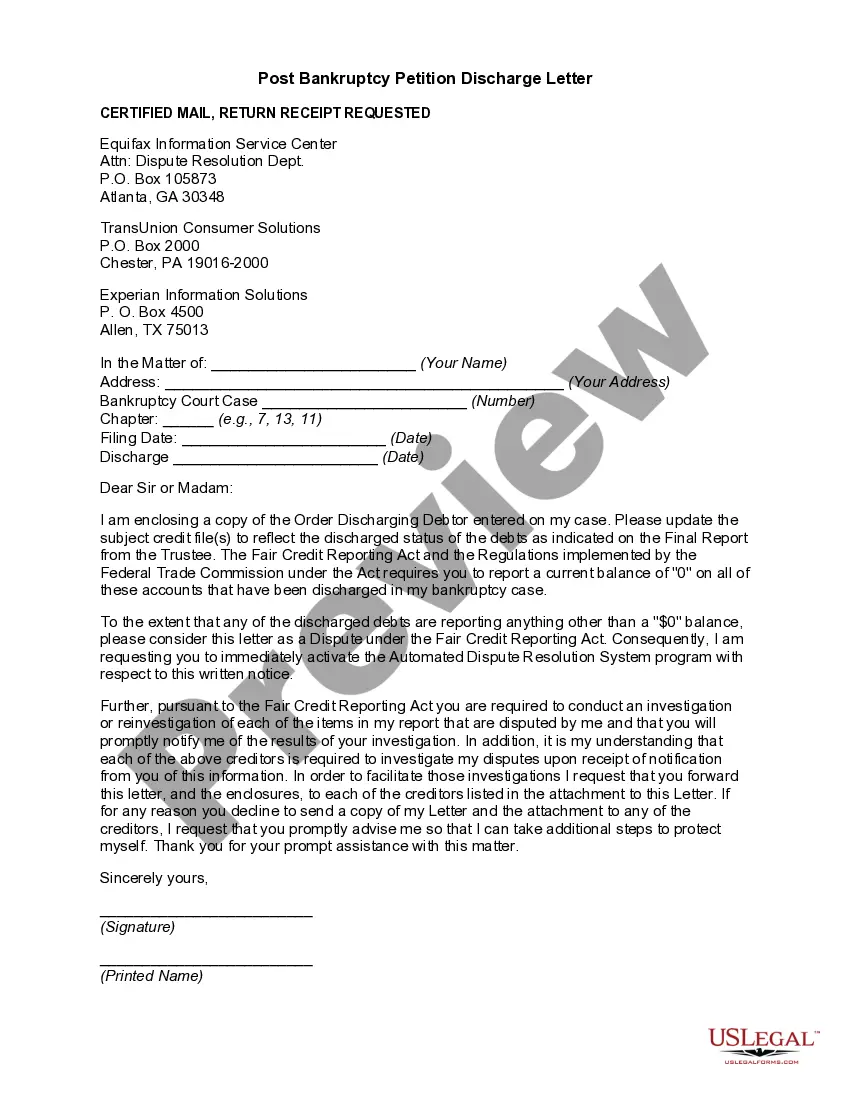

Idaho Sample Letter regarding Discharge of Debtor

Description

How to fill out Sample Letter Regarding Discharge Of Debtor?

Finding the right legitimate record format could be a have a problem. Needless to say, there are a lot of web templates accessible on the Internet, but how would you discover the legitimate kind you will need? Use the US Legal Forms site. The services provides a huge number of web templates, like the Idaho Sample Letter regarding Discharge of Debtor, that can be used for company and private demands. Every one of the types are checked by professionals and satisfy federal and state needs.

In case you are presently registered, log in in your account and click the Acquire button to get the Idaho Sample Letter regarding Discharge of Debtor. Use your account to appear from the legitimate types you might have purchased formerly. Check out the My Forms tab of your respective account and get an additional backup of your record you will need.

