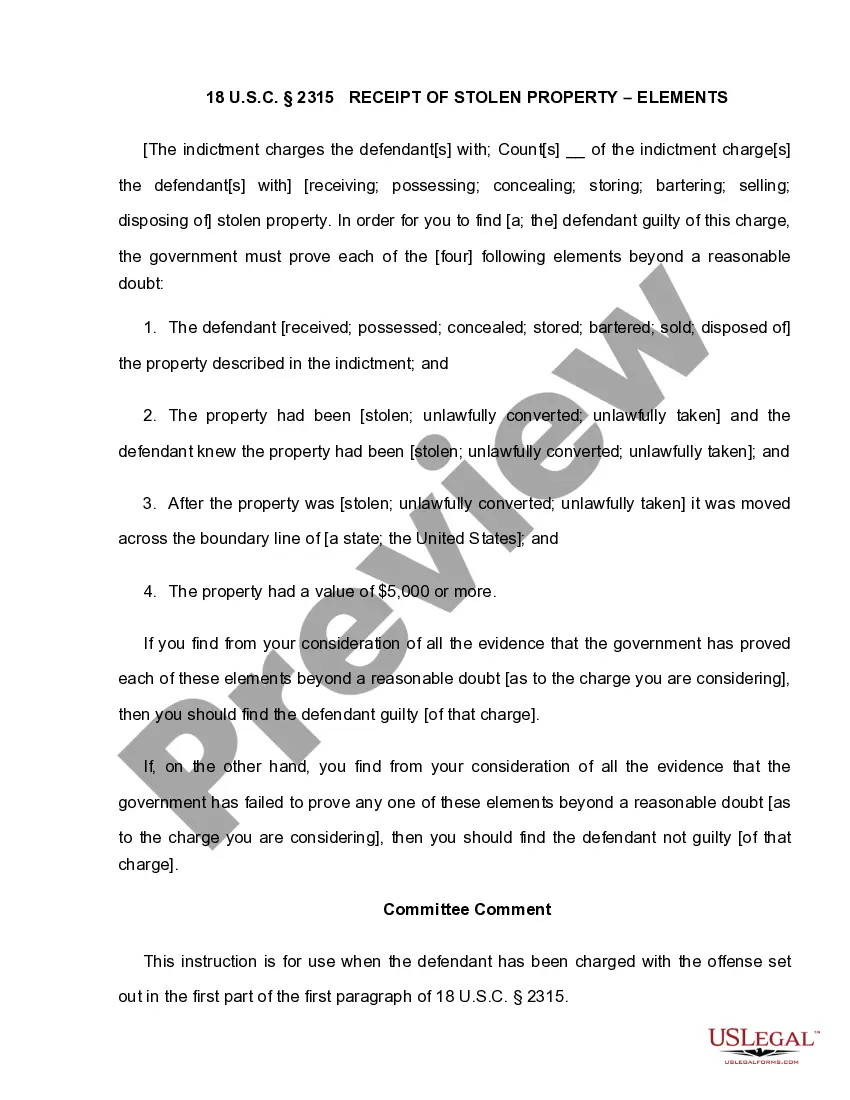

- Step 1. Make sure you have chosen the form for your right area/nation.

- Step 2. Make use of the Review choice to check out the form`s content material. Never neglect to see the description.

- Step 3. Should you be not happy together with the develop, use the Lookup field at the top of the monitor to get other models of the legitimate develop template.

