Idaho Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a wide array of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Idaho Assignment of LLC Company Interest to Living Trust in just moments.

If you already have an account, Log In to download the Idaho Assignment of LLC Company Interest to Living Trust from the US Legal Forms database. The Download button will be displayed on every form you view. All previously downloaded forms are accessible in the My documents section of your account.

Make adjustments. Complete, modify, print, and sign the downloaded Idaho Assignment of LLC Company Interest to Living Trust.

Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Access the Idaho Assignment of LLC Company Interest to Living Trust with US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure that you have chosen the correct form for your city/state.

- Click the Review button to examine the form's details. Refer to the form overview to confirm that you've selected the right form.

- If the form does not fit your requirements, utilize the Search bar at the top of the screen to find the one that does.

- If you are happy with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your credentials to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

Removing a member from an LLC in Idaho requires following the terms outlined in your operating agreement. If your agreement does not specify a process, you may need a unanimous decision from remaining members. It’s also good practice to document the removal and update any related documents, which may include considerations for an Idaho Assignment of LLC Company Interest to Living Trust.

If the membership interests are securities, then you perfect by taking possession or control of the securities or both. If the membership interests are certificated, then you perfect by taking possession of the certificates and by taking control by having the security interest noted in the company's records.

What should an LLC operating agreement include?The legal name of the company.Any fictitious business names or DBAs.The company address.Name and address of your registered agent (who accepts legal service of process on your behalf.) Every LLC must have a registered agent under state law.

Some LLC Operating Agreements will also contain what are called Classes of Interests or Membership Interests. It's important to understand these terms before filing your LLC's Operating Agreement, as they will likely have profound consequences on ownership structure and members' rights.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

