Idaho Domestic Partnership Dependent Certification Form

Description

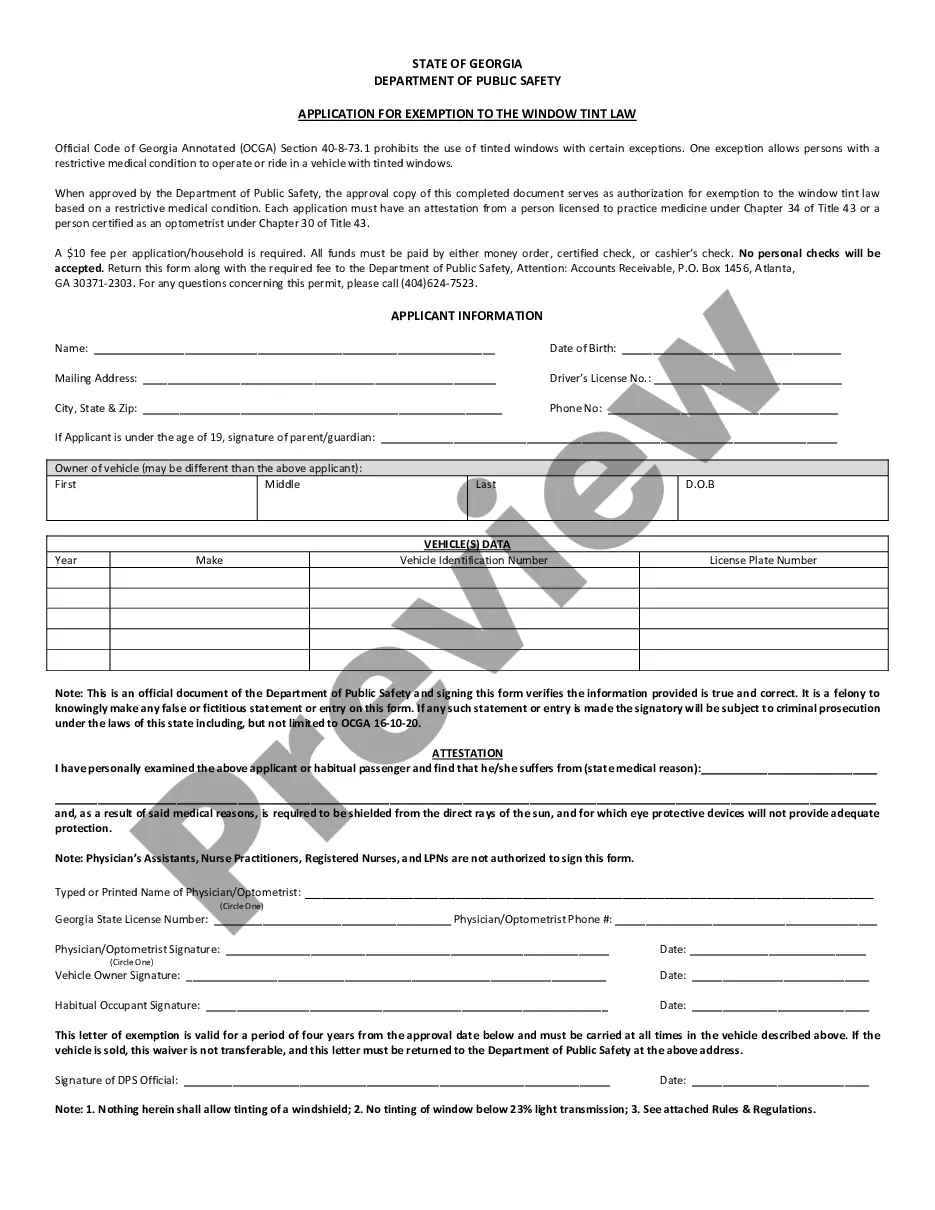

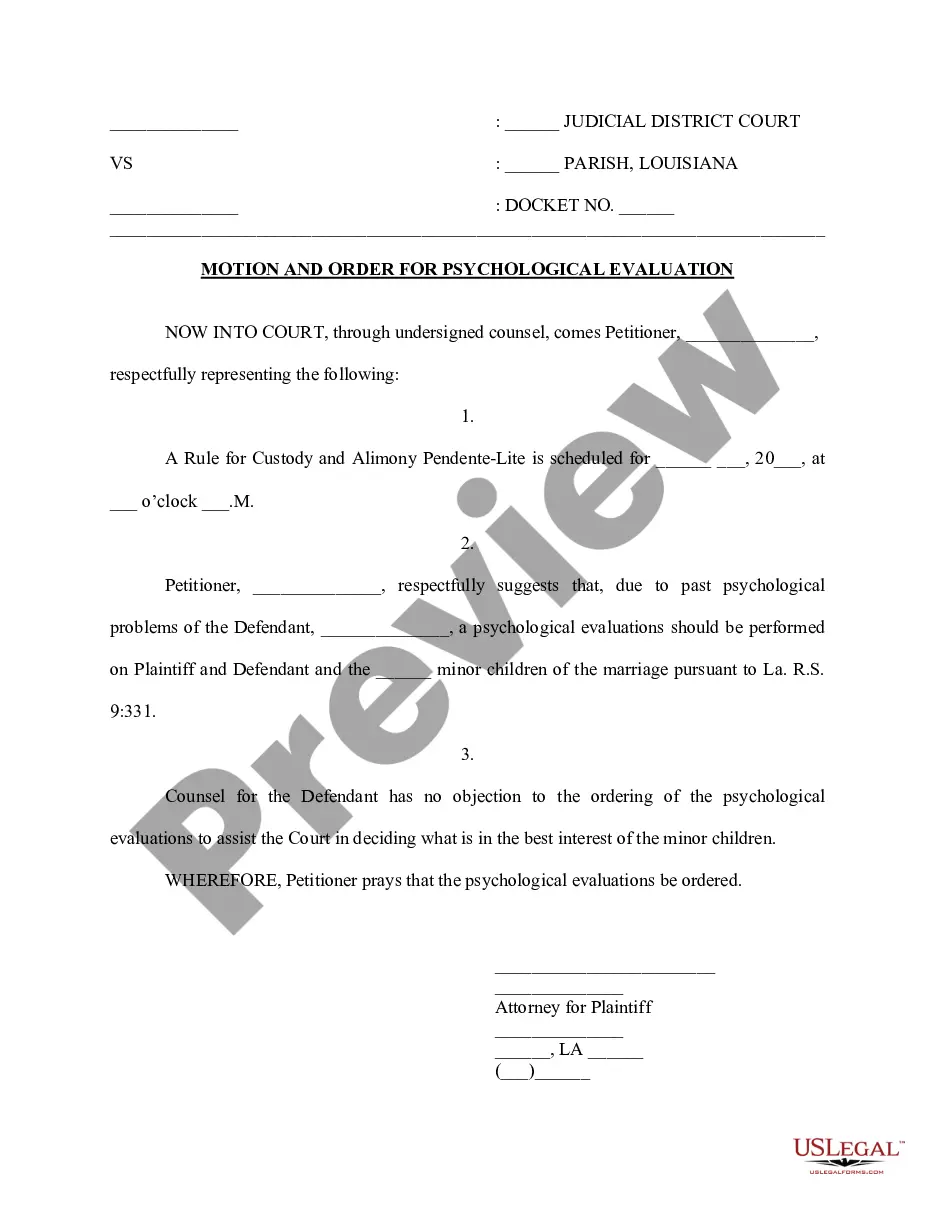

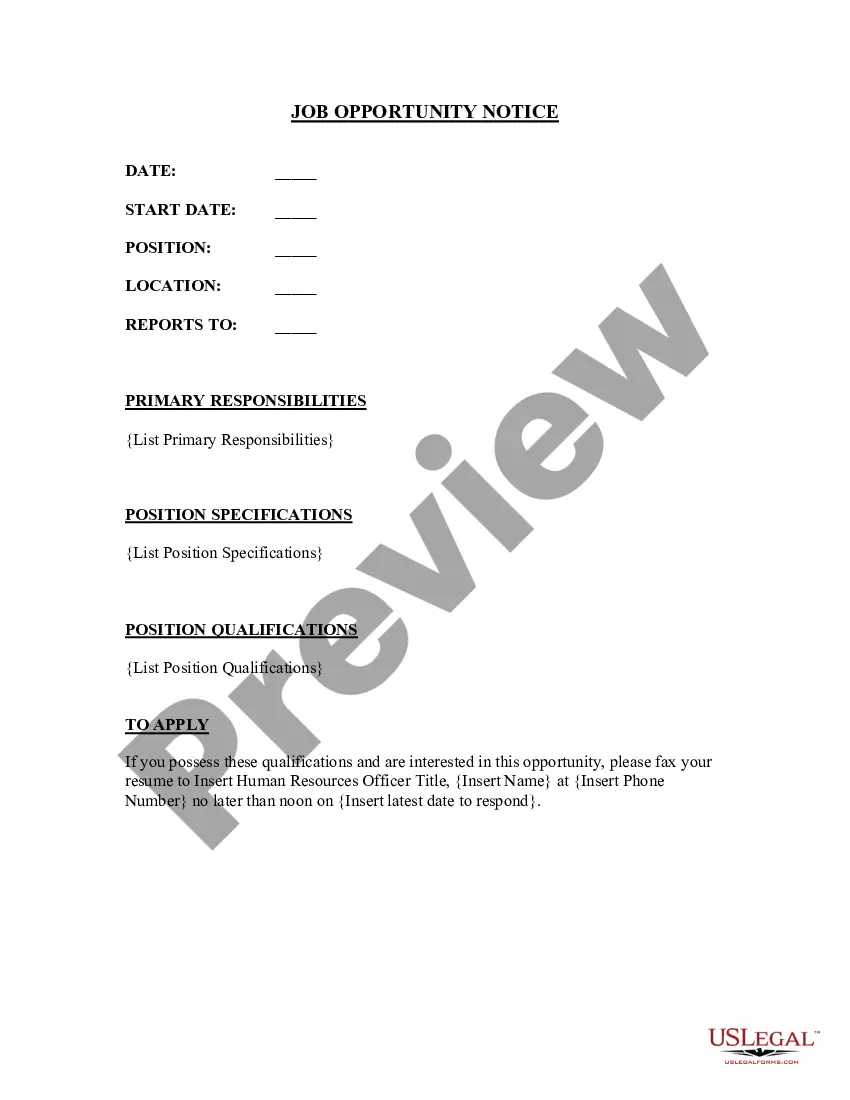

How to fill out Domestic Partnership Dependent Certification Form?

US Legal Forms - one of the largest collections of legal templates in the United States - offers an extensive array of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, sorted by categories, states, or keywords.

You can obtain the most recent versions of forms such as the Idaho Domestic Partnership Dependent Certification Form in just moments.

If the form does not meet your requirements, use the Search box at the top of the page to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking on the Acquire now button. Then, choose your preferred payment plan and provide your details to register for the account.

- If you already have a subscription, Log In and retrieve the Idaho Domestic Partnership Dependent Certification Form from the US Legal Forms library.

