Idaho Letter regarding trust money

Description

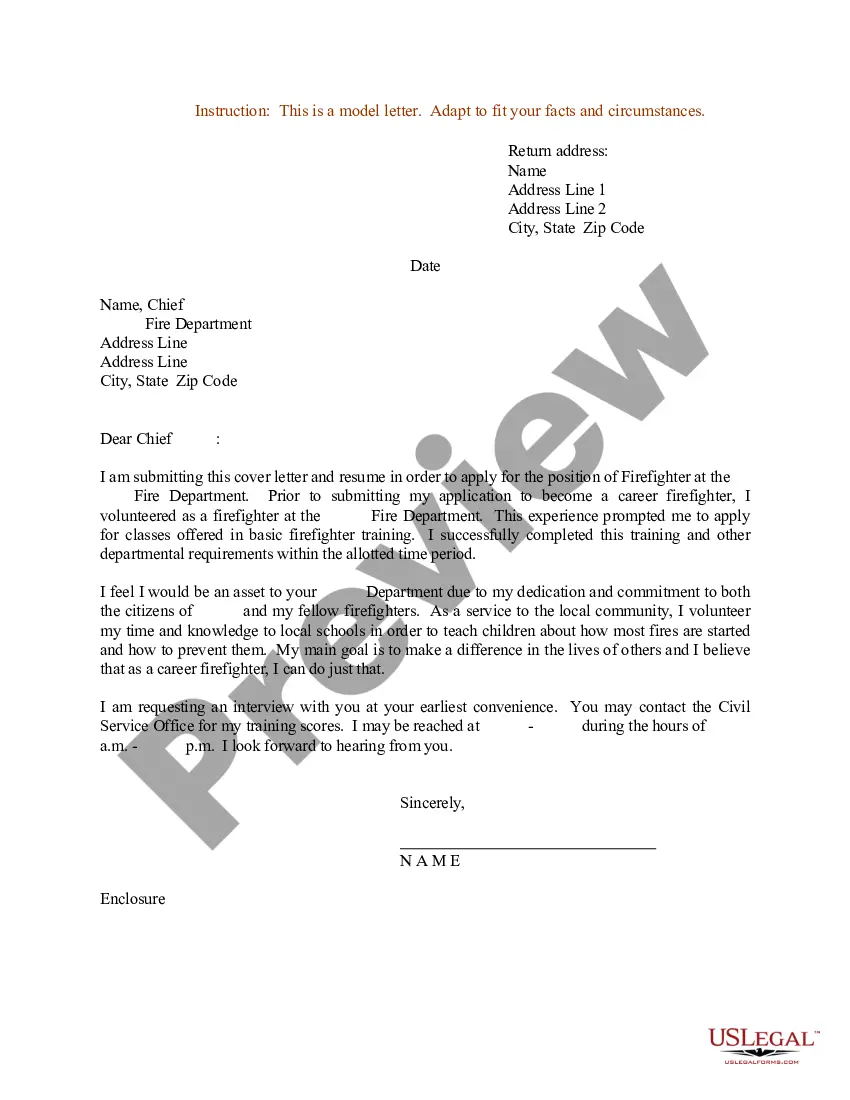

How to fill out Letter Regarding Trust Money?

US Legal Forms - one of the largest collections of official documents in the US - provides a vast selection of legal paper templates that you can purchase or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can locate the latest versions of forms such as the Idaho Letter concerning trust funds in seconds.

If you have a monthly membership, Log In to access the Idaho Letter concerning trust funds within the US Legal Forms library. The Download feature will appear on every form you review. You can access all previously acquired forms in the My documents section of your account.

Select the format and download the form to your device.

Make modifications. Fill in, edit, and print and sign the downloaded Idaho Letter concerning trust funds. Each document you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

