Idaho Shipping Reimbursement

Description

How to fill out Shipping Reimbursement?

It is feasible to spend hours online attempting to locate the legal document template that meets the state and federal stipulations you require.

US Legal Forms offers a multitude of legal forms that have been vetted by professionals.

You can obtain or print the Idaho Shipping Reimbursement from my service.

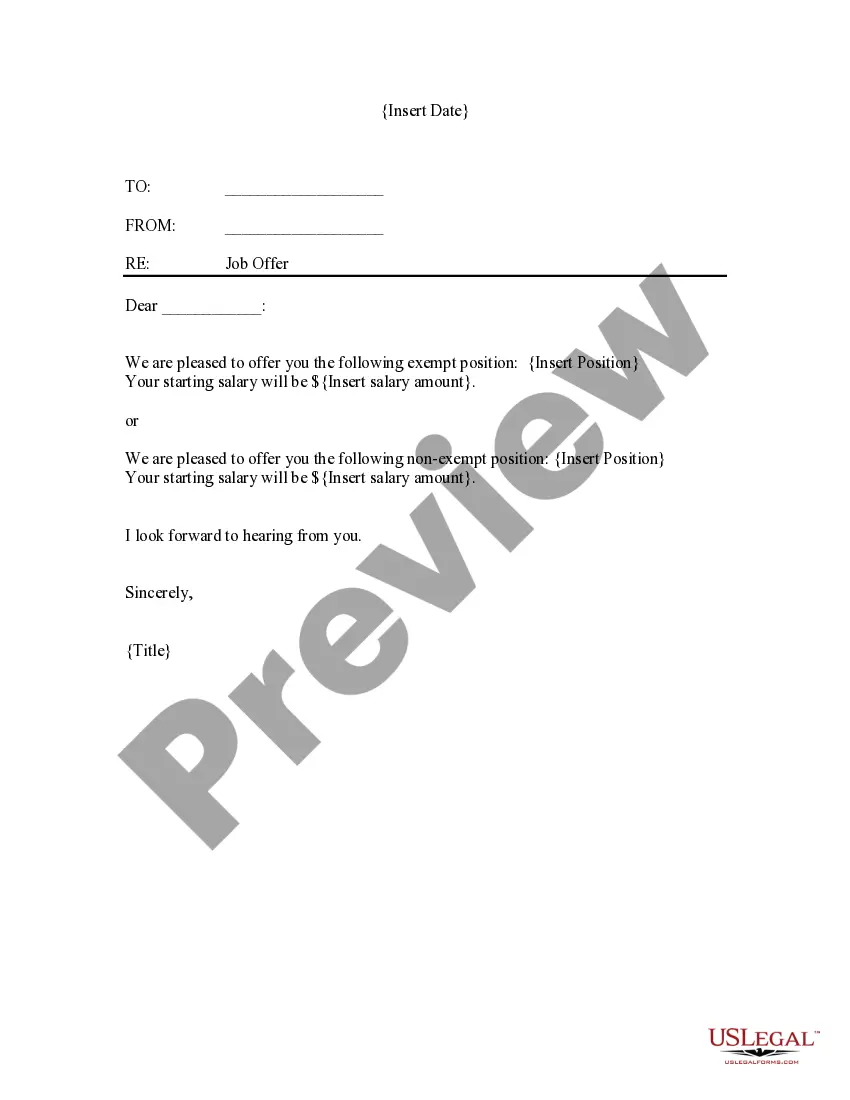

If needed, use the Preview function to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then select the Download option.

- Subsequently, you may complete, edit, print, or sign the Idaho Shipping Reimbursement.

- Each legal document template you purchase is yours indefinitely.

- To retrieve an additional copy of any acquired form, navigate to the My documents section and select the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions provided below.

- First, ensure that you have selected the correct document template for your selected county/town.

- Review the form description to confirm you have chosen the correct document.

Form popularity

FAQ

In Summary:You do not have to charge your customers sales tax on shipping and handling charges in Idaho if you do these two things: List the shipping and handling charges separately on the invoice. If ordering a product for a buyer from another seller, have that seller ship directly to the customer.

Idaho is one of only six states where grocery items, such as bread or canned goods, are fully taxable. (See how every state taxes groceries here.) In most states, grocery items are either totally tax exempt, or taxed at a reduced rate.

In the state of Idaho, the clothing exemption is specifically applicable to any purchases of clothing and footwear made by non-sale clothiers who provide free clothes to those who need them.

Idaho taxes food purchases with a 6% sales tax, the same rate as any other purchase in the state. Idaho is one of 13 states that impose a sales tax on groceries. To offset that tax, though, Idaho provides a tax credit of $100 per person, or $120 for seniors.

Services in Idaho are generally not taxable. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

Services in Idaho are generally not taxable. However if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on products. Tangible products are taxable in Idaho, with a few exceptions such as prescription drugs.

Out-of-state retailersRetailers without a physical presence in Idaho must collect Idaho sales tax when their sales in Idaho exceed $100,000 in the current or previous year.

Several examples of exemptions are prescription drugs, some groceries, truck campers, office trailers, and transport trailers. These categories may have some further qualifications before the special rate applies, such as a price cap on clothing items.

When you buy goods on the internet, by telephone, or from a mail-order catalog, the retailer might not charge sales tax. Use tax is owed by the purchaser on goods used or stored in Idaho when Idaho sales tax hasn't been properly paid.