Idaho Customer Invoice

Description

How to fill out Customer Invoice?

If you wish to acquire, obtain, or print authentic document templates, utilize US Legal Forms, the primary selection of legal forms available on the web.

Take advantage of the site’s straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal use are categorized by types and jurisdictions, or keywords.

Step 4. Once you’ve found the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your system.

Step 7. Fill out, modify and print or sign the Idaho Customer Invoice.

- Utilize US Legal Forms to find the Idaho Customer Invoice in just a few clicks.

- If you are a current US Legal Forms customer, Log In to your account and click the Acquire button to download the Idaho Customer Invoice.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the correct form for the relevant state/country.

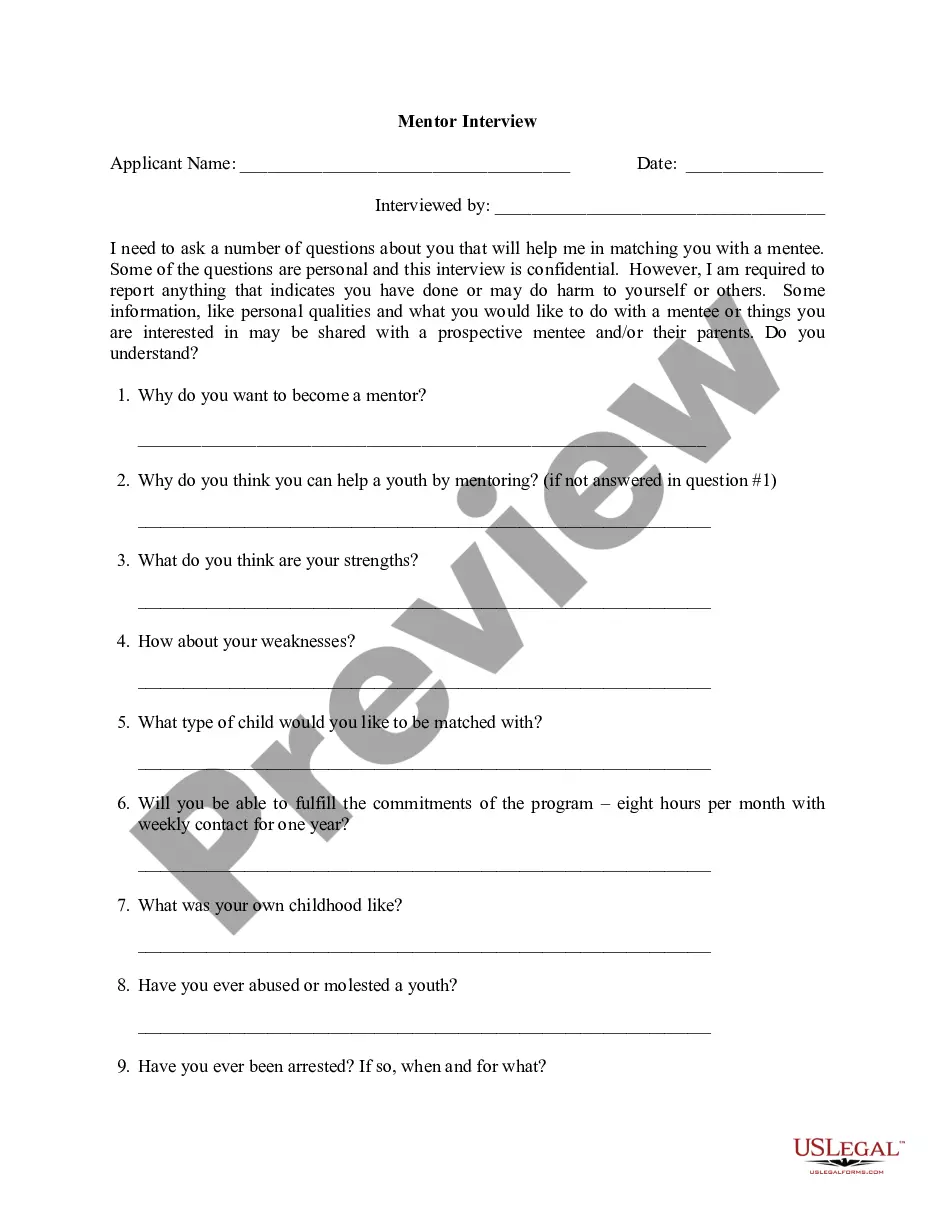

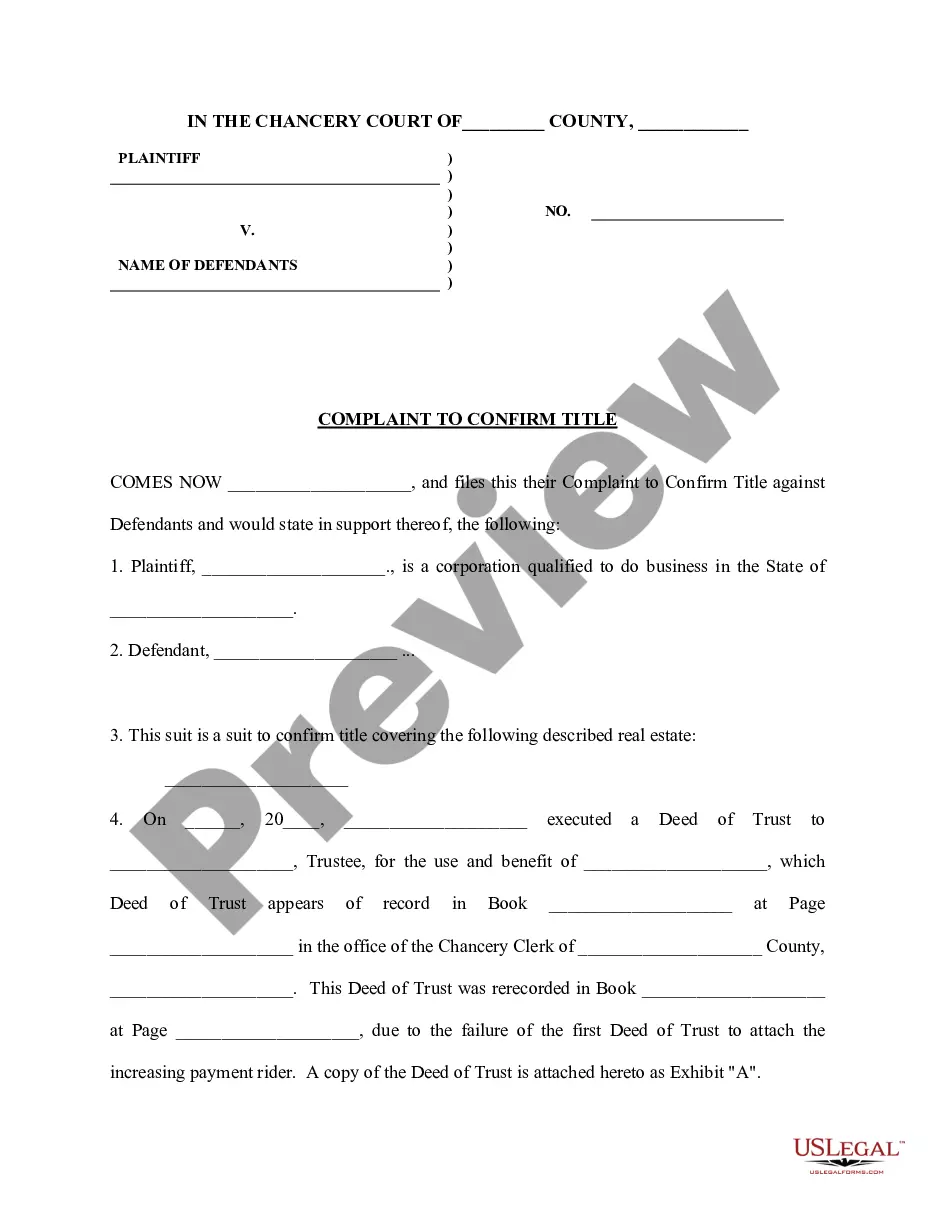

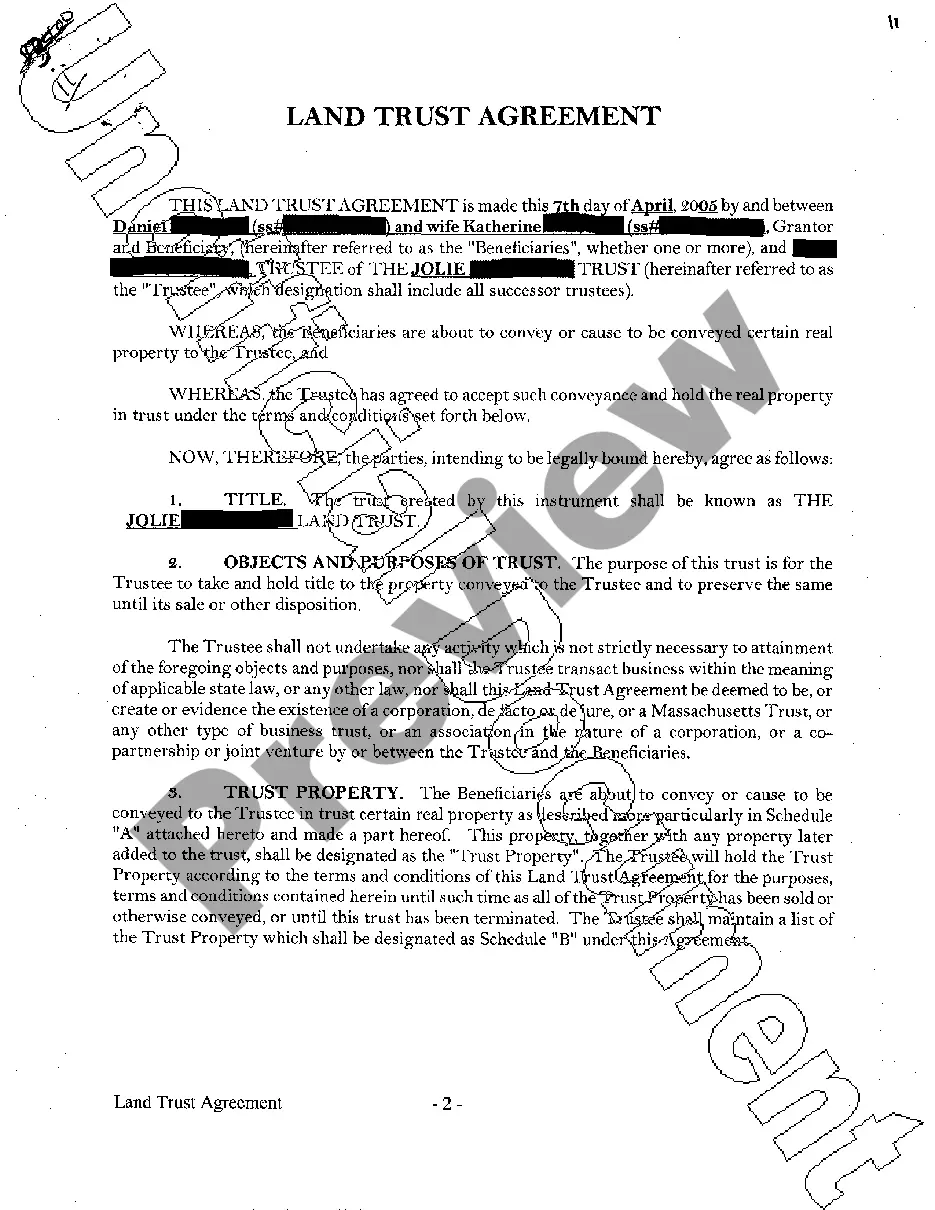

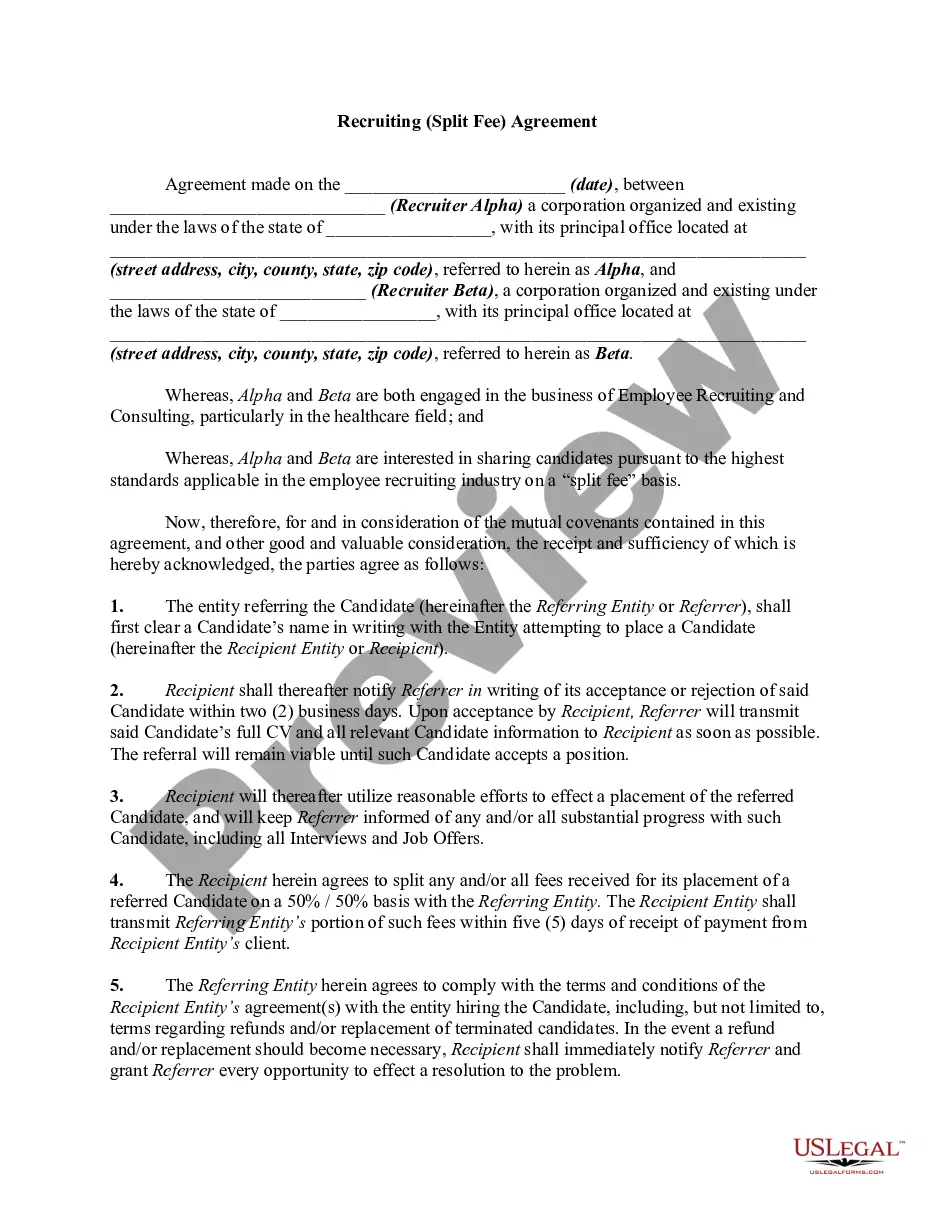