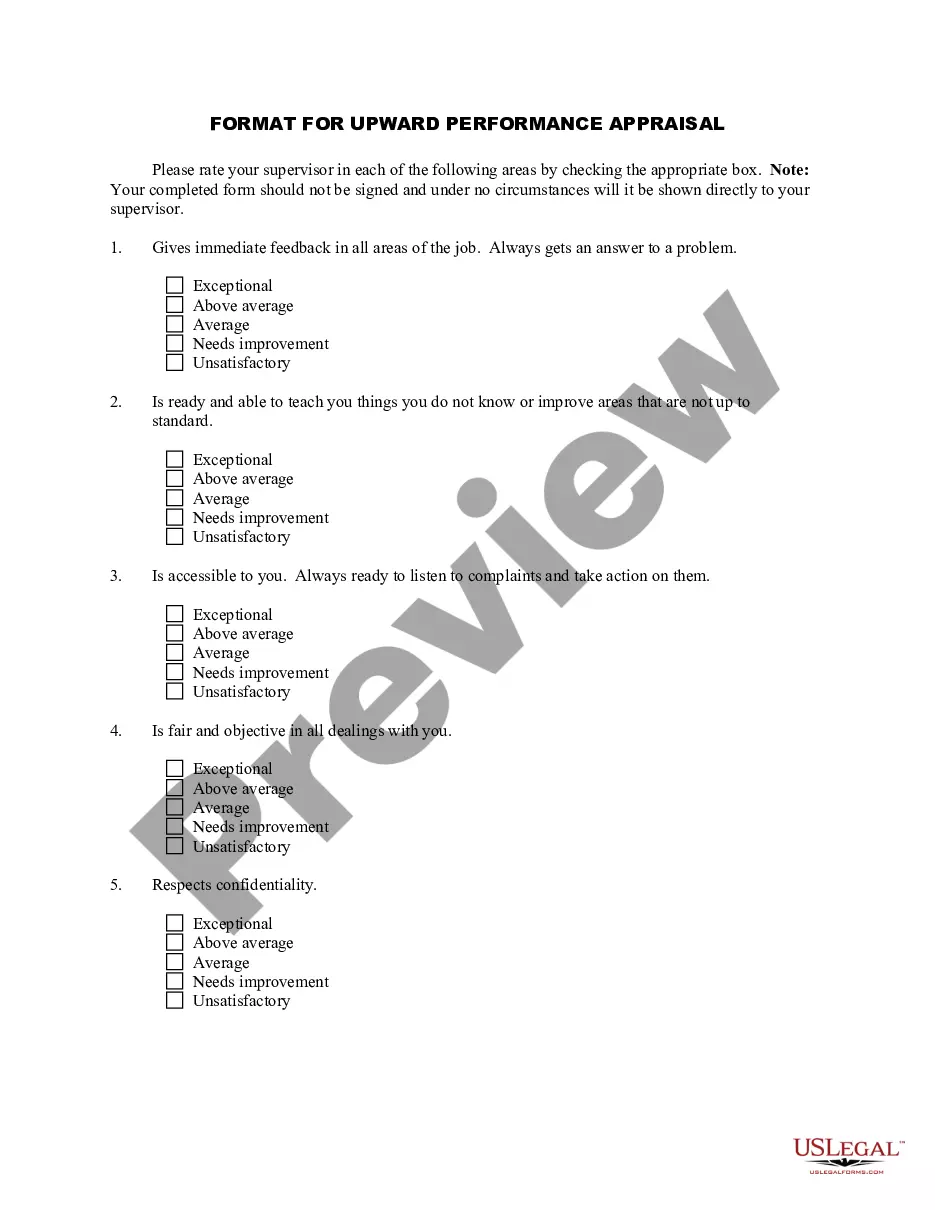

- Ensure that you have selected the correct form for your area/state. Click the Preview option to review the contents of the form.

- Check the form description to confirm that you have chosen the right document.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are happy with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

- Proceed with the payment. Use your Visa, Mastercard, or PayPal account to complete the transaction.

