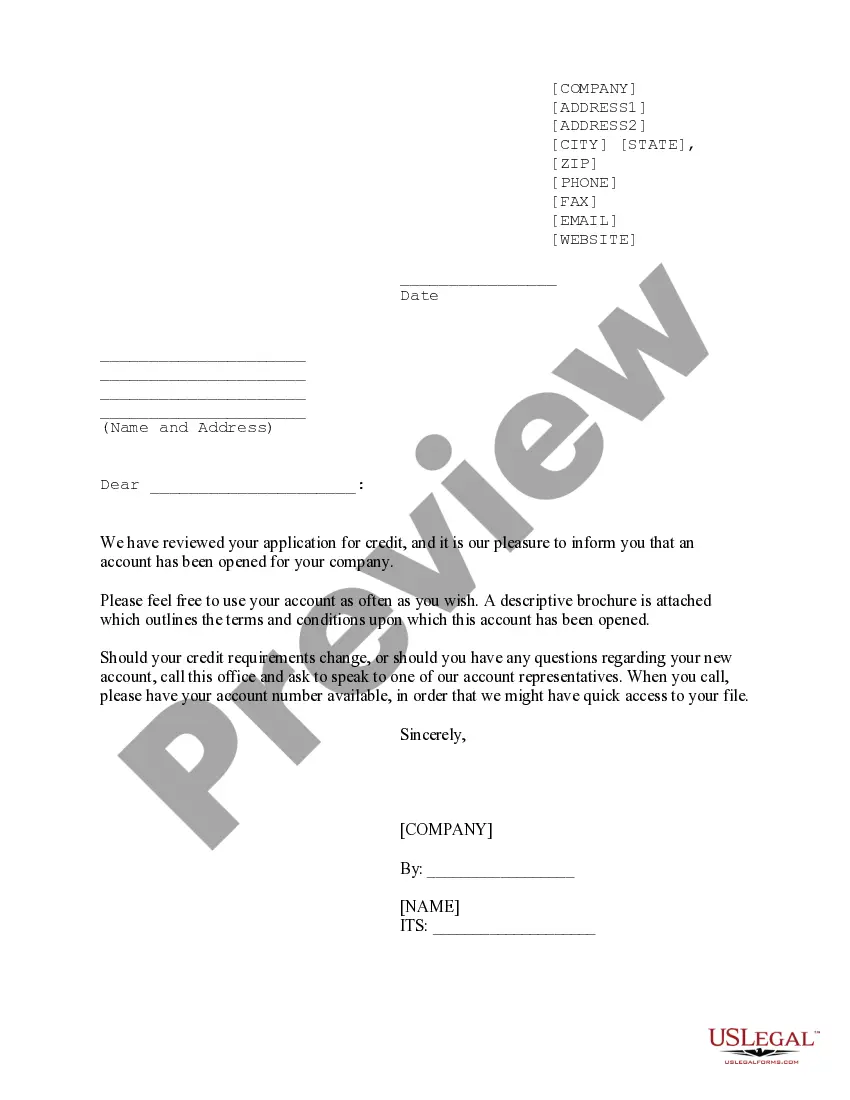

Idaho Credit Approval Form

Description

How to fill out Credit Approval Form?

Locating the appropriate legal documents web template can be quite challenging. It's worth mentioning that numerous templates are accessible online, but how can you obtain the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Idaho Credit Approval Form, suitable for both business and personal purposes. All forms are reviewed by professionals and adhere to state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to acquire the Idaho Credit Approval Form. Use your account to review the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the documents you need.

Select the file format and download the legal documents template to your device. Complete, modify, and print, then sign the acquired Idaho Credit Approval Form. US Legal Forms is the largest collection of legal documents where you can find various paper templates. Leverage this service to obtain professionally crafted paperwork that complies with state requirements.

- First, confirm that you have selected the correct form for your specific city/region.

- You can examine the form using the Review option and read the form description to ensure it is appropriate for you.

- If the form does not meet your needs, utilize the Search field to find the correct form.

- Once you are certain that the form is suitable, click on the Buy now option to acquire the form.

- Choose the pricing plan that you prefer and input the required information.

- Create your account and complete the payment process using your PayPal account or credit card.

Form popularity

FAQ

A credit application form is a document used to assess a potential borrower's creditworthiness. It collects personal and financial information that lenders require to make informed decisions. This form may ask for details regarding income, assets, and previous credit history. The Idaho Credit Approval Form serves as a critical tool in this evaluation process, ensuring that your financial background is thoroughly reviewed.

You don't have to withhold Idaho income tax in any of the following situations: The employee isn't a resident of Idaho and earns less than $1,000 in Idaho in a calendar year. You employ an agricultural laborer who earns less than $1,000 in a calendar year.

Electronic Filing Mandate Idaho does not currently mandate electronic filing for individual returns. Individual income tax returns can be e-filed or filed by mail to the address below.

The taxpayer authorizes the ERO to enter or generate the taxpayer's personal identification number (PIN) on his or her e-filed individual income tax return.

Claim allowances for you or your spouse.If you're married filing jointly, only one of you should claim the allowances. The other should claim zero allowances. If you work for more than one employer at the same time, you should claim zero allowances on your W-4 with any employer other than your principal employer.

You must e-file if you file 11 or more individual federal returns per calendar year, and you must have an IRS-issued EFIN in order to e-file. (An EFIN designates you as an authorized e-file provider.) To apply for an EFIN, use the IRS' e-Services - Online Tools for Tax Professionals.

Form 910. Monthly filers: You must file Form 910 monthly if you're in one of these situations: You withhold less than $25,000 a month and more than $750 a quarter. You have only one monthly pay period.

Form ID K-1 Partner's, Shareholder's, or Beneficiary's Share of Idaho Adjustments, Credits, Etc. is used to provide the partner, shareholder, or beneficiary of a pass-through entity with information required to complete the pass-through owner's Idaho income tax return.

Form 967. Send Form 967 to us once a year. On it, you report the taxable wages and reconcile the total amount of Idaho taxes you withheld during the calendar year to the amount you paid us during the same year.

As an employer, you're responsible for paying SUI (remember, if you pay your state SUI in full and on time, you get a 90% tax credit on FUTA). Idaho's SUI rates range from 0.24% to 5.4%. The taxable wage base in 2022 is $46,500 for each employee. New employers pay 0.97% for at least the first six quarters.