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search option at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To file Idaho sales tax, businesses must submit their sales tax returns through the Idaho State Tax Commission's online portal or via mail. The process involves detailing total sales, tax collected, and any deductions or exemptions. Utilizing a platform like uslegalforms can simplify your filing process and help maintain compliance while generating your Idaho Customer Invoice.

Idaho does not tax certain items, including most food products, medical services, and sales to non-profit organizations. Understanding what Idaho does not tax can help businesses and consumers make informed decisions. Be sure to highlight these non-taxable items on your Idaho Customer Invoice for clarity.

You should send your Idaho state tax return to the appropriate department based on your filing method. Generally, if you file by mail, it goes to the Idaho State Tax Commission. If you choose to file online, follow the instructions provided by your tax software or the state's portal for e-filing, often integrated into platforms for your convenience.

Idaho does not impose sales tax on items like most food and beverage products purchased for home use, prescription drugs, and some health care services. This non-taxable status helps residents manage their budgets more effectively. When issuing an Idaho Customer Invoice, be aware of these non-taxed items to ensure accuracy.

Sales tax exemptions in Idaho apply to specific categories such as food for home consumption, prescription drugs, and certain educational materials. Understanding these exemptions is important for both consumers and businesses. Make sure your Idaho Customer Invoice reflects any applicable exemptions to streamline transactions.

In Idaho, some items commonly fall under tax exemption, including groceries, prescription medicines, and certain agricultural supplies. These exemptions are designed to ease the financial burden on consumers. When preparing your Idaho Customer Invoice, be sure to account for these exemptions to provide accurate billing.

Yes, Idaho requires businesses to submit 1099 forms for certain payments made throughout the year. This reporting is crucial for tax purposes and helps ensure compliance with Idaho tax regulations. If your business issues payments categorized as reportable, make sure to follow the proper reporting guidelines to avoid penalties.

An ST101 is the form used in Idaho to allow buyers to make tax-exempt purchases when applicable. This form serves as a seller’s exemption certificate for tax-exempt buyers. When creating your Idaho Customer Invoice, make sure to reference the ST101 for any tax-exempt sales, ensuring compliance with Idaho tax regulations.

Any business selling goods or services in Idaho typically needs a seller permit. This permit allows you to collect sales tax from customers. If you're issuing an Idaho Customer Invoice, having a seller permit is essential to ensure your business operates legally and fulfills tax obligations.

In Idaho, the sales tax rate on vehicles is typically 6%. However, this rate can vary depending on the county. When completing any Idaho Customer Invoice for vehicle purchases, ensure that you calculate the correct sales tax to avoid complications during registration with the Department of Motor Vehicles.