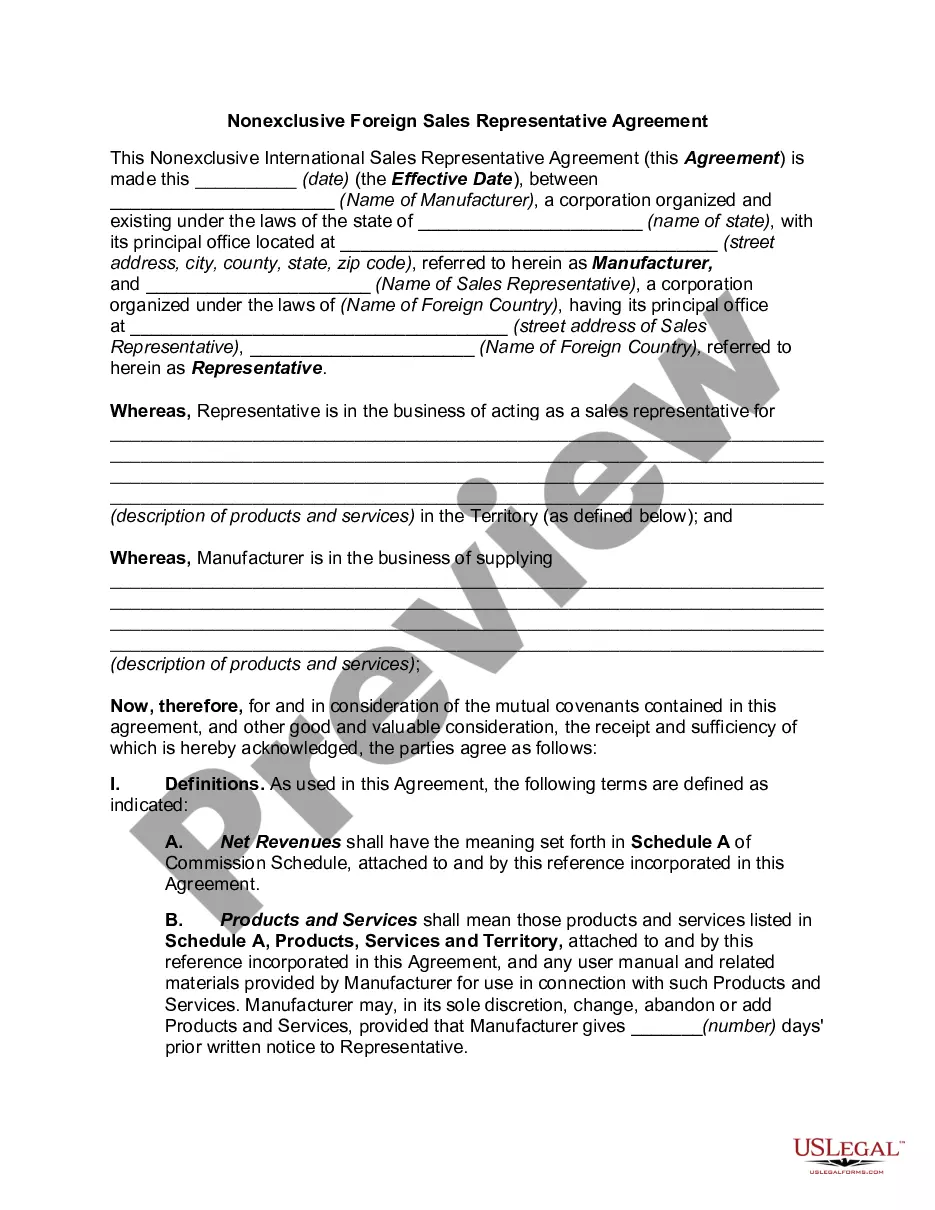

- Step 4. Upon having identified the form you will need, click on the Acquire now button. Opt for the pricing plan you choose and include your credentials to register for the account.

- Step 5. Process the financial transaction. You may use your bank card or PayPal account to complete the financial transaction.

- Step 6. Select the formatting of the legitimate develop and obtain it on the gadget.

- Step 7. Comprehensive, revise and printing or indicator the Idaho Waiver of the Right to be Spouse's Beneficiary.

Every legitimate document template you get is yours for a long time. You possess acces to every develop you saved within your acccount. Select the My Forms segment and select a develop to printing or obtain yet again.

Contend and obtain, and printing the Idaho Waiver of the Right to be Spouse's Beneficiary with US Legal Forms. There are many skilled and state-certain forms you can utilize to your business or specific needs.