- The Download button will be available on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your jurisdiction/county.

- Click the Review button to check the form’s content.

Form popularity

FAQ

A domestic partnership is a legal relationship between two individuals who live together and share a common domestic life, but are not married (to each other or to anyone else). People in domestic partnerships receive benefits that guarantee right of survivorship, hospital visitation, and others.

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

To qualify as a dependent, your partner must receive more than half of his or her support from you. If your partner is a dependent, you might also be eligible for other favorable tax treatment. If you think that your partner might be your dependent under federal law, consult a tax professional.

In addition, joint filers are eligible to take a standard deduction that's double that of a single taxpayer. However, since the IRS only allows a couple to file a joint tax return if the state they reside in recognizes the relationship as a legal marriage; unmarried couples are never eligible to file joint returns.

The IRS doesn't recognize domestic partners or civil unions as a marriage. This means that on your federal return, you should file as single, head of household, or qualifying widow(er).

You must have paid more than half of your partner's living expenses during the calendar year for which you want to claim that person as a dependent. When calculating the total amount of support, you must include money received from: You and other people.

Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes.

Domestic partners file separate federal tax returnsCalifornia domestic partners file as individuals for federal filing, however, under California law, the state return must be filed as a married return. This requires the creation of a mock federal return that reflects joint-filing status.

Registered domestic partners may not file a federal return using a married filing separately or jointly filing status. Registered domestic partners are not married under state law. Therefore, these taxpayers are not married for federal tax purposes.