In case you are a whole new customer of US Legal Forms, allow me to share basic directions that you can adhere to:

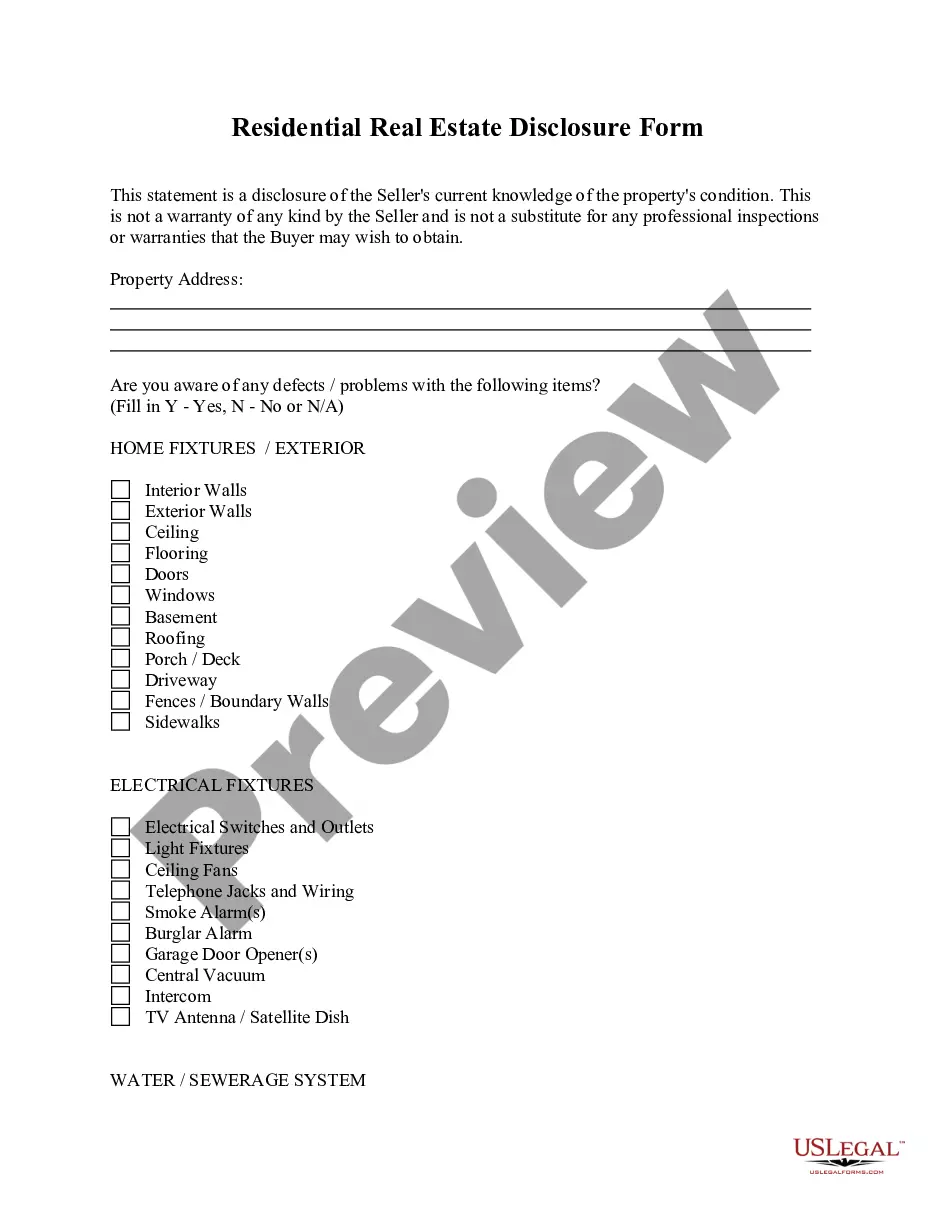

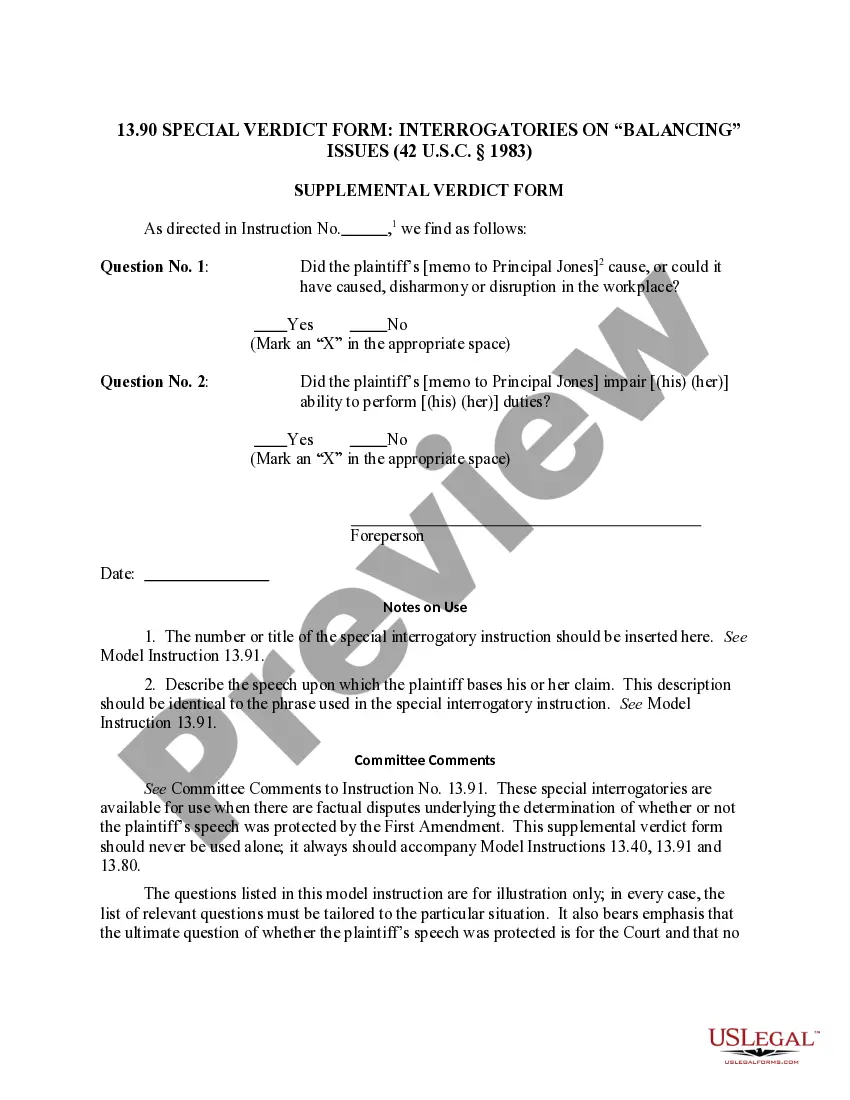

- Very first, make sure you have chosen the appropriate kind to your area/region. You can look through the shape while using Review button and study the shape outline to make certain this is the right one for you.

- If the kind does not satisfy your needs, take advantage of the Seach field to discover the correct kind.

- When you are certain that the shape is suitable, click on the Purchase now button to get the kind.

- Pick the costs plan you would like and type in the essential info. Design your account and pay for the transaction utilizing your PayPal account or bank card.

- Select the data file format and obtain the legitimate record format in your system.

- Full, modify and print out and signal the obtained Idaho Sample Letter regarding Discharge of Debtor.

US Legal Forms is the most significant local library of legitimate types that you can find numerous record web templates. Use the service to obtain professionally-produced papers that adhere to express needs.

Form popularity

FAQ

From filing to discharge (wiping out debts), Chapter 7 bankruptcy cases typically take 4-6 months. As far as personal bankruptcies go, Chapter 7 is the fastest. By comparison, Chapter 13 can take up to five years because a repayment plan is involved.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

Generally, a discharge removes the debtors' personal liability for debts owed before the debtors' bankruptcy case was filed. Also, if this case began under a different chapter of the Bankruptcy Code and was later converted to chapter 7, debts owed before the conversion are discharged.

May the debtor pay a discharged debt after the bankruptcy case has been concluded? A debtor who has received a discharge may voluntarily repay any discharged debt. A debtor may repay a discharged debt even though it can no longer be legally enforced.

The Process of a Debt Discharge The bankruptcy court will look at your plan and decide whether it is fair and in ance with the law. You will also need to work with a trustee who will distribute these payments to the creditors. The trustee will pay creditors ing to priority.

Courts can issue a discharge ruling when the debtor meets the discharge requirements under Chapter 7 or Chapter 11 of federal bankruptcy law, or the ruling is based on a debt canceling. A canceling of debt happens when the lender agrees that the rest of the debt is forgiven.

People who file for personal bankruptcy get a discharge ? a court order that says they don't have to repay certain debts. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

An individual receives a discharge for most of his or her debts in a chapter 7 bankruptcy case. A creditor may no longer initiate or continue any legal or other action against the debtor to collect a discharged debt. But not all of an individual's debts are discharged in chapter 7.