Idaho Disclaimer of Inheritance Rights for Stepchildren

Description

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

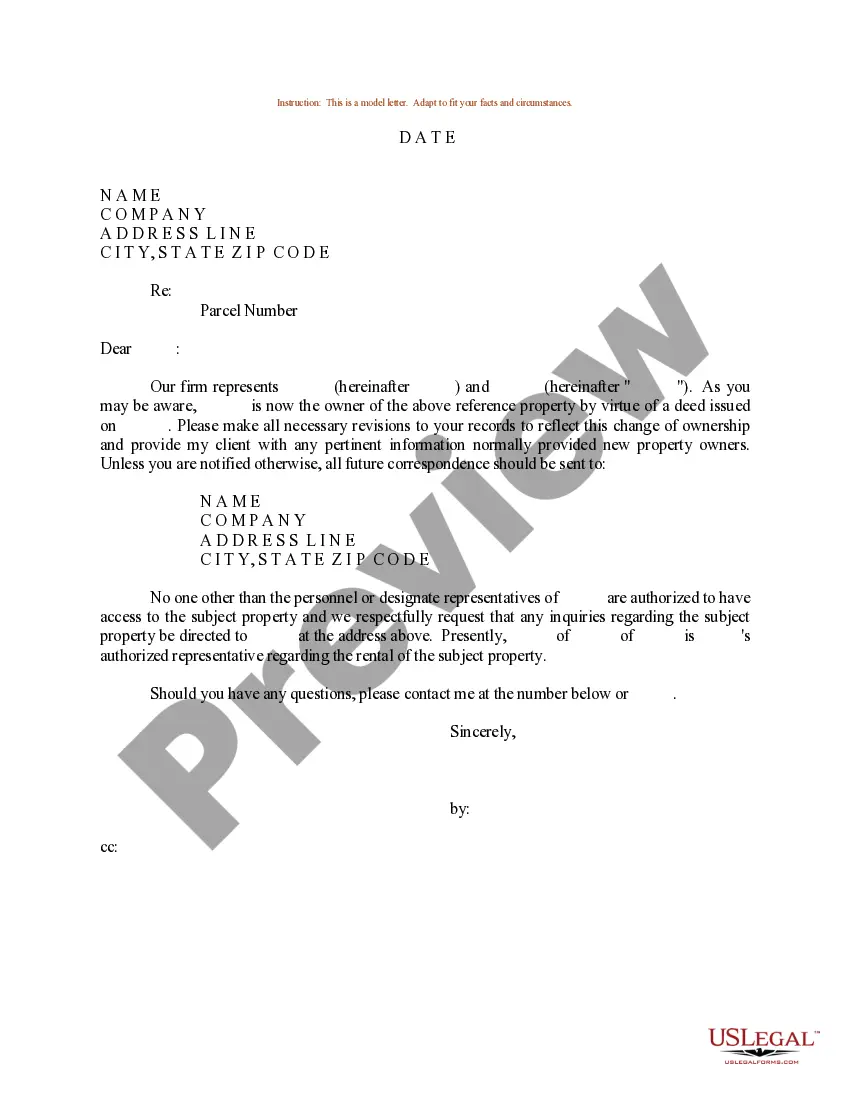

Are you currently within a position the place you need to have paperwork for sometimes enterprise or personal reasons just about every day time? There are a variety of lawful file templates available on the Internet, but finding ones you can rely isn`t effortless. US Legal Forms provides 1000s of kind templates, like the Idaho Disclaimer of Inheritance Rights for Stepchildren, which are written to fulfill federal and state demands.

If you are already familiar with US Legal Forms website and have your account, merely log in. Afterward, you may acquire the Idaho Disclaimer of Inheritance Rights for Stepchildren web template.

