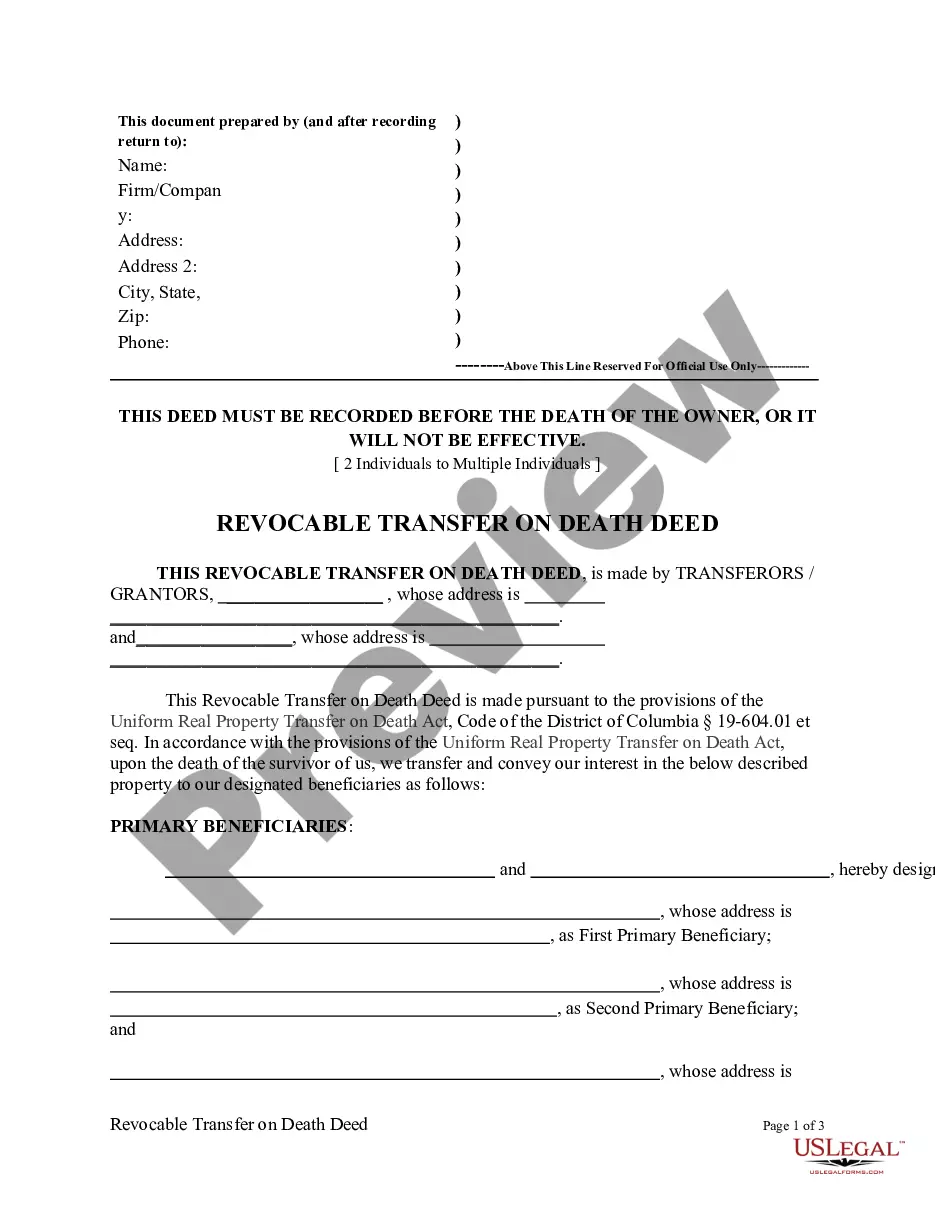

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Idaho Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

US Legal Forms - one of the largest collections of legal documents in the country - provides various legal template documents available for download or printing.

By utilizing this site, you will find thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of documents like the Idaho Declaration of Gift Over Several Year Period within seconds.

Click the Review button to examine the form's content. Read the form description to verify that you have chosen the right document.

If the form does not meet your requirements, utilize the Search bar at the top of the screen to find the one that does.

- If you have an account, Log In to download the Idaho Declaration of Gift Over Several Year Period from the US Legal Forms collection.

- The Download option will be available on each form you view.

- You can access all previously downloaded documents from the My documents section in your account.

- If this is your first time using US Legal Forms, here are some simple steps to get started.

- Ensure you select the correct form for your city/county.

Form popularity

FAQ

Idaho doesn't impose a state gift tax, which means you can give without the worry of additional costs at the state level. However, federal regulations still apply, so understanding the limits under the Idaho Declaration of Gift Over Several Year Period is important. It's advisable to keep records of any substantial gifts to ensure compliance with those federal guidelines.

Your parents can gift you a specific amount each year without triggering any gift tax, thanks to the Idaho Declaration of Gift Over Several Year Period. Staying updated on the current limits ensures they stay within the tax-exempt range. This approach allows for meaningful contributions without worrying about tax consequences.

Idaho allows individuals to give up to a specified amount annually, per recipient, without incurring a gift tax. This limit can change, so it's wise to familiarize yourself with current regulations, especially if you are planning for an Idaho Declaration of Gift Over Several Year Period. Understanding this exemption can help you maximize your gifting strategies.

In general, anyone can give gifts without tax implications, but specific rules apply to the Idaho Declaration of Gift Over Several Year Period. Individuals can gift a certain amount to each recipient annually without incurring a gift tax. Remember, the recipient's relationship with the giver can also play a role in eligibility.

Gifting a car in Idaho can be more beneficial than selling it for $1, especially when considering the implications of the Idaho Declaration of Gift Over Several Year Period. A gift may qualify for tax exemptions, and you can avoid complications that may arise with selling. It's always best to consult resources or professionals who can help you understand the best course of action for your situation.

In Idaho, seniors may qualify for a property tax reduction when they reach the age of 65. This reduction allows eligible individuals to save on property taxes, making homeownership more manageable. Additionally, if you are considering an Idaho Declaration of Gift Over Several Year Period, it is essential to understand the tax implications for seniors.

Form 709 does not need to be filed with your Form 1040, but it may be relevant to attach them if required. The Idaho Declaration of Gift Over Several Year Period focuses primarily on gift tax obligations, independent of your income tax return. Review instructions to confirm the correct filing procedure for your situation. Keeping both documents separate helps maintain clarity for tax purposes.

Form 709 can be filed electronically, but not all individuals may be eligible for this option. Ensure that your filing complies with the requirements set by the IRS for the Idaho Declaration of Gift Over Several Year Period. If electronic filing is not available, you may need to submit the form by mail. Always verify your options before proceeding.

Certain IRS forms, including some related to gift and estate taxes, cannot always be filed electronically. Form 709, particularly, may have restrictions based on the filing method. For your Idaho Declaration of Gift Over Several Year Period, it's crucial to check whether electronic submission is permitted. Refer to IRS guidance for the most accurate information.

You can file a gift tax return at any time, but it's essential to be aware of potential penalties. If you file an Idaho Declaration of Gift Over Several Year Period late, you may incur interest and late fees. To minimize consequences, file as soon as you realize the return is overdue. Each situation may vary, so consider consulting a tax professional.