Idaho Affiliate Program Agreement

Description

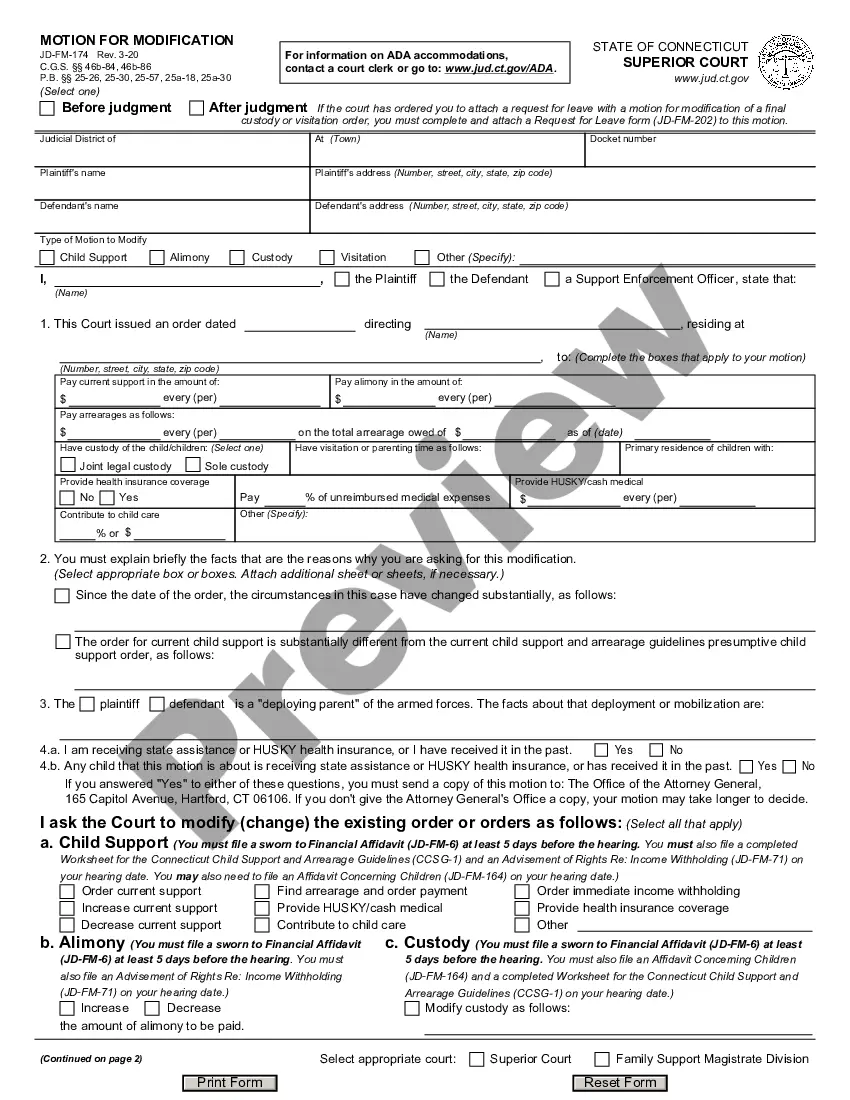

How to fill out Affiliate Program Agreement?

US Legal Forms - one of the most significant repositories of legal documents in the United States - offers a vast selection of legal form templates that you can download or create.

Using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest forms like the Idaho Affiliate Program Agreement in moments.

If you have a monthly subscription, Log In and download the Idaho Affiliate Program Agreement from the US Legal Forms library. The Download button will be visible on every form you view. You can access all your previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Idaho Affiliate Program Agreement. Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, simply visit the My documents section and click on the form you desire. Access the Idaho Affiliate Program Agreement with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Before using US Legal Forms for the first time, here are simple instructions to help you get started.

- Confirm that you have selected the correct form for your city/state.

- Click on the Review button to inspect the form's content.

- Check the form description to ensure you have chosen the correct document.

- If the form does not meet your requirements, utilize the Search box at the top of the page to find one that does.

- Once you are happy with the form, confirm your choice by clicking the Get now button.

- Then, choose the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

An Idaho Affiliate Program Agreement outlines the terms and conditions between a business and its affiliates. This document details how affiliates promote the business's products or services and the payment structure for their efforts. By establishing clear guidelines, the agreement helps protect both parties while fostering a fruitful partnership. You can create a comprehensive affiliate agreement through USLegalForms to ensure a smooth collaboration that meets Idaho regulations.

Yes, Idaho permits composite returns, allowing partnerships and S corporations to file a unified return on behalf of all non-resident partners. This simplifies the tax process for non-resident owners. In the context of an Idaho Affiliate Program Agreement, leveraging composite returns can lessen the tax burden and provide convenience.

Yes, Idaho allows the Pass-Through Entity Tax (PTET), enabling partnerships and S corporations to be taxed at the entity level. This legislative change can provide tax flexibility for business owners. If you are part of an Idaho Affiliate Program Agreement, knowing about PTET can be significant in your financial planning.

1 form in Idaho documents a partner’s or shareholder’s share of income, losses, and credits from partnerships or S corporations. It's crucial for accurate tax reporting and must be filed accurately. Engaging in an Idaho Affiliate Program Agreement means that you will be reporting income on this form if you are a partner or shareholder.

1 tax form serves to report the income, deductions, and credits of partners or shareholders in a business. This information flows through to individual tax returns, ensuring correct income reporting for tax purposes. For those involved in an Idaho Affiliate Program Agreement, keeping accurate K1 records is crucial for tax compliance.

In Idaho, seniors can apply for property tax reductions when they reach age 65. This reduction is part of the property tax benefit program designed to assist seniors. If you are participating in an Idaho Affiliate Program Agreement, consider how these benefits may affect your financial planning.

An Idaho K-1 is a tax document issued to individuals involved in partnerships or S corporations in Idaho. It shows the individual’s share of the entity's income, losses, and credits. If you engage in an Idaho Affiliate Program Agreement, your K-1 will reflect the income from your partnership earnings.

Typically, partnerships and S corporations need to fill out a K-1 form. This form provides information about each partner's or shareholder's share of income, deductions, and credits. If you are part of an Idaho Affiliate Program Agreement, understanding your K-1 obligations helps ensure compliance with tax reporting.

A participating affiliate agreement details the specifics of how affiliates will contribute to the marketing efforts of a business. In an Idaho Affiliate Program Agreement, this type of agreement emphasizes performance and compensation criteria tailored to incentivize affiliates. Having clear terms in a participating affiliate agreement enhances engagement and motivates affiliates to succeed.

An affiliate arrangement outlines the relationship between a business and its affiliates, focusing on how they collaborate to drive sales. Within the framework of an Idaho Affiliate Program Agreement, this arrangement defines the expectations, compensation, and any guidelines that govern the partnership. A well-defined affiliate arrangement fosters trust and ensures both parties achieve their goals.