Idaho Annual Expense Report

Description

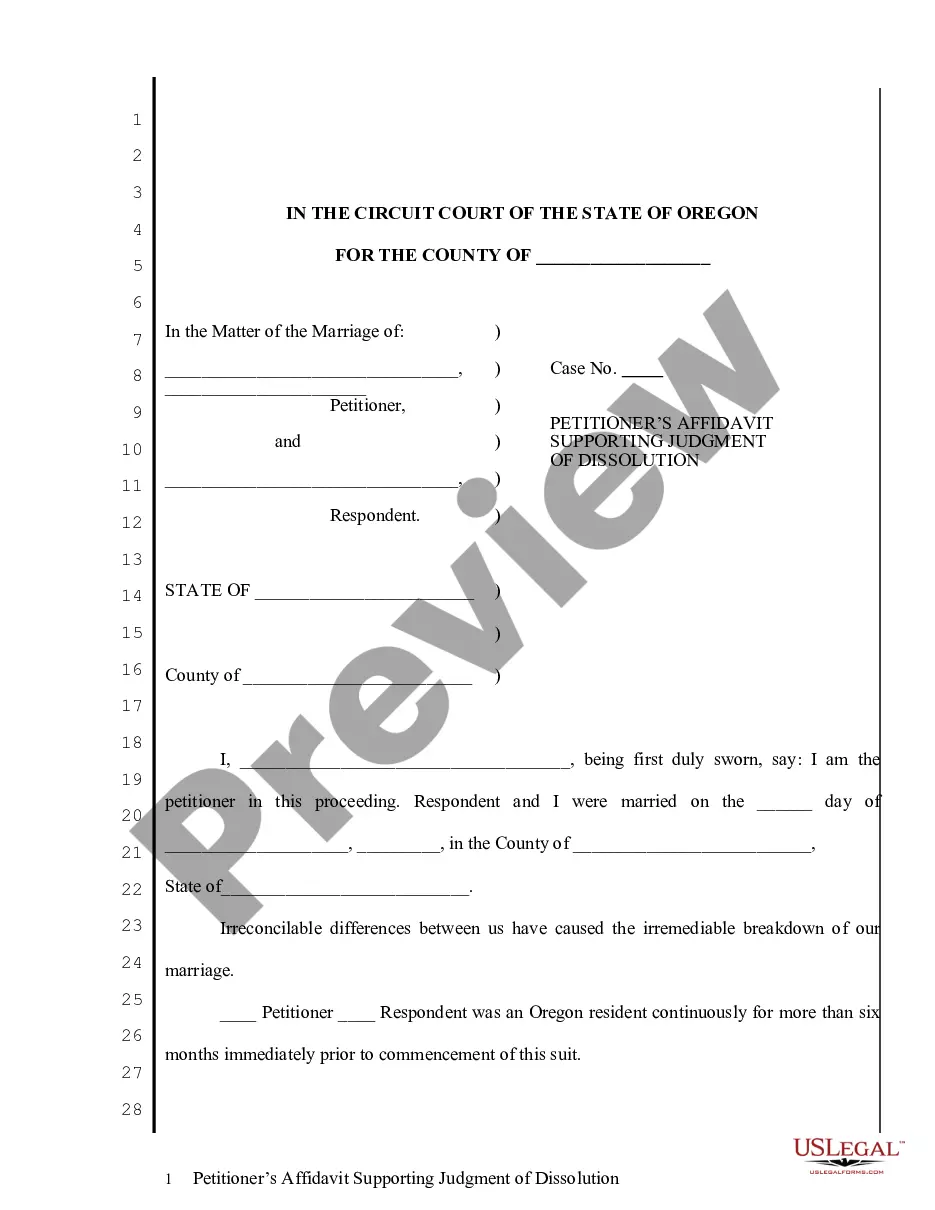

How to fill out Annual Expense Report?

If you need to acquire, download, or print legal document templates, utilize US Legal Forms, the leading selection of legal forms available online. Use the website's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal use are organized by categories and states, or keywords. Leverage US Legal Forms to obtain the Idaho Annual Expense Report with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Idaho Annual Expense Report. You can also retrieve forms you have previously downloaded from the My documents section of your account.

Each legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section to select a form to print or download again.

Fill out and download, then print the Idaho Annual Expense Report using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to assess the form’s content. Remember to read the instructions.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative templates from the legal form database.

- Step 4. Once you have located the necessary form, click the Purchase now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Complete the payment. You can use your Мisa or Ьastercard or PayPal to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Idaho Annual Expense Report.

Form popularity

FAQ

The Idaho Annual Expense Report is a document that businesses must file each year to provide financial information to the state. This report helps maintain compliance with state laws and demonstrates your business's financial status. Utilizing services like USLegalForms can simplify the process, making it easier for you to gather the necessary information and submit your report accurately.

If you miss filing your Idaho Annual Expense Report, you may face penalties and legal complications. It is crucial to note that failure to file can lead to fines, and in some cases, your business may lose good standing with the state. To avoid such issues, consider using resources like USLegalForms which can guide you in completing and submitting your annual report on time.

In Idaho, the approval process for an LLC is typically efficient, often taking just a few business days if all documents are properly submitted. Once you file the Articles of Organization, the state reviews your application to ensure compliance with Idaho laws. While waiting for approval, it's a great time to prepare for your Idaho Annual Expense Report, ensuring your business stays on track from the start. USLegalForms can help expedite this process, making it even smoother for you.

To file an annual report for your LLC in Idaho, begin by gathering your business information, including your LLC name and registration details. You can complete the filing online through the Idaho Secretary of State's website or by submitting a paper form. Timely submission of your Idaho Annual Expense Report is crucial to maintain good standing and avoid penalties, and USLegalForms can guide you through the process seamlessly.

Forming an LLC in Idaho offers significant benefits, such as limited liability protection, which safeguards your personal assets from business debts and lawsuits. Additionally, LLCs enjoy flexible management structures and pass-through taxation, avoiding double taxation on profits. By filing an Idaho Annual Expense Report, LLCs ensure compliance while enjoying these advantages, making it a smart choice for business owners.

An Idaho annual report is a document that businesses must file each year to maintain good standing with the state. It typically includes key information about the company, such as its business address and management details. Filing the Idaho Annual Expense Report is essential for compliance and transparency. Utilizing USLegalForms can help you navigate the requirements efficiently, ensuring you stay on track.

You should send your LLC annual report to the Idaho Secretary of State’s office. This is where you handle all filings related to business entities in Idaho. Make sure to check the deadline for submission, as it varies each year. By using USLegalForms, you can simplify the process of preparing and submitting your Idaho Annual Expense Report correctly.

Many states in the U.S. require businesses to file annual reports, including Idaho. Each state has specific rules and timelines for these filings, and failure to comply can lead to penalties. It's essential to keep track of your obligations, and using the Idaho Annual Expense Report through our platform can simplify that process for you.

If you don’t file an annual report for your LLC, your business may face serious consequences. This includes potential fines, penalties, or administrative dissolution of your company. By timely submitting the Idaho Annual Expense Report, you not only avoid these issues but also contribute to the reliability of your business standing in the eyes of clients and suppliers.

An annual filing report is a document that businesses must submit to disclose necessary information to state authorities. This report typically includes financial data, changes in management, and other relevant updates for the year. By providing the Idaho Annual Expense Report, businesses can fulfill their legal obligations while showcasing their growth to stakeholders.