Idaho Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive variety of legal document formats that you can download or print.

By using the site, you will access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest templates of documents like the Idaho Option of Remaining Partners to Purchase in just moments.

If you already have an account, Log In and download the Idaho Option of Remaining Partners to Purchase from your US Legal Forms library. The Download button will be visible on every document you view. You can access all previously downloaded documents from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the document to your device. Edit. Fill out, modify, print, and sign the downloaded Idaho Option of Remaining Partners to Purchase. Each template you add to your account does not have an expiration date and is yours forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you need. Access the Idaho Option of Remaining Partners to Purchase with US Legal Forms, the most extensive collection of legal document formats. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct document for your city/county.

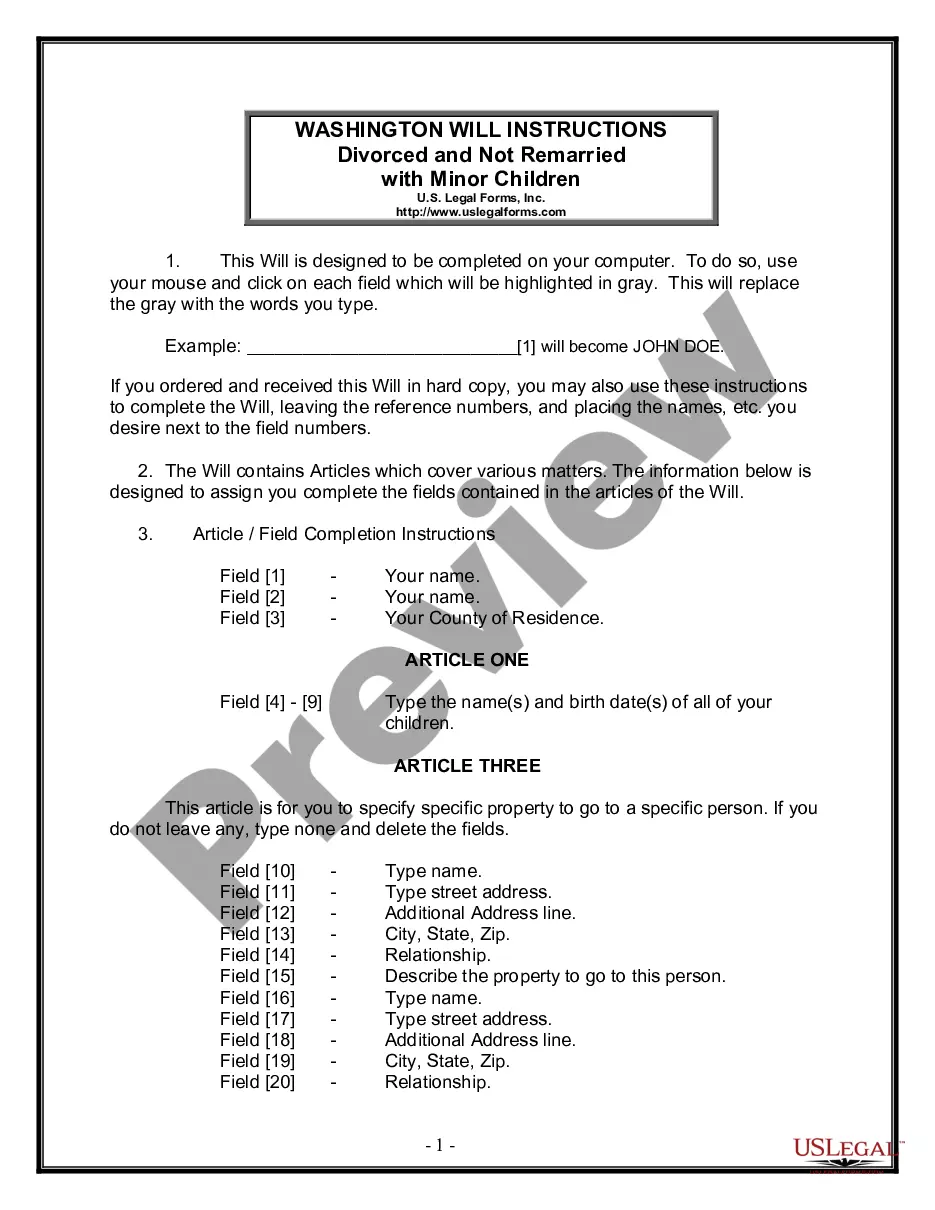

- Click the Preview button to review the form's content.

- Check the form details to make sure you’ve chosen the correct document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your choice by clicking the Purchase now button.

- Next, select the pricing plan you prefer and provide your details to create an account.

Form popularity

FAQ

If you can't file your return by the due date, Idaho allows you an automatic six-month extension of time to file.

To dissolve your Domestic LLC in Idaho, you can sign in to your SOSBiz account and choose terminate business. Or, you can provide the completed Statement of Dissolution Limited Liability Company form in duplicate to the Secretary of State by mail, fax or in person.

According to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement.

Lack of Flexibility in Transferring Ownership While the partnership may start out with both parties agreeable and committed, the reality is that opinions and desires change once a business is profitable, and transferring ownership becomes very difficult without a formal agreement written beforehand.

It is simple to transfer ownership. If the other partners object to a new partner becoming involved in the partnership, a partner cannot give ownership of the business to another person.

These, according to , are the five steps to take when dissolving your partnership:Review Your Partnership Agreement.Discuss the Decision to Dissolve With Your Partner(s).File a Dissolution Form.Notify Others.Settle and close out all accounts.

The easiest and the most hassle-free method to dissolve a partnership firm is by mutual consent or an agreement. A partnership firm may be discontinued with the approval of all the partners or by a contract between the partners. A partnership is formed by a contract and may be terminated using a contract itself.

The partnership can be dissolved if the partner has breached the agreements that are related to the management of business affairs. The dissolution of partnership also can be done when a partner indulges in any other illegal or unethical business activities.

A limited partner is a part-owner of a company whose liability for the firm's debts cannot exceed the amount that an individual invested in the company. Limited partners are often called silent partners.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.