Form popularity

FAQ

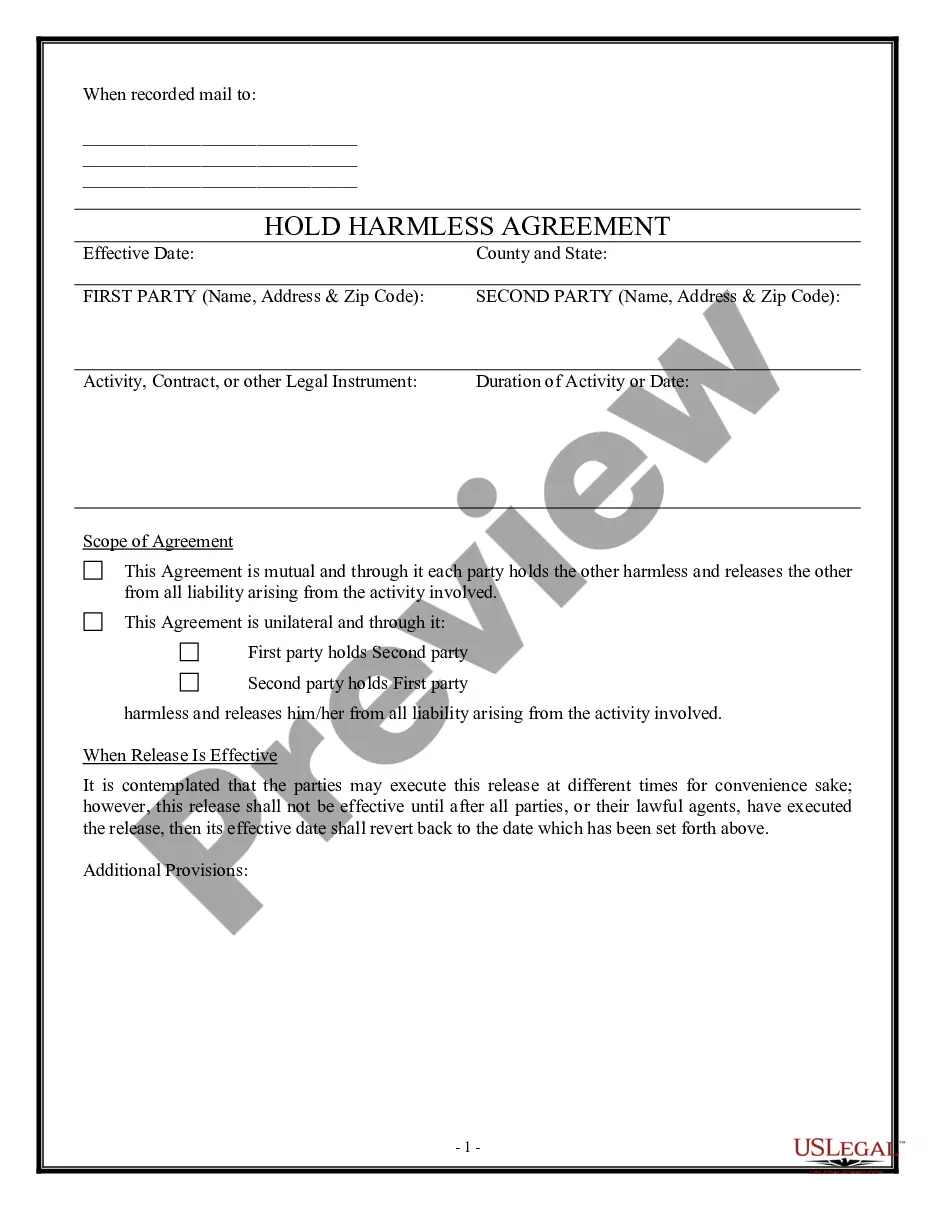

How to Create a Living Trust in IdahoIdentify what will go into the trust.Choose the appropriate type of living trust.Next choose your trustee, who will manage the trust.Now create a trust agreement.Then sign the trust document in front of a notary public.Finally, fund the trust by retitling assets in its name.