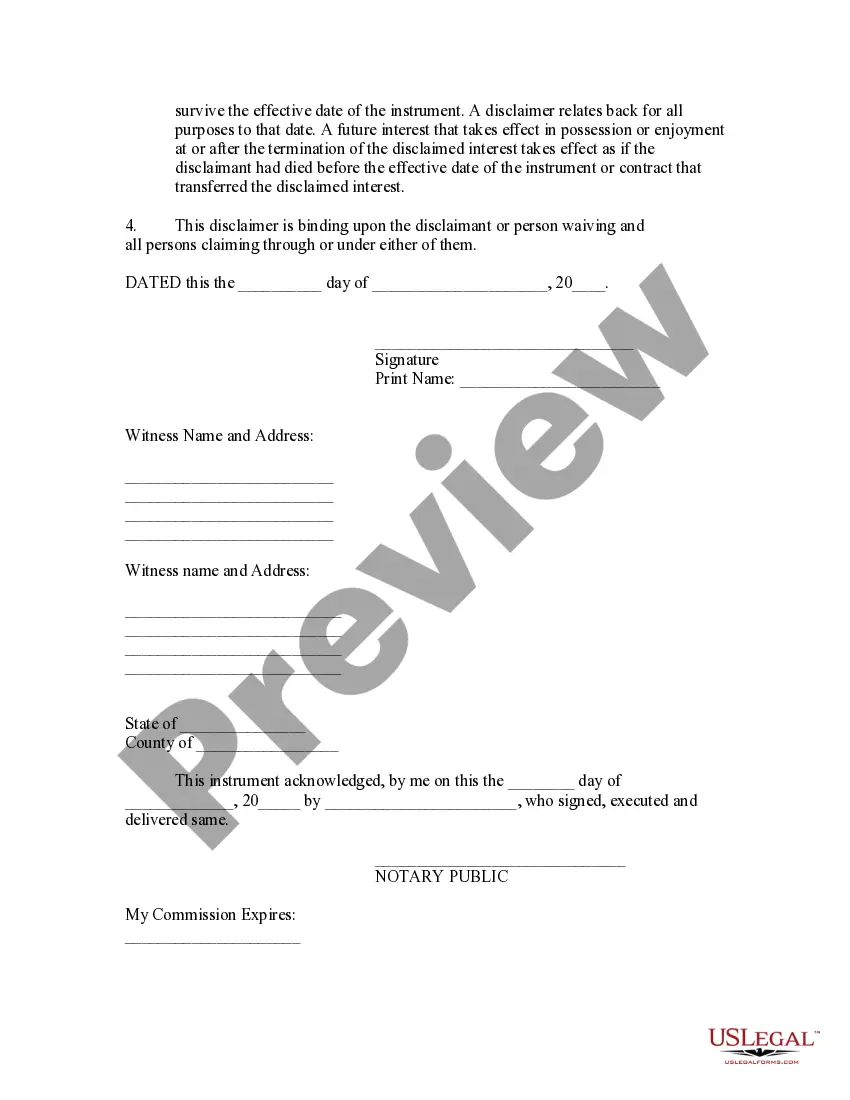

Should you not have an account and wish to begin to use US Legal Forms, follow these steps:

- Get the kind you want and make sure it is for that right area/state.

- Take advantage of the Preview option to check the shape.

- See the explanation to actually have chosen the appropriate kind.

- When the kind isn`t what you are searching for, take advantage of the Look for discipline to discover the kind that fits your needs and demands.

- Whenever you find the right kind, simply click Acquire now.

- Choose the rates prepare you need, fill in the necessary details to make your bank account, and pay money for the transaction making use of your PayPal or credit card.

- Pick a handy document structure and acquire your duplicate.

Find all of the file templates you have bought in the My Forms food selection. You may get a additional duplicate of Idaho Disclaimer of Inheritance Rights for Stepchildren at any time, if possible. Just select the required kind to acquire or produce the file web template.

Use US Legal Forms, probably the most considerable collection of lawful forms, in order to save time as well as stay away from blunders. The services provides skillfully manufactured lawful file templates which can be used for a variety of reasons. Produce your account on US Legal Forms and begin making your daily life a little easier.

