Idaho Sample Letter for Corporation Taxes

Description

How to fill out Sample Letter For Corporation Taxes?

You are able to devote hrs on-line looking for the authorized papers design which fits the federal and state needs you want. US Legal Forms supplies 1000s of authorized types which are reviewed by pros. You can actually acquire or printing the Idaho Sample Letter for Corporation Taxes from the support.

If you already have a US Legal Forms accounts, you may log in and click the Acquire key. Afterward, you may complete, edit, printing, or indicator the Idaho Sample Letter for Corporation Taxes. Every single authorized papers design you acquire is your own eternally. To get another backup of any purchased form, proceed to the My Forms tab and click the related key.

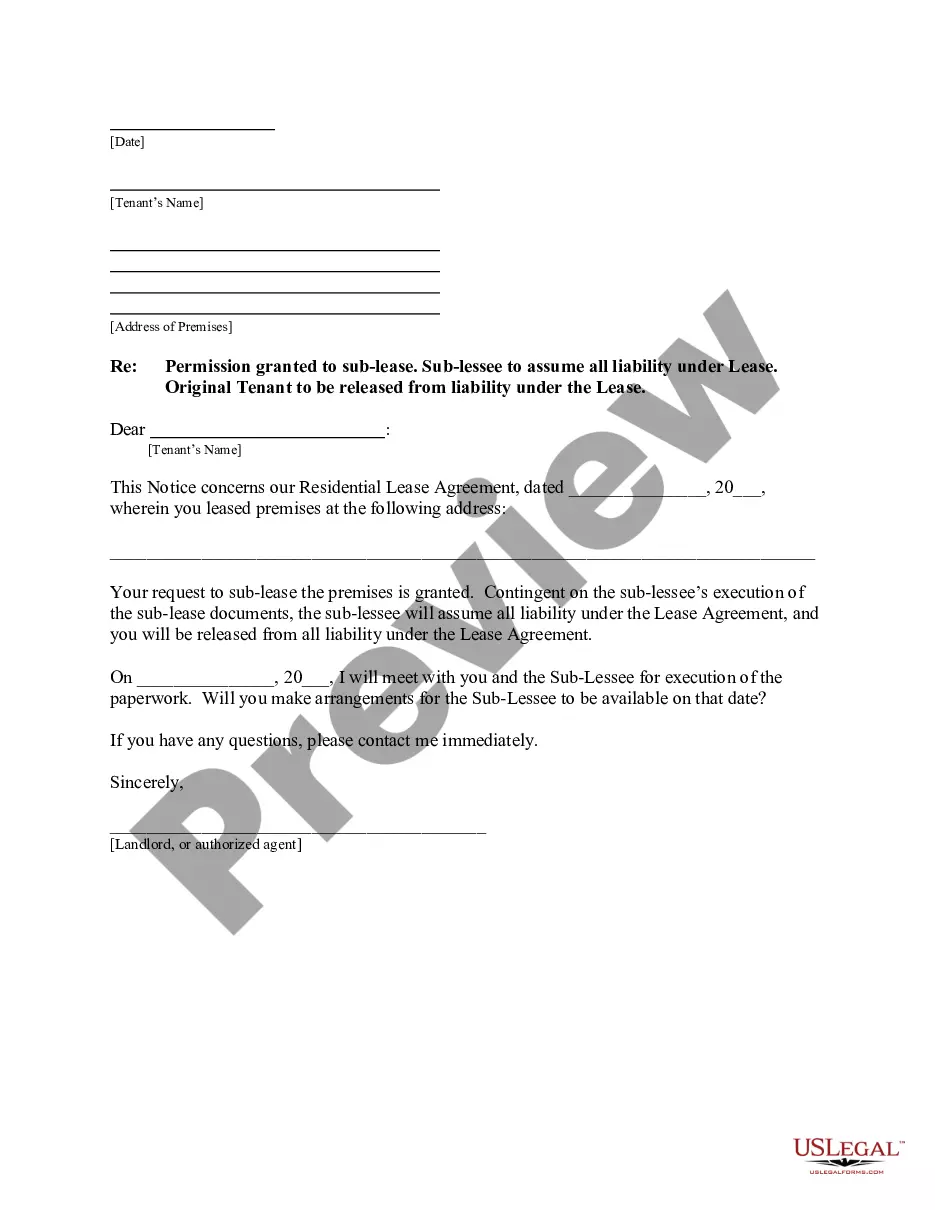

If you work with the US Legal Forms web site initially, keep to the simple recommendations below:

- Initially, ensure that you have chosen the proper papers design for that county/city of your liking. See the form explanation to make sure you have selected the appropriate form. If accessible, take advantage of the Preview key to check from the papers design too.

- If you wish to discover another variation from the form, take advantage of the Research discipline to find the design that meets your requirements and needs.

- After you have found the design you want, click Acquire now to carry on.

- Select the pricing program you want, type in your references, and register for your account on US Legal Forms.

- Total the financial transaction. You can use your bank card or PayPal accounts to cover the authorized form.

- Select the format from the papers and acquire it to your product.

- Make changes to your papers if required. You are able to complete, edit and indicator and printing Idaho Sample Letter for Corporation Taxes.

Acquire and printing 1000s of papers layouts using the US Legal Forms web site, that offers the largest assortment of authorized types. Use professional and state-distinct layouts to deal with your company or personal demands.

Form popularity

FAQ

We'll continue to process payments throughout 2022 and early 2023 as taxpayers file their returns and become eligible for the rebate. We've already issued the majority of the first 2022 rebate payments, but we continue to send more as taxpayers file their returns and become eligible.

Form 42 is used to show the total for the unitary group. A schedule must be attached detailing the Idaho apportionment factor computation for each corporation in the group.

The Tax Commission might need to verify your identity. This helps safeguard your information and keeps your refund from going to criminals. You could receive one of three letters: A PIN letter that asks you to enter a personal identification number (PIN) we provided to confirm you filed the tax return we received.

All income tax returns go through fraud detection reviews and accuracy checks before we issue any refunds. We might send you letters asking for more information. Please respond quickly so we can review your information and get your refund to you as soon as possible.

You must pay Business Income Tax in Idaho if your corporation is conducting business in Idaho. The business income tax is levied on any taxable business income of a rate of 6.5 percent.

Form PTE-12 is the reconciliation schedule you include with the entity's Idaho income tax return (Form 41S, Form 65, or Form 66) as required by Idaho Code section 63-3036B. Include each owner's complete information whether the owner has Idaho distributable income or a loss.

The Gem State is giving the rebate to anyone who was a state resident for the full year of 2020 and 2021 and has filed their taxes for the same tax years. The state has been disbursing the rebates since September and intends to give all of the payments by March 2023, ing to the state's tax commission.

The Tax Commission informs taxpayers about their obligations so everyone can pay their fair share of taxes, and it must enforce Idaho's laws to ensure the fairness of the tax system with those who don't voluntarily comply.