Idaho Balance Sheet Deposits

Description

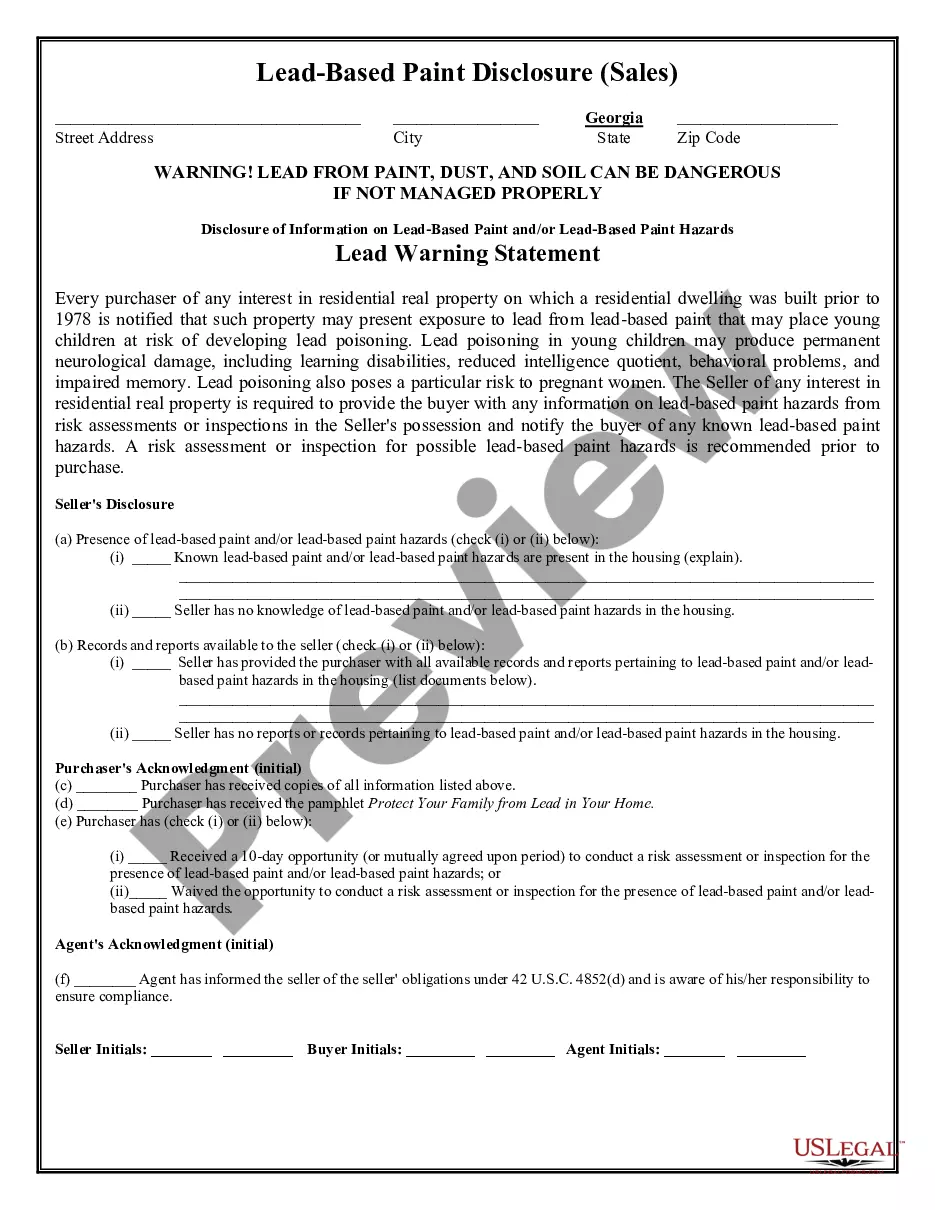

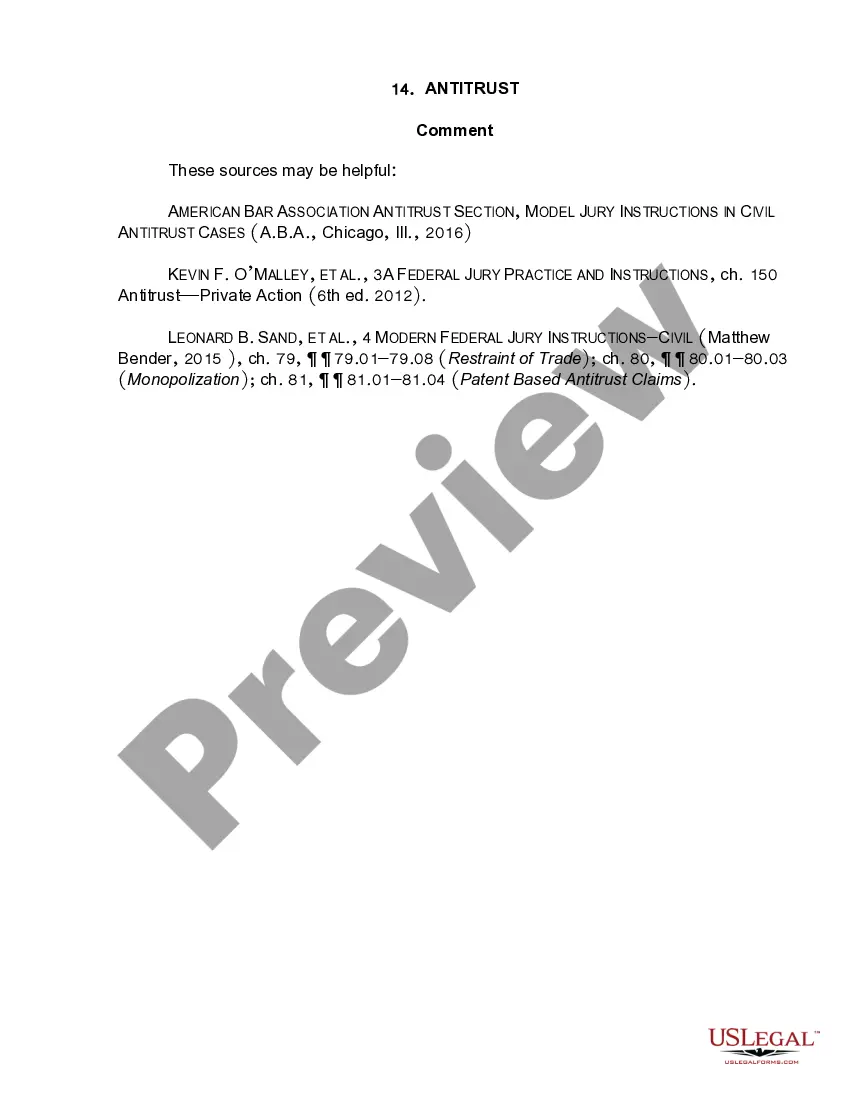

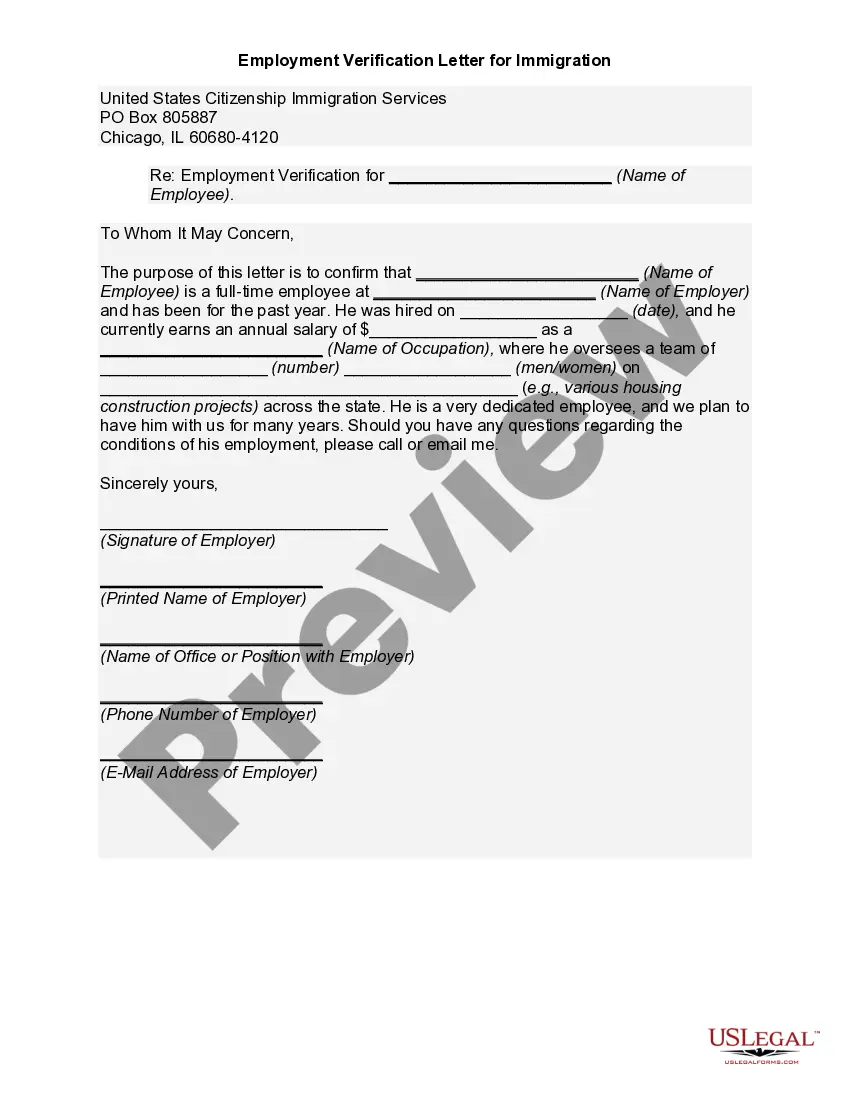

How to fill out Balance Sheet Deposits?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides an extensive selection of legal form templates that you can download or print.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Idaho Balance Sheet Deposits in seconds.

Read the form description to confirm that you have selected the correct form.

If the form doesn't meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and download Idaho Balance Sheet Deposits from the US Legal Forms catalog.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms within the My documents tab of your account.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have chosen the correct form for your city/county.

- Click the Preview button to review the content of the form.

Form popularity

FAQ

