Idaho Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership

Description

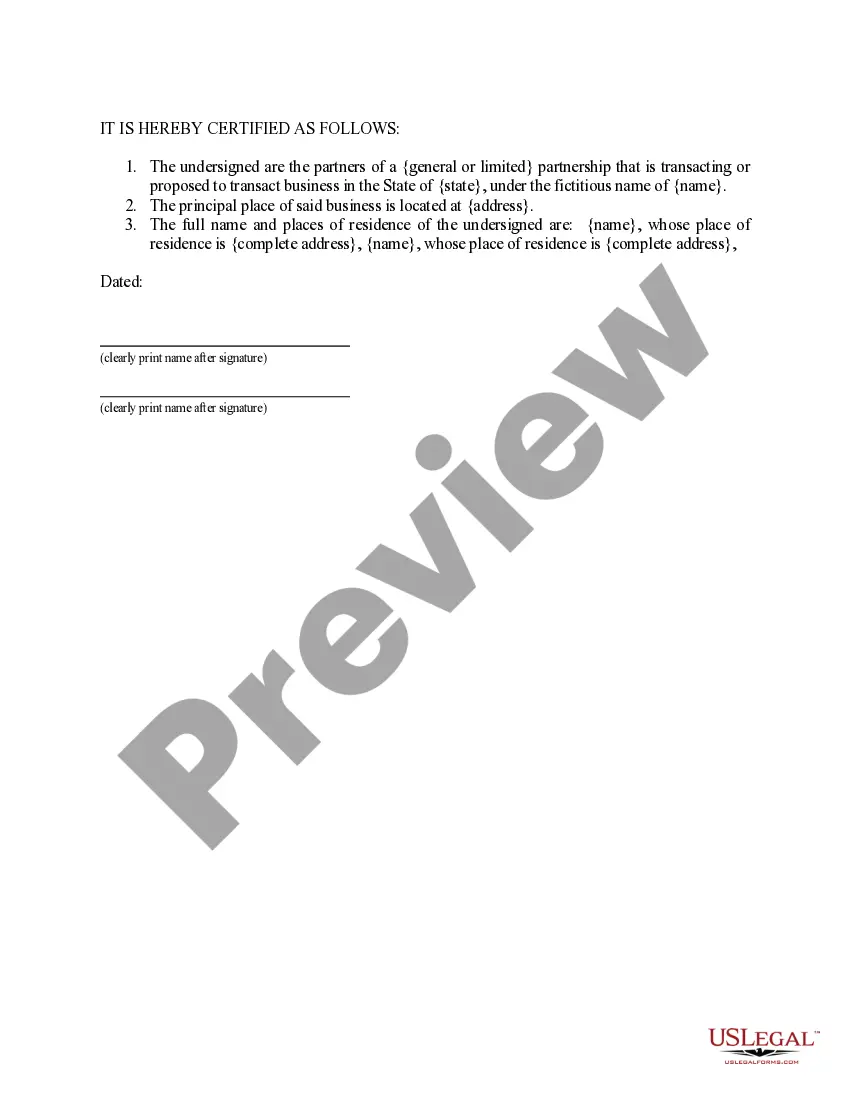

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

US Legal Forms - one of the largest libraries of legal varieties in the States - offers an array of legal papers web templates you can acquire or print out. Using the internet site, you can find a huge number of varieties for enterprise and person uses, sorted by categories, states, or search phrases.You will discover the latest variations of varieties like the Idaho Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership within minutes.

If you already have a registration, log in and acquire Idaho Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership from the US Legal Forms local library. The Download button will show up on every single kind you look at. You get access to all formerly acquired varieties inside the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, allow me to share straightforward guidelines to get you began:

- Make sure you have selected the best kind for your area/state. Select the Review button to analyze the form`s content material. Browse the kind description to actually have selected the appropriate kind.

- In the event the kind doesn`t suit your needs, take advantage of the Lookup area at the top of the monitor to find the one which does.

- If you are content with the shape, confirm your option by clicking on the Buy now button. Then, select the costs plan you prefer and supply your references to register for the accounts.

- Method the purchase. Use your bank card or PayPal accounts to accomplish the purchase.

- Select the formatting and acquire the shape on your system.

- Make alterations. Complete, modify and print out and signal the acquired Idaho Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership.

Every single format you added to your money does not have an expiry date and it is your own eternally. So, if you wish to acquire or print out another backup, just check out the My Forms section and click on in the kind you want.

Gain access to the Idaho Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership with US Legal Forms, the most considerable local library of legal papers web templates. Use a huge number of skilled and express-specific web templates that meet your small business or person demands and needs.

Form popularity

FAQ

Where can I find information on Idaho business licenses? Business license information can be found on the business.Idaho.gov website.

The cost to start an Idaho LLC is $100 for online filings, and $120 for paper filings.

A fictitious name is any assumed name, style or designation other than the proper name of the entity using such name. The term fictitious name includes a name assumed by a general partnership.

?? Any person who proposes to or intends to transact business in Idaho under an assumed business name shall, before. beginning to transact business, file with the secretary of state a certificate of assumed business name?.? What is the difference between a DBA and an ABN? None.

The Limited Liability Company (LLC) has some of the characteristics of a sole proprietorship, some of a partnership, and some of a corporation. An LLC may, for tax purposes, be disregarded, be taxed like a partnership or taxed like a corporation (Idaho Code 63-3006A). The LLC has members rather than shareholders.

The EIN can be obtained by calling (800) 829-4933 or by visiting the IRS website at . If you are interested in attending a Business Basics class in your area, sign up today at .