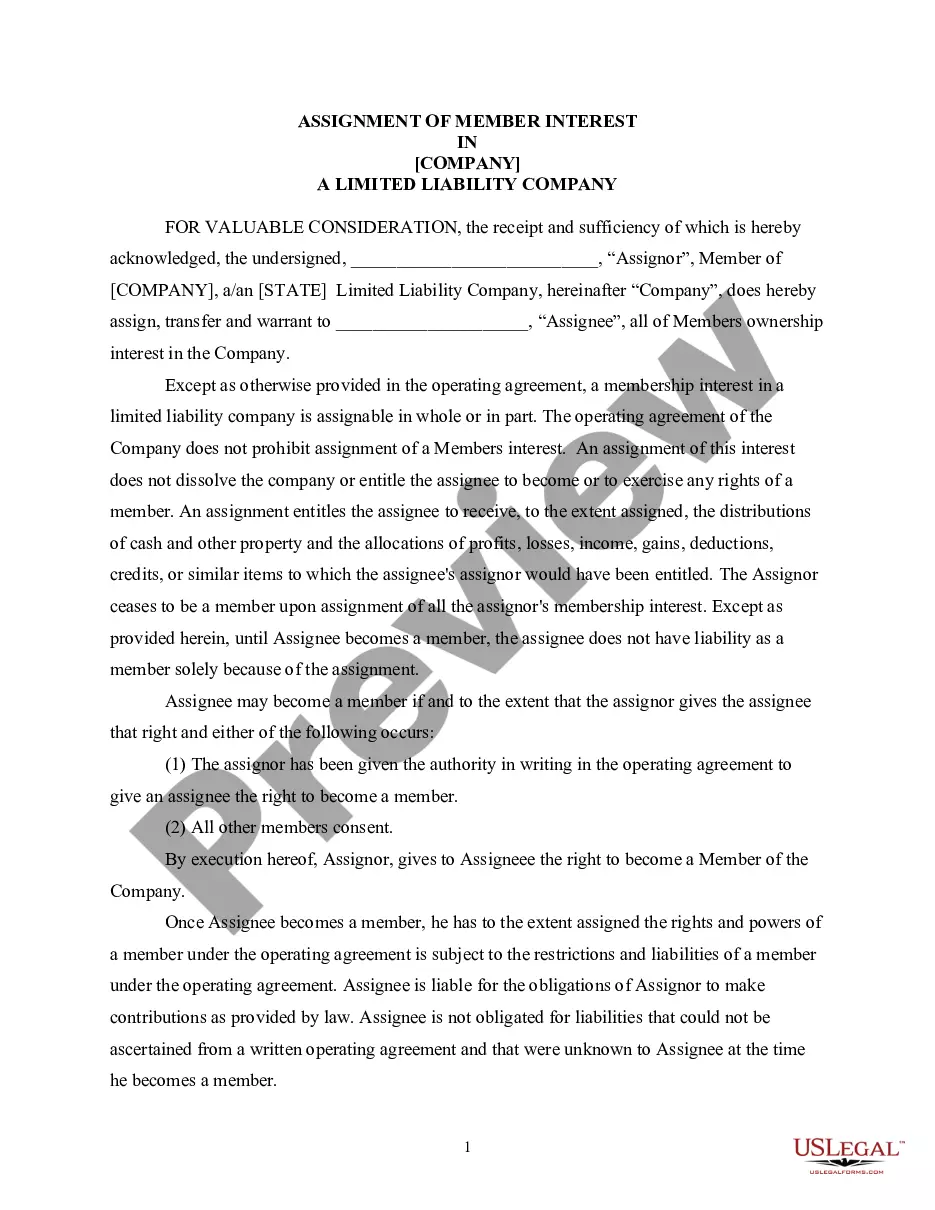

A transferable interest is defined in the New Act as The right, as initially owned by a person in the person's capacity as a member, to receive distributions from a limited liability company, whether or not the person remains a member or continues to own any part of the right.

An LLC operating agreement is a document that customizes the terms of a limited liability company according to the specific needs of its members. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation.

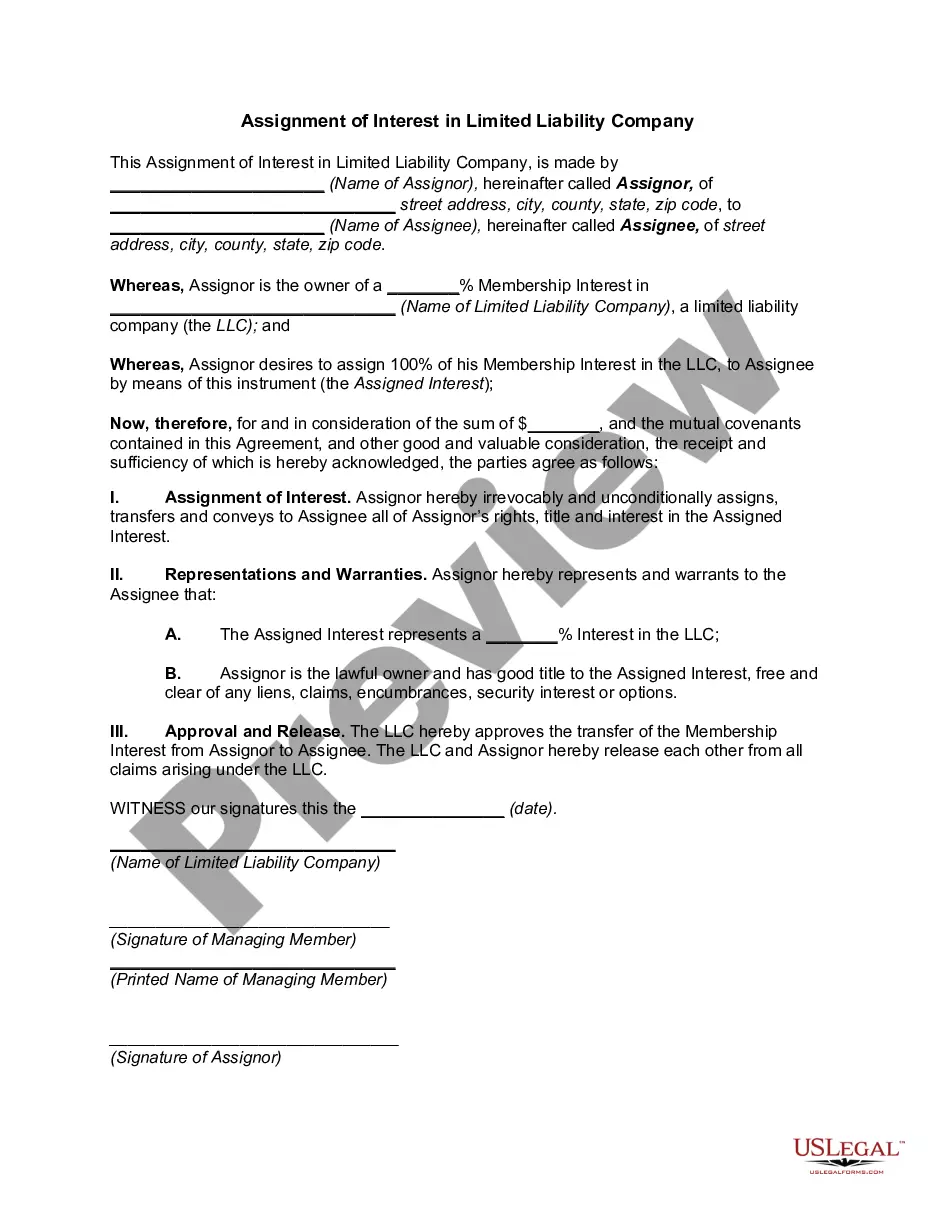

The member (assignor) and the person assigned (assignee) sign a document called the Membership Assignment of Interest....The Membership Interest Assignment DocumentPercentage of interest that will go to the assignee.Whether the assignee will have voting rights.The signatures of the assignor and the assignee.

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other