In the context of balance sheets, a deposit is typically classified as an asset. This is because deposits represent funds that a company can access, which increases its financial resources. Specifically, Idaho Balance Sheet Deposits are essential for understanding how these funds fit into the larger financial picture of a business. Therefore, managing deposits carefully can provide clarity on overall financial health.

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited. When someone opens a bank account and makes a cash deposit, he surrenders the legal title to the cash, and it becomes an asset of the bank.

The items which are generally present in all the Balance sheet includes Assets like Cash, inventory, accounts receivable, investments, prepaid expenses, and fixed assets; liabilities like long-term debt, short-term debt, Accounts payable, Allowance for the Doubtful Accounts, accrued and liabilities taxes payable; and

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

A bank's balance sheet is different from that of a typical company. You won't find inventory, accounts receivable, or accounts payable. Instead, under assets, you'll see mostly loans and investments, and on the liabilities side, you'll see deposits and borrowings.

Deposits as Assets When a business places a security deposit that is, it gives someone else money to hold against possible future charges the deposit is listed as an asset on its balance sheet.

Cash and cash equivalents under the current assets section of a balance sheet represent the amount of money the company has in the bank, whether in the form of cash, savings bonds, certificates of deposit, or money invested in money market funds. It tells you how much money is available to the business immediately.

Off-balance-sheet items are contingent assets or liabilities such as unused commitments, letters of credit, and derivatives. These items may expose institutions to credit risk, liquidity risk, or counterparty risk, which is not reflected on the sector's balance sheet reported on table L.

However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

If a party takes out a loan, they receive cash, which is a current asset, but the loan amount is also added as a liability on the balance sheet. If a party issues a loan that will be repaid within one year, it may be a current asset.