Idaho Debit Shipping Authorization

Description

How to fill out Debit Shipping Authorization?

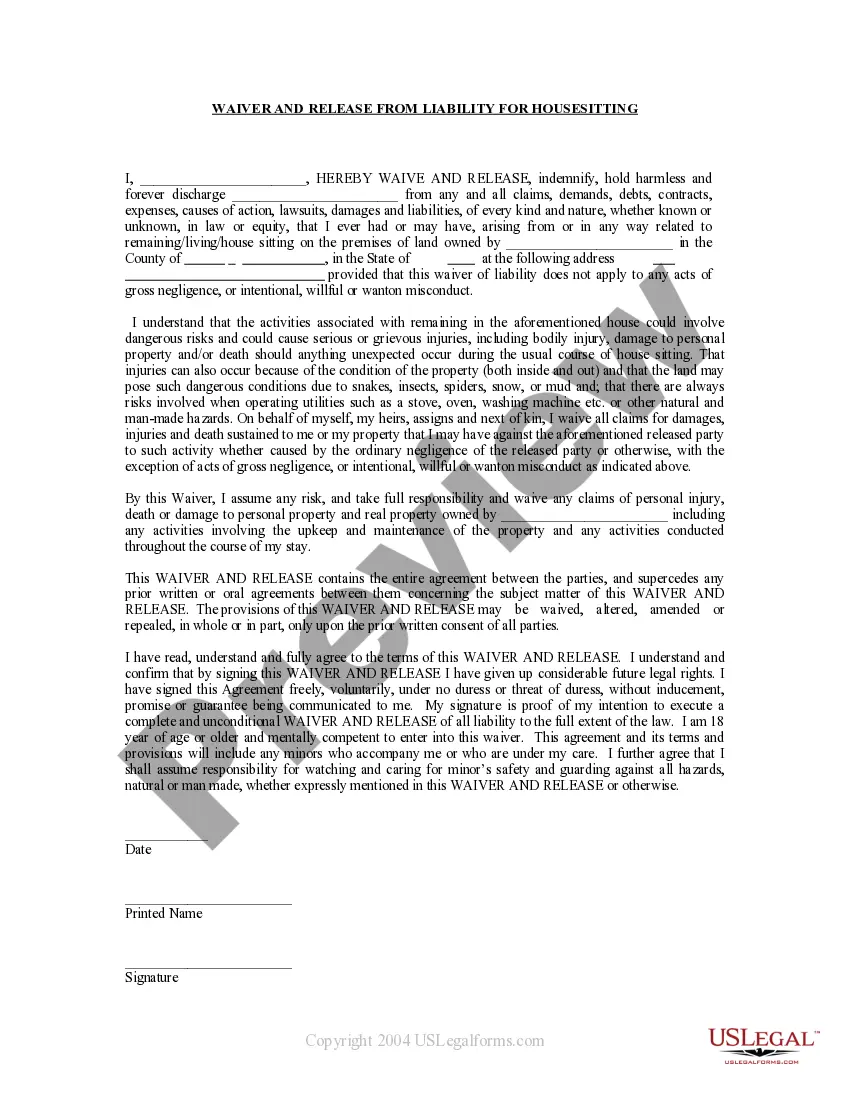

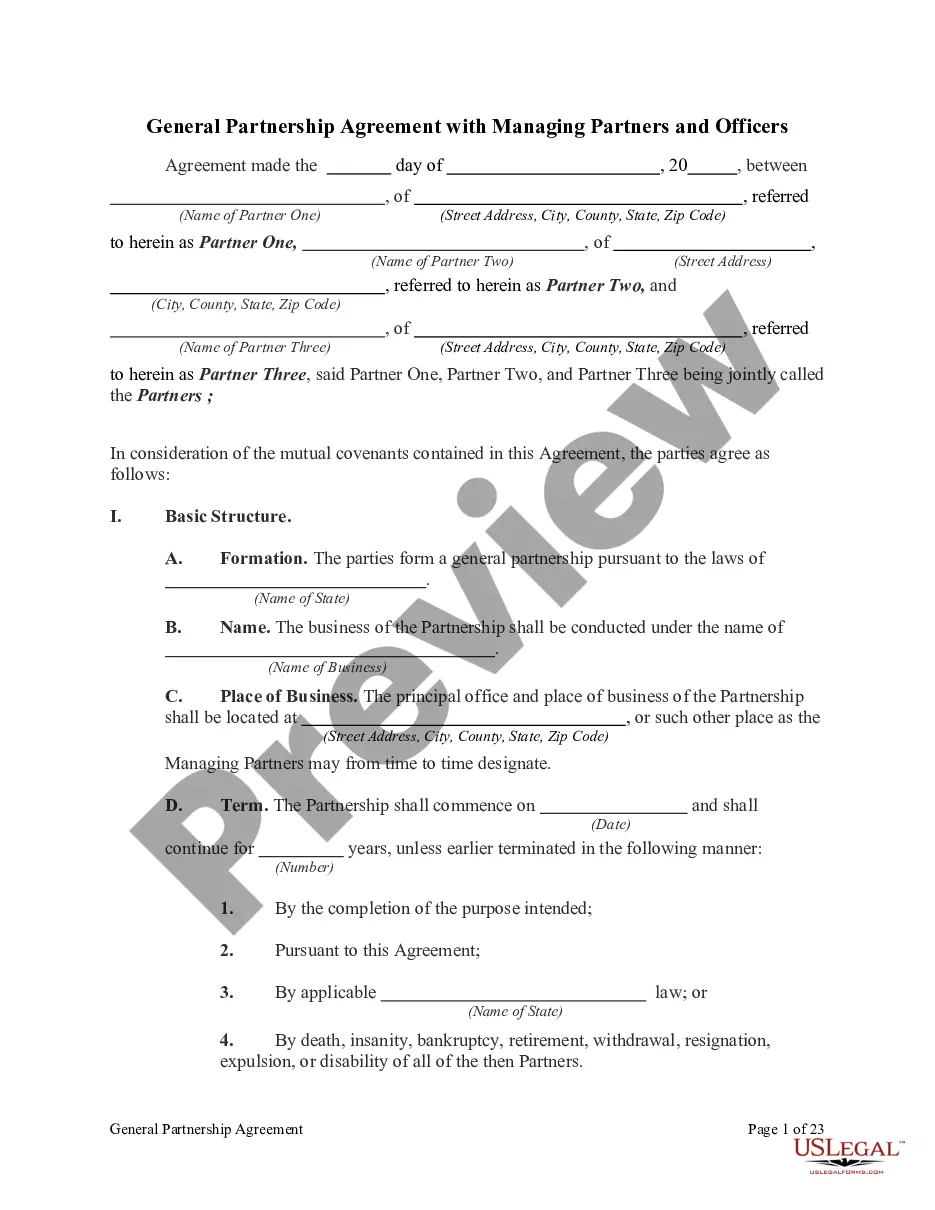

Selecting the appropriate official document format can be a challenge. Of course, many templates are available online, but how can you locate the official form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Idaho Debit Shipping Authorization, suitable for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to acquire the Idaho Debit Shipping Authorization. Use your account to browse through the legal forms you have previously ordered. Proceed to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure that you have selected the correct form for your city/state. You can view the form using the Preview feature and read the form description to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the appropriate form. Once you are confident that the form is appropriate, click the Get now button to obtain the form. Select the payment plan you desire and enter the necessary information. Create your account and finalize the transaction using your PayPal account or credit card. Choose the document format and download the official document format to your device. Complete, edit, print, and sign the obtained Idaho Debit Shipping Authorization.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Utilize the service to download professionally created papers that adhere to state requirements.

Form popularity

FAQ

Pay by Internet: Credit Card Payment Options: Pay On-line by credit card or e-check: Click on the Taxes Due Link. If you are paying on a delinquent account, please call our office for the correct total at (208) 983-2801.