Form popularity

FAQ

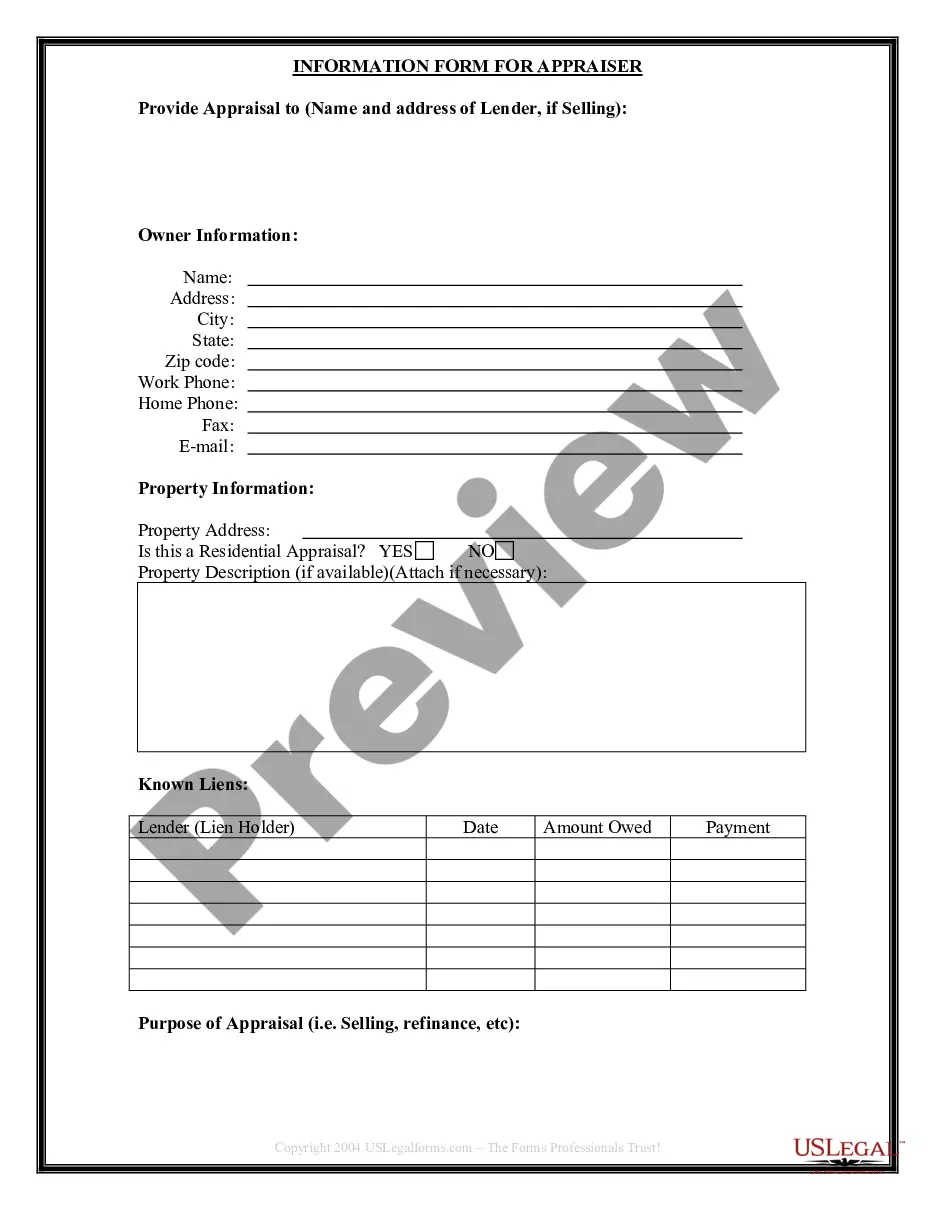

Reasons for Disclaiming an Inheritance Inheriting assets would increase the size of your estate and potentially create tax planning complications for your own heirs once it's time to pass your assets on.

Idaho statutes dealing with intestate succession state that a surviving spouse receives all of the community property and they receive one half of any separate property owned by the decedent. The remaining 1/2 of the separate property will go to the decedent's children or parent or other heirs if there are any.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

A beneficiary is a person who is named in this contract as a recipient of the life insurance proceeds in the event of the insured person's death. The beneficiary may be a spouse, a relative, a child, a friend, a trust, etc. Usually, the owner of the policy may name any person or an entity as the beneficiary.

When you receive a gift from someone's estate, you can refuse to accept the gift for any reason. This is called "disclaiming" the gift, and the refusal is called a disclaimer. When you disclaim a gift, you do not get to decide who gets it. Instead, it passes on to the next beneficiary, as if you did not exist.

Idaho Statutes Any estate in personal property held by a husband and wife as community property with right of survivorship shall, upon the death of one (1) spouse, transfer and belong solely to the surviving spouse as a nontestamentary disposition at death.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

Because Idaho is a community property state, it does allow a right of survivorship in real property to be given to a surviving spouse.

Key Takeaways. Common reasons for disclaiming an inheritance include not wishing to pay taxes on the assets or ensuring that the inheritance goes to another beneficiaryfor example, a grandchild. Specific IRS requirements must be followed in order for a disclaimer to be qualified under federal law.

The short answer is that TOD deeds are not allowed in Idaho. The reason for this is because Idaho is a community property state.