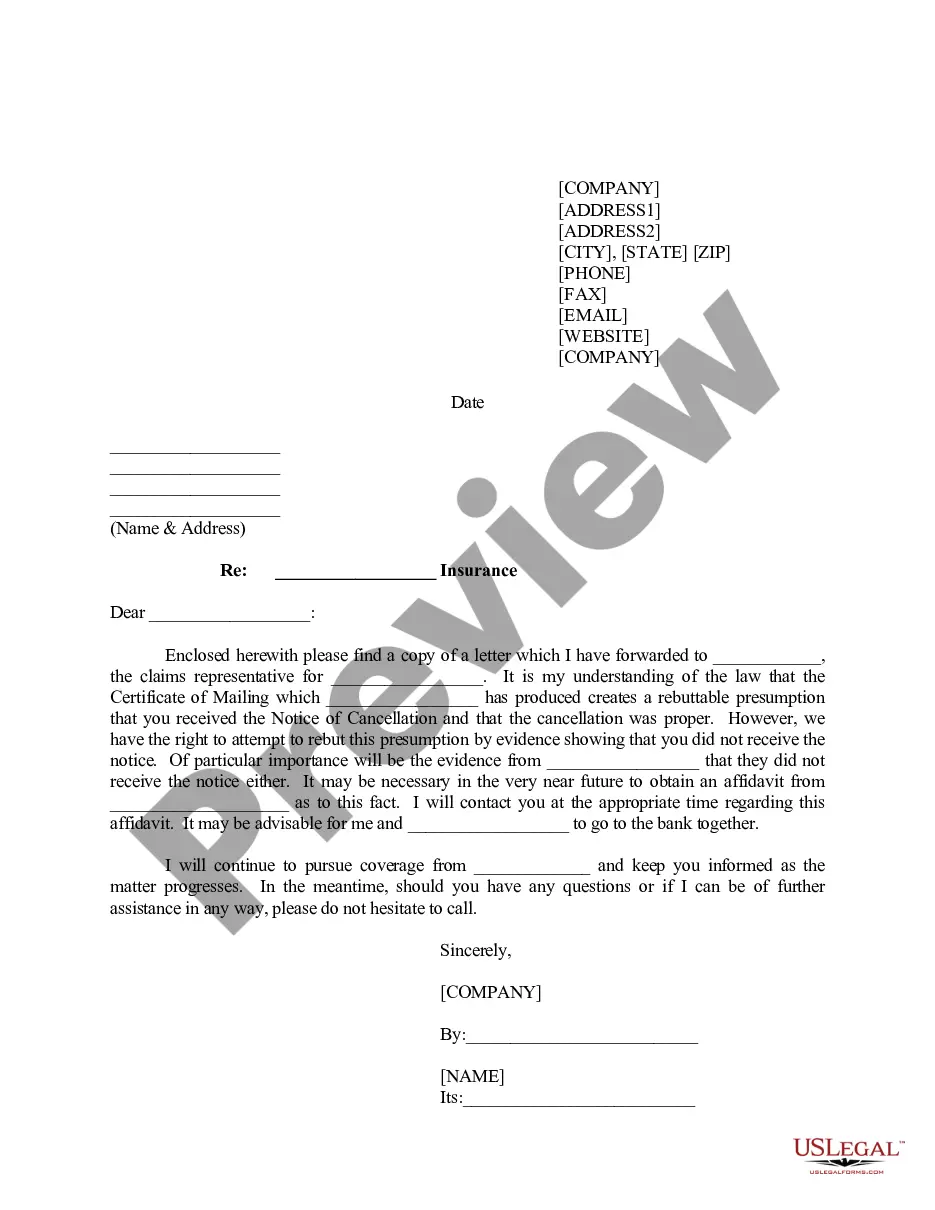

While a will outlines how you would like your property and assets distributed after your death, a trust allows you to name a beneficiary or beneficiaries and then holds the money or property on their behalf until it is time to distribute it.

Who Should Get a Living Trust in Idaho? If your primary reason for getting a living trust is to avoid probate, you will not need one if your estate is worth $100,000 or less. At that level, there is a simplified process for small estates that doesn't involve probate or even informal probate.

The main purpose of a living trust is to oversee the transfer of your assets after your death. Under the terms of the living trust, you are the grantor of the trust, and the person you designate to distribute the trust's assets after your death is known as the successor trustee.

To make a living trust in Idaho, you:Choose whether to make an individual or shared trust.Decide what property to include in the trust.Choose a successor trustee.Decide who will be the trust's beneficiariesthat is, who will get the trust property.Create the trust document.More items...

If you create a trust that takes effect while you are alive - known as a living trust or inter vivos trust - it will cost at least $1,000 to set up and establish. For a large trust, you will need to appoint a trustee to oversee it and manage investments held within the trust.

In total dollars, the cost of a Family Trust or Living Trust package for an unmarried person would cost $1,895. For a married couple, the total cost would be just $2,295.

An Idaho living trust is an estate planning tool that allows you to maintain control of your assets in trust during life and determine their distribution after death. A revocable living trust offers many benefits that you may want to consider.

In a trust, assets are held and managed by one person or people (the trustee) to benefit another person or people (the beneficiary). The person providing the assets is called the settlor. Different kinds of assets can be put in trust, including: cash.