Idaho Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

If you require extensive, downloading, or printing legal document templates, utilize US Legal Forms, the biggest repository of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

A wide range of templates for business and personal purposes is categorized by groups and states, or by keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Step 4. After finding the form you need, click the Buy now button. Choose your preferred pricing plan and enter your details to register for an account.

- Use US Legal Forms to obtain the Idaho Notice of Adverse Action - Non-Employment - Due to Credit Report in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to get the Idaho Notice of Adverse Action - Non-Employment - Due to Credit Report.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

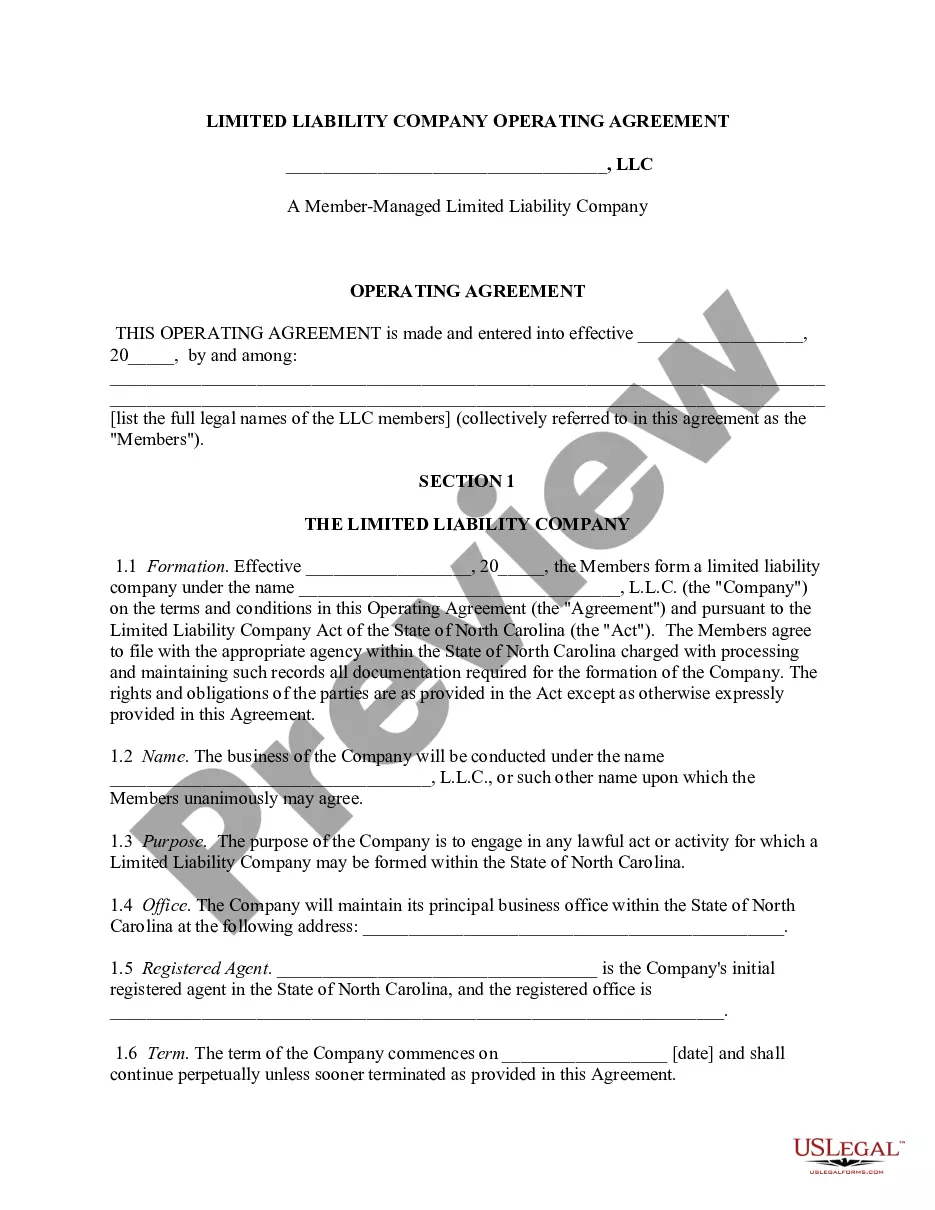

- Step 2. Use the Preview option to view the form’s content. Don’t forget to check the description.

Form popularity

FAQ

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

If you do not provide any additional information or dispute the accuracy of your background check with Checkr within the number of days provided in your Pre-Adverse Action Notice, you will receive a Post-Adverse action notice, and at which time your account will be deactivated for failing to pass your background check.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

The Process of Handling Adverse ActionStep 1: Provide Disclosure and Send a Notice for Pre-Adverse Action.Step 2: The Waiting Period.Step 3: Review the Report Results Again.Step 4: Provide the Notice of Adverse Action.Step 5: Properly Dispose of Sensitive Information.

Adverse Action Notice notifies the candidate that information contained on their background report may negatively affect a decision about their employment. It is intended to give the candidate an opportunity to respond to the information contained in the report, so by law it must contain a copy of the report.

Pre-Adverse Action The pre-adverse action letter can be delivered via electronic or hard copy form. Its purpose is to inform the applicant that you will not hire them for the position based on information uncovered in the background check.

What is an adverse action letter? With respect to background checks, an adverse action letter is a written notice required by federal law, delivered in hard copy or electronic form, that informs a job candidate he or she will not be hired for a particular position because of the findings in a background check.

An adverse action notice is an explanation that issuers must give you if you're denied credit or if you're given less favorable financing terms based on your credit history. You may also get an adverse action notice if your credit is a reason an employer turns you down for a job.

In the hiring process, adverse action means a company is considering not hiring the applicant or that they may withdraw an offer. Usually, this is based on an adverse report on a consumer report or background check.