Form popularity

FAQ

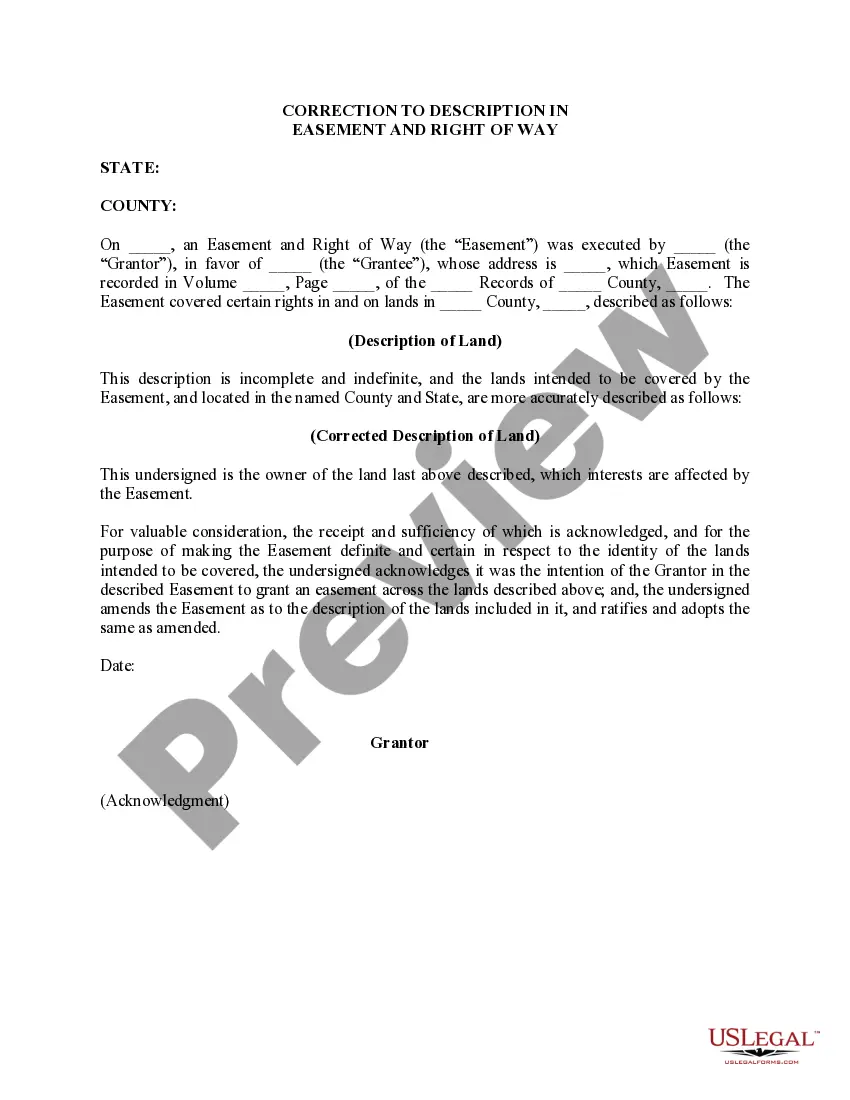

Trusts. A trust offers a more reliable method that works in nearly any circumstance. To keep assets from going directly to stepchildren on your death, you can set up a trust and name your spouse as the trustee. If you do this, however, your spouse will decide where assets go, so they may still go to stepchildren.

In general, a surviving spouse receives all of the community property and the spouse and children share the decedent's separate property. If there is no surviving spouse, the decedent's property is equally divided among the decedent's children, with special rules for deceased children.

You must expressly identify your stepchildren as beneficiaries in at least one estate planning document, such as a will, trust, or beneficiary designation, if you want them to inherit from you.

You can create a trust during your lifetime or through your will and name your child as the beneficiary. You can also appoint a trustee who will be responsible for distributing the trust income and principal ing to your instructions. A Trust can offer several advantages over leaving money directly to your child.

Lastly, a step-child can also be named as a beneficiary of a life insurance policy or a Pay-On-Death financial account. While there is no legal obligation to leave step-children an inheritance, it may be the best choice when there's a close relationship or the step-parent played a significant role in raising the child.

Trusts. A trust offers a more reliable method that works in nearly any circumstance. To keep assets from going directly to stepchildren on your death, you can set up a trust and name your spouse as the trustee. If you do this, however, your spouse will decide where assets go, so they may still go to stepchildren.

Stepchildren do not have inheritance rights unless you have legally adopted them. If you want your stepchildren to inherit from you, you must specifically name them as beneficiaries using at least one estate planning tool, such as a will, trust, or beneficiary designation.

A last will and testament: Name your stepchildren as beneficiaries of your will. You can designate a set amount for them or instruct that they receive a percentage of whatever your estate is worth at the time of your death. A trust: Create a trust and make your stepchildren beneficiaries.