Idaho Invoice Template for Sole Trader

Description

How to fill out Invoice Template For Sole Trader?

If you desire to completely, download, or create authentic document templates, utilize US Legal Forms, the largest compilation of legal forms available on the web.

Take advantage of the site's user-friendly and convenient search functionality to acquire the paperwork you need.

Different templates for business and personal purposes are organized by categories and regions, or keywords.

Step 5. Proceed with the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of your legal document and download it to your device. Step 7. Complete, modify, and print or sign the Idaho Invoice Template for Sole Trader. Every legal document template you acquire is yours forever. You will have access to every form you've downloaded within your account. Click the My documents section and select a form to print or download again. Stay competitive and download, and print the Idaho Invoice Template for Sole Trader with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to get the Idaho Invoice Template for Sole Trader in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Idaho Invoice Template for Sole Trader.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you are visiting US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for the correct city/state.

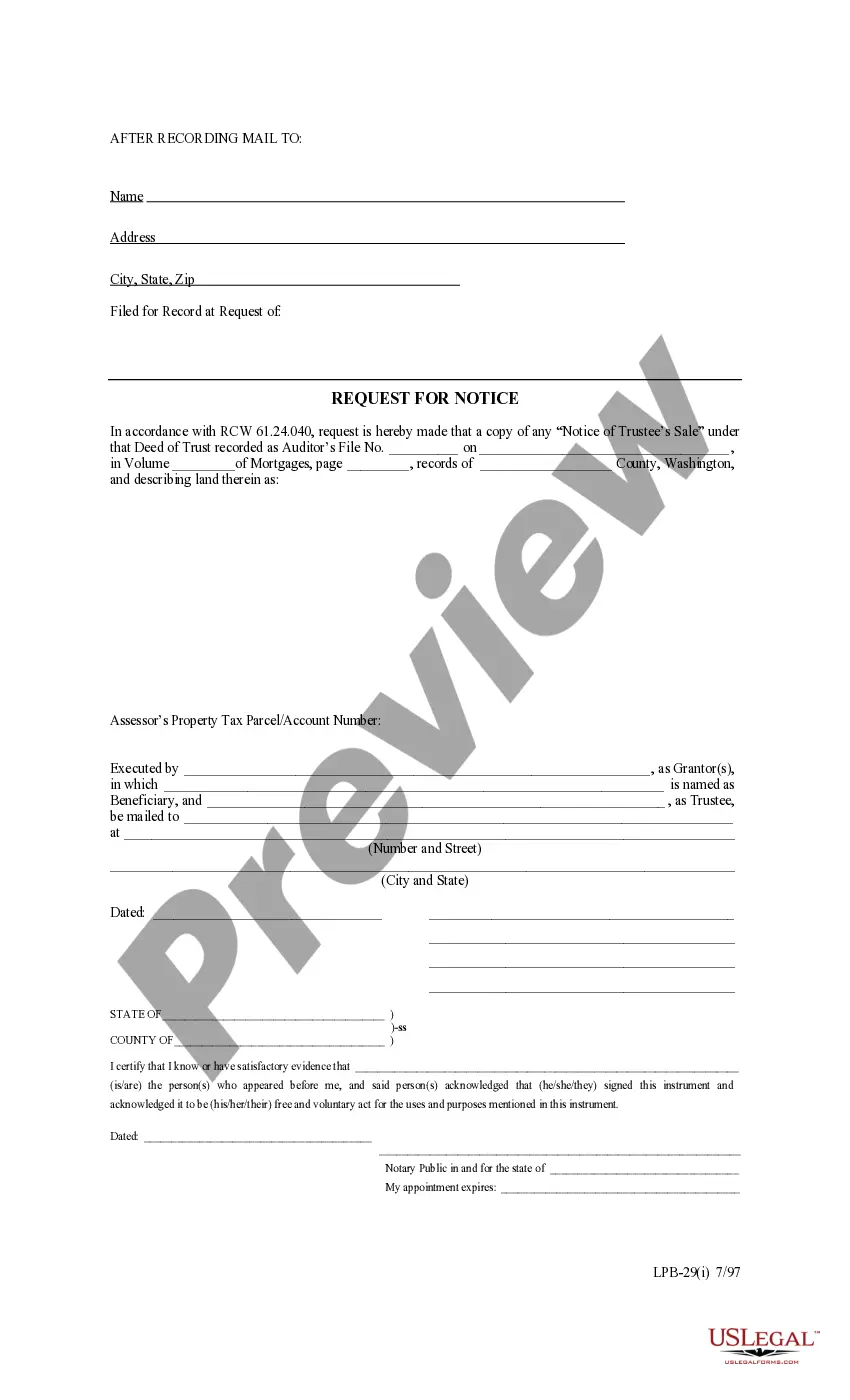

- Step 2. Use the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other types of your legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

Sending an invoice as a sole proprietor can be done easily with an Idaho Invoice Template for Sole Trader. You can either email the invoice directly to your client or print and mail a hard copy, depending on your client's preference. Many online platforms, like uslegalforms, streamline this process, making it easier to manage your invoicing efficiently. Remember to keep a copy for your records, ensuring you stay organized.

Creating an invoice for a sole trader is straightforward with an Idaho Invoice Template for Sole Trader. Begin by including your business information and the client's details. Then, list the services or products provided, along with their prices. Finally, ensure to add payment terms and your preferred payment methods for a smooth transaction.

Yes, sole traders can absolutely issue invoices. An Idaho Invoice Template for Sole Trader is an excellent tool for ensuring your invoices are clear and professional. By providing invoices, you create a record of your services or products, which simplifies accounting. You also present a more legitimate business image to your clients.

To create an invoice as a sole proprietorship, start by gathering your business details and client information. Utilize an Idaho Invoice Template for Sole Trader, which makes it easy to plug in your data and format the invoice correctly. Be sure to list your services or products, include a unique invoice number, and specify your payment terms. This approach helps you present a professional image to your clients.

Yes, you can invoice without an LLC. As a sole trader, you operate as an individual and can issue invoices directly under your name. Using an Idaho Invoice Template for Sole Trader simplifies this process, ensuring that your invoices meet legal standards without the need for an LLC. This allows you to start billing clients right away while maintaining clear records.

Creating invoices as a sole trader is straightforward. Begin by using an Idaho Invoice Template for Sole Trader, which includes all necessary elements such as your business name, address, and contact details. Clearly list the services or products provided, along with their prices and any applicable taxes. Finally, number the invoice and provide payment terms to keep everything organized and professional.

Completing an invoice for self-employed individuals involves including your contact details, the client's info, a breakdown of services, and the total amount. You should also denote the payment methods and due date clearly. To simplify your work, opting for an Idaho Invoice Template for Sole Trader makes the task easier, ensuring you capture all necessary details accurately.

Invoicing as a sole trader requires a template that captures key elements such as your business information, client details, services provided, and payment terms. Templates streamline this process by offering a structured approach to invoicing. Using an Idaho Invoice Template for Sole Trader gives you a ready-made solution to ensure clarity and professionalism in all your invoices.

To create an invoice for yourself, start by using a professional invoice template that captures essential details. You'll need your name or business name, service descriptions, prices, and payment instructions. An Idaho Invoice Template for Sole Trader offers an easy way to outline your charges clearly and ensures you have all necessary components for your records.

When invoicing as a sole trader, begin with your personal and business information header. Include customer details, a unique invoice number, and the date of service. Detail the services provided, with corresponding costs, while clearly stating payment information. An Idaho Invoice Template for Sole Trader can provide you with a straightforward, effective solution to create your invoices correctly.