Electronic Filing Mandate Idaho does not currently mandate electronic filing for individual returns. Individual income tax returns can be e-filed or filed by mail to the address below.

Credit/debit cardRegister with Access Idaho or use TAP. We accept American Express, Discover, MasterCard, and Visa. If you pay by credit/debit card, our third-party provider will charge a convenience fee.

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Idaho State Tax Commission, PO Box 56, Boise ID 83756-0056.

We accept cash, checks, money orders, credit cards, ACH credit, and ACH debit payments. (Note: If you pay with a credit/debit card or e-check, our third-party provider will charge a convenience fee. These fees are not initiated or collected by the Idaho State Tax Commission.)

Using your TAP accountRegister with TAP to file returns and make payments for many types of tax accounts. You'll see a history of your payments. Choose ACH Debit for no-fee payments. Note: If you have a debit block on your account, use this number to authorize Tax Commission debits: 6826001011.

However, HMRC no longer accepts credit card payments. So if you're looking to pay your tax bill for the 2017-18 tax year, you'll need to do so using a different method. Self Assessment taxpayers need to pay their 2017-18 tax bill by 31 January 2019.

You must e-file if you file 11 or more individual federal returns per calendar year, and you must have an IRS-issued EFIN in order to e-file. (An EFIN designates you as an authorized e-file provider.) To apply for an EFIN, use the IRS' e-Services - Online Tools for Tax Professionals.

Intro to Taxpayer Access Point (TAP)It's free.You can access TAP when and where you want, 24/7.Your information stays in a secure environment.TAP is the fastest way to file and pay.